As President-elect Donald Trump prepares for his inauguration, his administration is getting ready to implement vital coverage adjustments. Amongst these measures is the choice of Robert F. Kennedy Jr. to steer the Division of Well being and Human Providers – a call that’s already placing stress on vaccine stocks. For cautious buyers, this could possibly be a sign to keep away from Pfizer Inc (NYSE:PFE)a inventory with a historical past of underperformance in January.

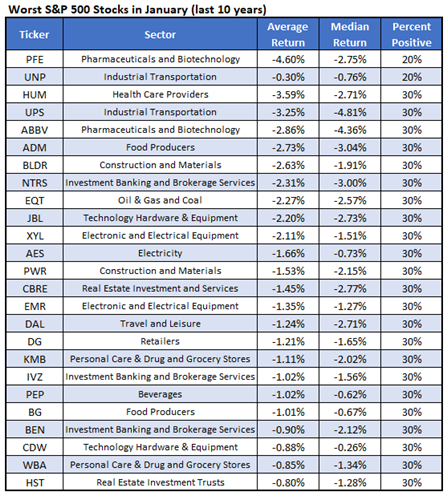

In response to knowledge from Rocky White, Schaeffer’s senior quantitative analyst, PFE has averaged a 4.6% loss in January over the previous 10 years and has completed the month within the crimson eight occasions. In reality, the final time Pfizer inventory rose for the month of January was in 2018. A comparable transfer from the present $26.39 stage would put it close to the $25 stage.

Shares are retreating barely at the moment, though they continue to be properly above their Nov. 15 decline to $24.48 — its lowest stage since January 2013. Shares are down 8.2% in 2024, even when they count on a small acquire in December to realize a small acquire. four-month dropping streak.

If this historic development repeats itself, it may pressure choices merchants to alter their bullish tone – a transfer that would weigh on PFE. This corresponds to Schaeffer’s put/name open curiosity ratio (SOIR) of 0.55 which is within the 1st percentile of annual readings, indicating a bias in direction of calls amongst premium short-term gamers.

Choices look like an attention-grabbing path to take to weigh in on Pfizer inventory, based mostly on its Schaeffer Volatility Index (SVI) of 20% which ranks within the eleventh percentile for the trailing 12 months. As well as, safety Schaeffer Volatility Dashboard (SVS) sits at a comparatively low 30 out of 100, making it a primary candidate for these short-term bulls.

#Worst #Shares #January , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america