When Wall Road will get concerned in a narrative, it will probably result in unusual outcomes. For instance, Youngsters Morgane (NYSE:KMI) has seen a major worth rise and is now producing a comparatively minimal yield of 4.1%. You are able to do greater than two share factors higher by investing in its midstream vitality friends. Enterprise Product Companions (NYSE:EPD) Or Enbridge (NYSE:ENB).

And that is only a snapshot of why these two midstream giants are higher selections than Kinder Morgan. Here is what you have to know.

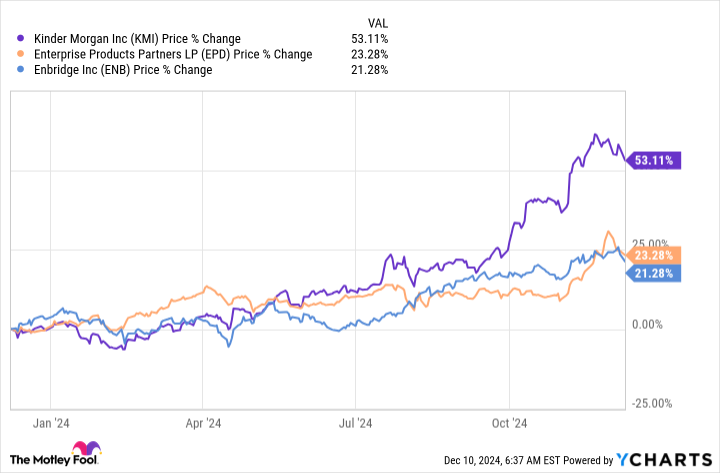

Shares of Kinder Morgan are up about 50% over the previous 12 months, greater than twice as a lot as Enterprise or Enbridge. Whereas it’s debatable whether or not or not this early advance was justified, what could be very clear at this level is that Kinder Morgan’s 4.1% yield is considerably decrease than the 6.4% you’d get in the event you purchased Enterprise and Kinder Morgan’s 6.2% yield. dividend yield from Enbridge.

When you’re in search of a high-yielding mid-tier funding, Kinder Morgan simply does not rank as properly on the earnings aspect of the equation. However do not cease there, as a result of Kinder Morgan has different drawbacks that must be thought-about with regards to distributing money to unitholders.

First, in late 2015, it requested buyers to anticipate dividend will increase of as much as 10%. And some months later, it introduced that the dividend can be minimize by round 75%.

The following massive disappointment got here in 2020, when it requested buyers to anticipate a 25% dividend enhance. However when issues acquired unhealthy, the master limited partnership solely proposed a 5% enhance.

The connecting issue right here is that, in each intervals, the vitality sector confronted headwinds. So, simply when unitholders most wished administration to maintain its phrase, they have been dissatisfied.

By comparability, Enterprise Merchandise Companions has elevated its distribution yearly for 26 consecutive years. Enbridge has elevated its dividend yearly for 30 consecutive years. Which means these two Kinder Morgan opponents handed on will increase in 2016 and 2020, regardless of headwinds within the vitality sector.

If dividend consistency is necessary to you, this truth alone ought to be sufficient to persuade you to keep away from Kinder Morgan and take a look at Enterprise and Enbridge. However there’s extra to like about every of them.

Enterprise and Enbridge are North American midstream giants with important infrastructure that might be troublesome to interchange or relocate. They supply integral providers – by the pipeline, storage, transmission and transformation property they personal – with out which the vitality sector merely can not perform. The charges they cost for using their property present dependable income in each good and unhealthy vitality markets.

#HighYielding #Midstream #Shares #Purchase #Keep away from , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america