Which is the most well liked S&P500 inventory of 2024? Palantir Applied sciences (NASDAQ:PLTR) is the palms down winner. Shares of the factitious intelligence (AI) and information analytics software program supplier have soared greater than 320% for the reason that begin of the 12 months.

With this spectacular efficiency, Palantir market capitalization it’s now round $165 billion. However I believe Palantir’s momentum might quickly fizzle out. Listed below are two shares that I feel might be value greater than Palantir in 5 years.

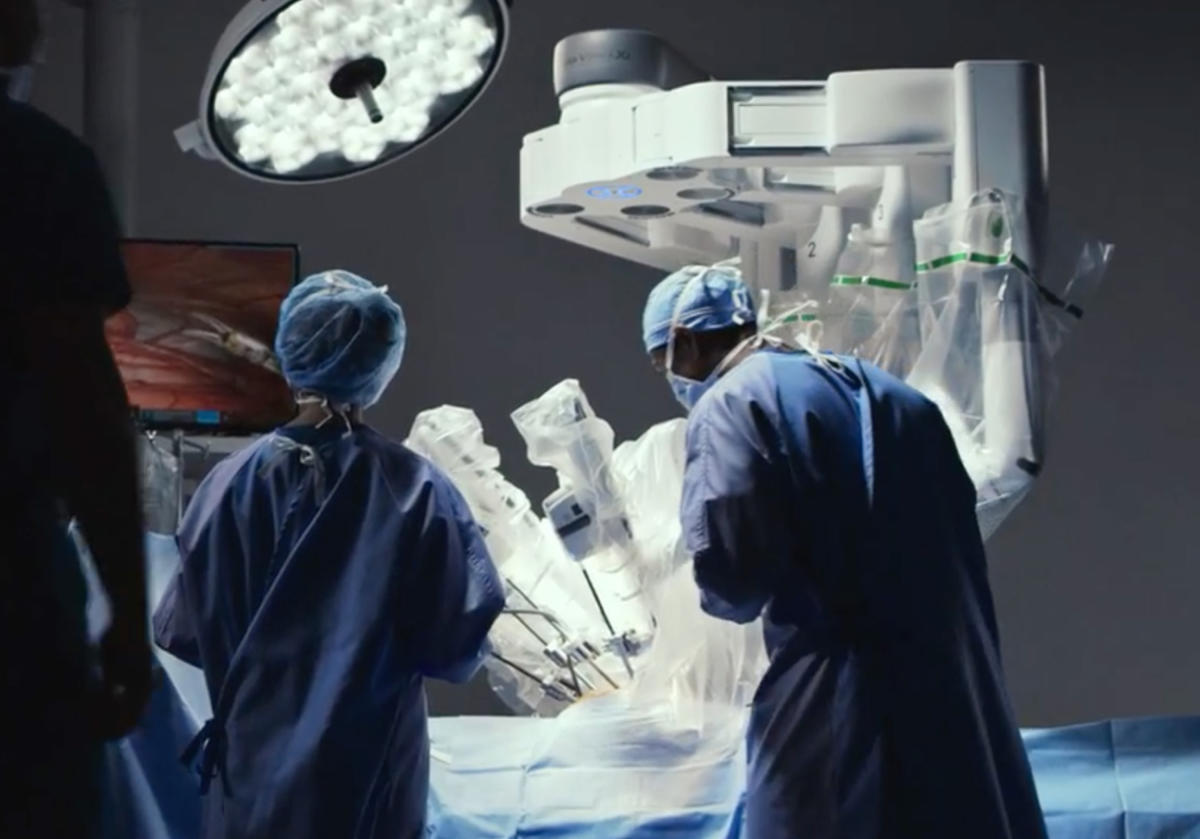

Intuitive surgical (NASDAQ:ISRG) might appear to be too simple a option to make. The maker of robotic surgical methods already has a market capitalization of round $194 billion, a lot increased than Palantir’s market capitalization. However I feel Intuitive Surgical is not only larger than Palantir now; I predict this may also be extra necessary sooner or later.

This inventory is on a roll in 2024, even when its efficiency hasn’t been in the identical league as Palantir’s. The put in base of Intuitive’s da Vinci Surgical System grew 15% 12 months over 12 months within the third quarter of 2024. Its process quantity jumped 18%. Extra put in methods and extra procedures translate into robust progress in firm income and earnings.

Intuitive Surgical is predicted to proceed to see progress within the coming years due to a big demographic tailwind. The inhabitants is growing older in the US and plenty of different nations all over the world. As folks age, they’re extra prone to require surgical procedure. This could lead to accelerated progress in process quantity for Da Vinci.

Roughly 2.2 million procedures had been carried out with da Vinci in 2023. Intuitive Surgical estimates that roughly 7 million procedures are carried out every year for which it already has merchandise and approvals. Nevertheless, thrice as many comfortable tissue surgical procedures are carried out every year. This represents an enormous alternative for the corporate.

The most important knock in opposition to Intuitive Surgical is its valuation. Shares of the chief in robotic surgical methods commerce at about 69 instances ahead earnings. In comparison with Palantir multiple of forecast profits out of 161, nevertheless, Intuitive Surgical appears low-cost.

You may suppose I am loopy, however I additionally predict that Pfizer (NYSE:PFE) might be value greater than Palantir in 5 years. The drugmaker’s present market capitalization of $145 billion is way decrease than Palantir’s. Pfizer inventory is down this 12 months whereas many shares have soared. So, what’s my logic behind this contrarian choice?

For my part, Pfizer is likely one of the most underrated shares, whereas Palantir is arguably overrated. Its shares commerce at simply 8.6 instances ahead earnings. That is half the typical ahead earnings a number of of S&P 500 healthcare shares. Pfizer’s price-to-earnings-to-growth (PEG) ratio, based mostly on five-year earnings progress projections, could be very low, at 0.18, relying on monetary market infrastructure and information supplier. LSEG.

#shares #value #Palantir #years , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america