I'm an enormous fan of investing in particular person shares and really imagine {that a} well-designed inventory portfolio can outperform the general inventory market. On the identical time, it helps to place a few of your investments on autopilot with premium index funds.

Index fund ETFs can’t solely provide you with diversified publicity to a whole portfolio of shares in a single funding automobile, however may also generate some fairly spectacular returns over lengthy durations of time. With that in thoughts, whereas a few of my favourite shares (particularly high-yielding dividend shares) presently look like glorious values, I plan to progressively buy shares of three ETFs particularly all through 2025.

Lacking the morning scoop? Get up with Breakfast Information in your mailbox each market day. Register for free »

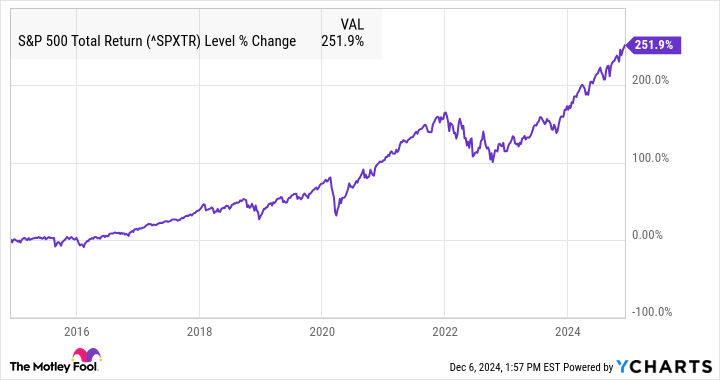

If I had been solely allowed to carry one funding, it might be Vanguard S&P 500 ETF (NYSEMKT: VOL). That is Vanguard's flagship S&P 500 index fund. As its identify suggests, this ETF follows the S&P500 (INDEXSNP: ^GSPC)which is extensively thought of the most effective benchmark for evaluating the efficiency of the U.S. inventory market.

This ETF has a lowest expense ratio of 0.03%, which means that in the event you invested $10,000 within the fund, solely $3 will go towards annual funding bills. Over lengthy durations of time, the S&P 500 has produced common complete returns of round 10% annualized. For context, which means that a $10,000 funding within the ETF might be value round $175,000 in 30 years, with no upkeep wanted alongside the best way.

Firstly of 2024, small-cap shares had been buying and selling at their lowest value/guide worth relative to large-cap shares because the late Nineteen Nineties. And all year long, the valuation hole widened additional , because of the outperformance of large-cap expertise shares and a smaller drop in rates of interest than consultants predicted.

Now, the common element of the Russell 2000 small-cap index trades at a price-to-book a number of of 1.9, in comparison with 4.7 for the everyday S&P 500 inventory. With rates of interest lastly beginning to fall and a doubtlessly favorable surroundings for development with the brand new Trump administration, small caps may gain advantage from important tailwinds. This is the reason the Vanguard Russell 2000 ETF (NASDAQ:VTWO) is my prime total ETF choose for 2025.

To be completely clear, I imagine that synthetic intelligence (AI) is a huge alternative and will find yourself being an important expertise pattern of my lifetime. Nevertheless, I’m good at evaluating banking shares, actual property corporations, and e-commerce corporations, to call just a few. The very best alternatives in AI are, frankly, not in my wheelhouse. Any good investor ought to know their circle of experience, and AI shares are a little bit exterior of mine.

#ETFs #Plan #Purchase #Hand #Fist #Low cost #Shares #Radar, #gossip247.on-line , #Gossip247

,