Dividend investing will most likely by no means exit of favor. This isn’t solely as a result of folks usually like the thought of making a living with out doing something, but additionally as a result of firms that pay out and improve their payouts often often have nice underlying companies . That is primarily why dividend shares have outperformed their non-dividend-paying counterparts over lengthy intervals of time. So, investing in high-income shares is not a foul technique to begin 2025.

Listed below are two nice candidates to think about: Coca-Cola (NYSE:KO) And Visa (NYSE:V).

Model names matter. Few firms on the earth have a stronger model than Coca-Cola, the comfortable drink market chief. Coca-Cola’s identify, status and presence in just about each identified nation means that it’s going to proceed to draw a good quantity of enterprise. That is the corporate’s aggressive benefit. Plus, it isn’t only a chief in comfortable drinks, though that is the way it made its identify. Coca-Cola has considerably diversified its portfolio. It provides just about all the things from alcohol to espresso and tea, sports activities drinks, vitality manufacturers and water.

Coca-Cola’s diversification is an important a part of its technique. This permits it to fulfill the wants and preferences of various markets. And with rising considerations in regards to the well being influence of a few of its hottest choices, this technique has additionally helped it scale back its publicity to those much less wholesome choices. This fashion, the corporate can survive and thrive in a extra health-conscious market. It is true that Coca-Cola might be not a very enticing model. growth stocks. Do not anticipate the inventory to maintain tempo with the AI leaders.

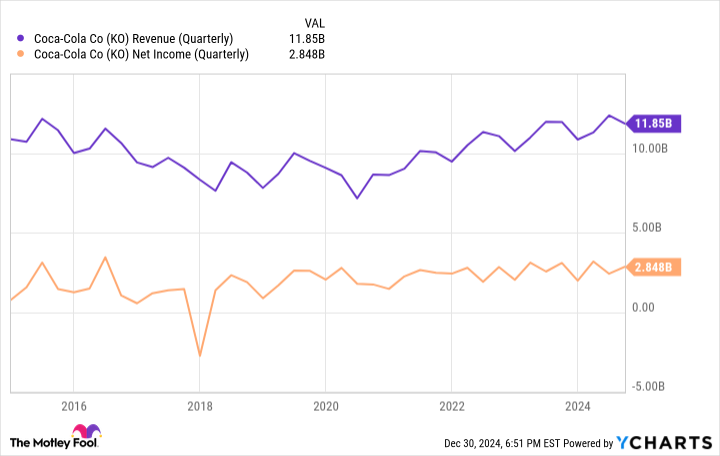

What it does provide, nonetheless, is consistency and reliability. Coca-Cola stories secure revenues and income.

KO income (quarterly) knowledge by Y Charts.

That is what it has been doing for a very long time, that is the way it’s sustained its unimaginable dividend historical past. Coca-Cola is a King of dividends with an lively streak of 62 consecutive cost will increase. The corporate’s ahead yield is 3.11%, nicely above the S&P500The common is 1.32%. Coca-Cola’s payout ratio appears a bit excessive, at 74%, however the firm has typically maintained a reasonably excessive payout ratio whereas growing its dividends. Traders needn’t fear: Coca-Cola will stay an ideal earnings inventory past 2025. It is no marvel the corporate stays a favourite of Warren Buffett.

Like Coca-Cola, Visa has some of the highly effective manufacturers in its market. Hundreds of thousands of bank cards in circulation bear the brand of the monetary business large, which reduces charges for each transaction it helps facilitate by its cost community. It’s true that the corporate’s operations will be liable to recessions. When issues get powerful and customers begin spending much less, Visa’s cost quantity can fall, resulting in a decline within the firm’s income and income.

#Dividend #Shares #Purchase , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america