“Do not choose a e-book by its cowl” is an outdated saying to heed when taking a look at high-yielding dividend shares. An excellent instance is the return of virtually 15% provided by AGNC Funding (NASDAQ:AGNC). In actual fact, it is too good to be true should you want a dependable supply of revenue. Most buyers would most likely be higher off with Actual property revenue (NYSE:O) and its yield of 5.6%.

There may be nothing inherently unsuitable with AGNC Funding. The mortgage actual property funding belief (REIT) has carried out a reasonably respectable job of producing complete returns for its shareholders over time. However investing for total return may be very totally different from invest to earn income.

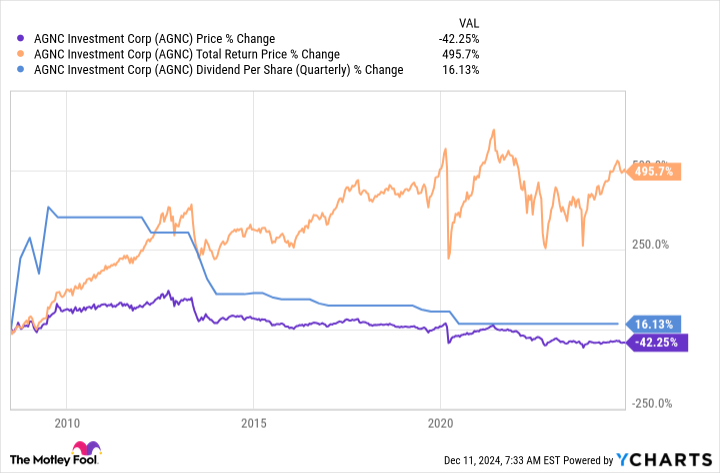

In case you are investing for revenue, you’ll most likely need to accumulate and spend dividends distributed by an organization. In case you are investing for complete return, you will want to reinvest dividends to maximise your positive factors. This distinction is essential as a result of AGNC Funding doesn’t behave like a conventional REIT that owns properties. As a substitute, consider it as an entity that invests in mortgage-backed securities, that are fairly advanced funding merchandise. Simply have a look at the chart under and you’ll perceive why spending the excessive income stream offered by AGNC Funding would have been a nasty resolution.

The blue line represents the dividend, which elevated sharply after the REIT’s IPO after which started to say no. The purple line represents the inventory value, which primarily tracks the dividend. Should you spent your dividends alongside the way in which, you’ll now obtain much less revenue and in addition be able that was price much less. However the complete return line rose noticeably as sturdy dividends greater than offset the decline in inventory value as AGNC Funding purchased and offered mortgage-backed securities over time. However you may solely get that return should you reinvest the dividends.

There may be an argument that dividends acquired over time offset the decline in inventory worth, since cumulative dividends plus the ultimate inventory worth would have left buyers with roughly $30,000 on an preliminary funding of $10 000 $. Nevertheless, should you spent the dividends to cowl dwelling bills, you continue to ended the interval with a decrease revenue stream due to the dividend minimize and a major loss in your preliminary funding. This isn’t a win for an income-oriented investor.

AGNC Funding is appropriate for a small group of buyers, however this group doesn’t embrace individuals searching for dependable sources of revenue.

On the opposite finish of the spectrum of dependable revenue streams is actual property revenue. This internet lease REIT has elevated its month-to-month funds yearly for 30 consecutive years. It has even elevated its dividends each quarter for over 100 consecutive quarters. That is most likely as shut as you will get to a inventory that may change a paycheck. Add to that its enticing yield – 5.6% on the present share value – and you may see why dividend buyers ought to make investments deeply in it.

#HighYielding #REIT #Inventory #Purchase #Keep away from , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america