The cybersecurity area is a profitable however crowded business. Fortune Enterprise Insights predicts that this business will develop at a price compound annual growth rate (CAGR) of 14% by means of 2032. This might imply that speedy development will drive all shares within the sector larger over time.

Sadly for buyers, it is also a crowded and extremely aggressive area. With many rising firms and established tech giants providing cybersecurity options, this might put appreciable strain on cybersecurity actions over time.

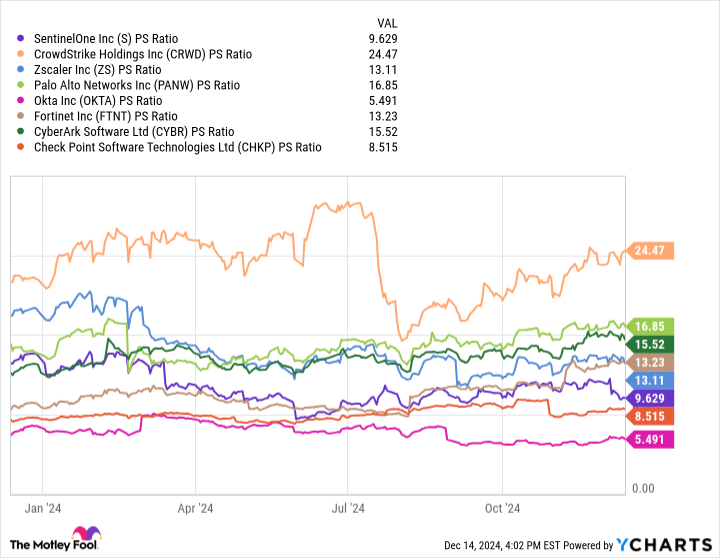

Nevertheless, SentinelOne (NYSE:S) seems to carry a bonus in synthetic intelligence (AI)-based cybersecurity merchandise, which might be a chance that many buyers appear to have missed.

SentinelOne stands out for its AI-based cybersecurity purposes. Certainly, its Singularity platform affords what it describes as “best-in-class safety.” It combines features comparable to information ingestion, menace intelligence assist, and execution of its automation capabilities. Moreover, the flexibility to trace safety threats makes it simpler to research assaults.

Nonetheless, the a part of Singularity that has attracted appreciable consideration is Purple AI. Purple AI works inside Singularity to automate safety alert triage, menace detection, and investigations, successfully simplifying the platform’s safety operations.

Moreover, the flexibility to know pure language makes it simpler to make use of. These options have made it one of many quickest rising options within the firm’s historical past.

Its strategy has additionally earned SentinelOne accolades in its business. Gartner acknowledges the cybersecurity firm as a pacesetter in its “Magic Quadrant” for endpoint safety, whereas CRN declared Singularity its cloud safety product of the 12 months.

Moreover, whereas it now not publishes whole buyer counts, the variety of clients spending at the very least $100,000 per 12 months on the platform elevated 24% to 1,310, and the variety of clients spending 1 million {dollars} or extra reached a file degree. Provided that organizations want to keep away from the disruption of switching cybersecurity suppliers, such development bodes properly for SentinelOne and its buyers.

SentinelOne’s monetary outcomes seem to replicate buyer development. Income for the primary 9 months of fiscal 2025 (ended Oct. 31) was $596 million, a 33% year-over-year achieve. Moreover, it restricted the expansion in working bills over the identical interval to 13%.

Sadly, this was not sufficient to cowl its working bills. Because of this, the corporate misplaced $218 million within the first three quarters of fiscal 2025. Whereas this determine is up from $267 million in the identical interval final 12 months, it exhibits that SentinelOne is unlikely to develop into worthwhile within the foreseeable future.

#SentinelOne #inventory #break , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america