Constructing long-term wealth is not essentially simple, however investing within the inventory market is likely one of the best methods to do it. With the correct funding, it’s potential to construct a portfolio price a whole bunch of 1000’s of {dollars} or extra.

When you’re on the lookout for a simple option to doubtlessly make some huge cash over time, investing in exchange-traded funds (ETFs) could also be a clever choice. An ETF means that you can purchase dozens or a whole bunch of shares directly, all in a single funding.

There are numerous ETFs to select from, masking totally different sectors of the market. Whereas there’s not essentially a proper or incorrect place to take a position, this Vanguard ETF may doubtlessly double your cash over time with nearly no effort in your half.

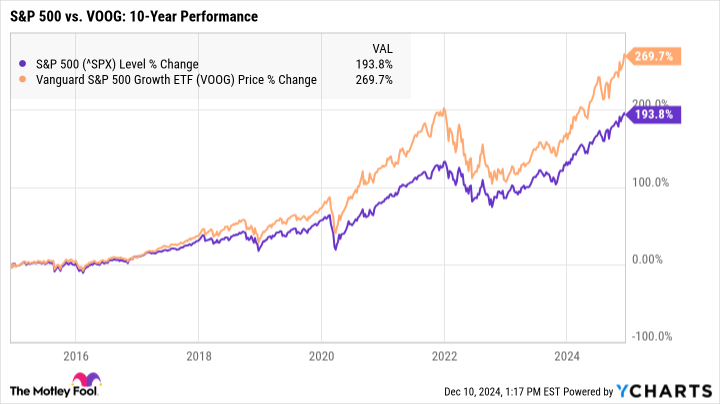

THE Vanguard S&P 500 Development ETF (NYSEMKT:VOOG) is actually a hybrid between a S&P 500 ETF and a progress ETF, as a result of it solely accommodates progress firms throughout the S&P 500 Index (INDEXSNP: ^GSPC).

The S&P 500 is likely one of the pillars of the inventory market as an entire and accommodates the shares of the five hundred largest publicly traded firms in the US. These shares are among the many strongest and healthiest on this planet, making them extra more likely to survive intervals of disaster. market turbulence.

Because the Vanguard S&P 500 Development ETF accommodates solely the expansion shares within the index, this fund has the potential to generate above-average returns whereas remaining a comparatively secure and secure funding in comparison with different ETFs. progress.

Though it solely accommodates progress shares, this ETF stays comparatively diversified. It consists of 234 shares from 11 totally different sectors, though virtually half of the fund is allotted to shares within the expertise sector. Larger diversification can restrict your threat, particularly if the market deteriorates.

As with every funding, the important thing to wealth creation is investing persistently and sustaining a long-term perspective. Nobody is aware of how the market will carry out over the approaching weeks or months, however should you keep invested for a number of years, and even many years, you will have a significantly better probability of creating huge features.

Over the previous 10 years, the Vanguard S&P 500 Development ETF has earned a median charge of return of 14.95% per yr. At that charge, you’d double your cash in about 5 years, assuming you simply let your cash sit with out making any extra contributions.

To essentially improve your revenue, you may take into account investing a little bit every month. When you have been to take a position, say, $200 monthly and earn a median annual return of 14%, right here is roughly how a lot you could possibly accumulate over time:

#Unstoppable #Vanguard #ETF #Double #Cash , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america