Michael Nagle/Bloomberg through Getty Photographs

U.S. inventory futures have been little modified after markets retreated from report highs on nervousness within the expertise sector; GameStop (GME) releases outcomes after market shut right now; Oracle (ORCL) shares fall as tech firm's income falls wanting expectations; European regulators are reportedly in search of info from Alphabet (GOOGLE) Google on its promoting program concentrating on youngsters on meta-platforms (META)Instagram; and Taiwan Semiconductor Manufacturing Co. (TSM) posts sturdy gross sales in November, displaying demand for AI stays sturdy for Apple (AAPL) and NVIDIA (NVDA) provider. Right here's what traders must know right now.

U.S. inventory futures little modified after main indexes started the week on a negative notepartly due to the weak spot of the expertise sector. Nasdaq And S&P500 futures are on the rise, whereas Dow Jones Industrial Average futures are pointing barely decrease. Buyers Put together to Digest Extra Earnings Experiences At this time, Watch inflation data later this week. Bitcoin (BTCUSD) is barely decrease at round $97,000, whereas gold futures are up 0.6%. Oil futures are down 0.5% and 10-year Treasury yields are barely increased, above 4.2%.

GameStop (GME) shares are down barely in pre-market buying and selling forward of the online game retailer's third-quarter earnings report after markets shut right now. The report comes after the inventory briefly jumped final week following a cryptic social media publish by meme-stock hero Keith “Roaring Kitty” Gill clearly encouraged certain investors to join. GameStop inventory will not be extensively adopted by Wall Avenue analysts, with the one analyst tracked by Seen Alpha giving it an “underperformance” rating and a worth goal of $10, properly under the inventory's closing worth of $27.93 on Monday.

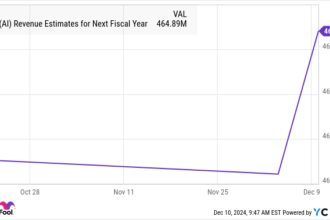

Oracle (ORCL) inventory falls 6% in premarket buying and selling after tech firm's quarterly report revenues lower than analysts' expectations. The cloud providers big, whose shares hit report highs final week on enthusiasm over artificial intelligence (AI) demand, reported income of $14.06 billion, up 9% yr over yr however under Seen Alpha estimates. Internet revenue of $3.15 billion, or $1.10 per share, in contrast with $2.5 billion, or 89 cents per share, a yr earlier, beat estimates. Adjusted earnings per share (EPS) of $1.47 barely missed expectations.

European regulators request extra info from Alphabet (GOOGLE) Google on the key promoting partnership the search big had with Instagram Father or mother metaplatforms (META), THE Monetary Instances reported. The settlement, which has since ended, Instagram ads targeted to teenagers on YouTubecircumventing Google's guidelines prohibiting customized advertisements aimed toward under-18s. Shares of Alphabet and Meta Platforms are increased in pre-market buying and selling.

#inventory #market #opens , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america