I do know; my title makes a giant promise. The “final information” to the whole lot may embody a number of books, providing in-depth evaluation of each technique and thought possible.

However in the case of constructing lasting wealth within the inventory market, I work with a really quick checklist of methods confirmed to supply robust outcomes over time. You do not have to seek out “the following massive factor” earlier than anybody else, and you do not have to take out a second mortgage to finance your inventory shopping for plans.

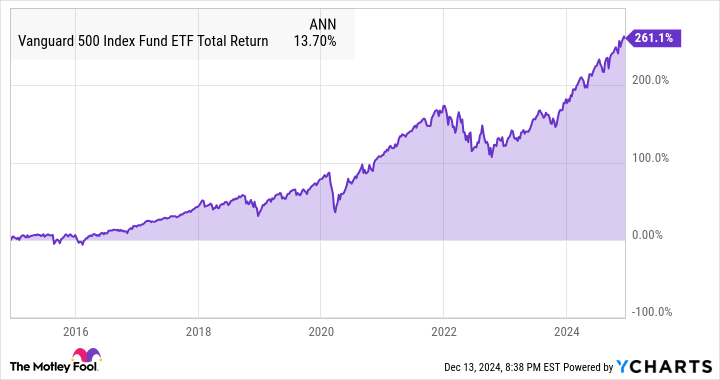

It is all about time, persistence and unwavering investing habits. That is much more true in the case of stable property like Vanguard S&P 500 ETF (NYSEMKT: VOL). In an ideal world, you’ll be able to arrange an automated value averaging plan, overlook about it for a number of a long time, and reap the rewards when it is time to increase the funds. required minimum distributions (RMDs) to assist your golden years.

Let me clarify.

Making constant investments over time serves a number of vital functions.

-

The principle thought is to make extra of your cash develop over time. I do not know your private price range, however for example you’ll be able to afford to ship $100 to your stockbroker every month. That is $12,000 per decade, however damaged down into small parts to ease the budgetary burden.

-

By letting this cash generate inventory market returns over the long run, your wealth will develop very steadily. THE S&P500 (INDEXSNP: ^GSPC) the market monitoring index offered a median total return — together with reinvested dividends — by 13.7% per yr since 1995.

-

$100 invested in an S&P 500 index fund again then could be value about $362 right this moment. Add one other $358 to the $100 you invested the next month, and… you get the drift. Loads of small investments can generate monumental worth over time.

-

I can not predict the long run with double-digit accuracy, however I can look again over long-term intervals of time to foretell what may occur subsequent. Investing $100 monthly within the Vanguard S&P 500 ETF over the previous 10 years, for instance, equates to a complete funding of $12,000. However the Vanguard fund’s ensuing place would now be value $26,540. This represents a market-based achieve of 121%, and these income have a tendency to extend over time.

It’s due to this fact very helpful to make many small investments over a protracted time frame. Imagine it or not, that is precisely how investing geniuses like Warren Buffett constructed their fortunes, regardless that they might have began with a much bigger price range.

The following tip is to take away emotion from the investing course of. You shouldn’t attempt to time the market and you aren’t obligated to search for the largest winners in a selected financial system. By making the identical funding each month, no matter inventory or fund value and different variables, you get extra shares when they’re low cost and fewer shares when they’re costly. This impact mitigates the affect of value will increase and worth decreases by including constant worth to your portfolio with every transaction.

#Final #Information #Investing #Vanguard #ETF #Most #Returns , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america