(Bloomberg) — As he celebrated his sixty fifth birthday, Financial institution of America Corp.’s Brian Moynihan took the stage at a city corridor assembly and shook up the group, saying he needed to stay CEO when the inventory eclipsed $100.

The remark, delivered with a wry smile, did not simply flip heads as a result of the inventory value is at present $45. It underlines how for much longer the person poised to turn into the business’s main statesman plans to savor his standing.

Among the many 4 giants of business and client banking in america, Financial institution of America stands out – with the established order. It is the one one not present process a radical overhaul or publicly transferring towards change on the high. Moynihan, who confounded critics by turning across the lender after the 2008 monetary disaster, is about to mark his fifteenth 12 months as CEO and goes for it – with no inheritor obvious and no indicators of stepping away from his easy “accountable progress” technique.

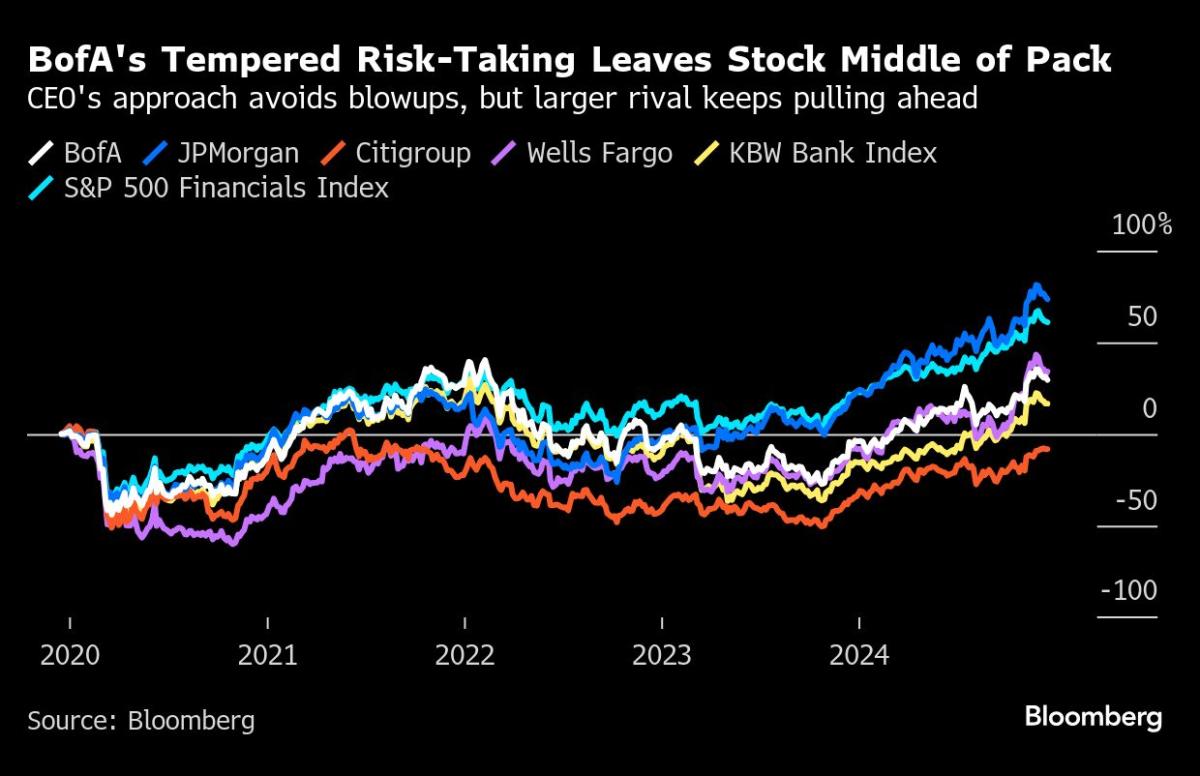

For shareholders, it is an strategy that has helped Financial institution of America rank eleventh among the many high 24 U.S. lenders within the KBW Financial institution Index over the previous 5 years. Analysts anticipate that by this time subsequent 12 months, the inventory may attain $49.

The corporate has prevented the regulatory upheaval that has pressured friends akin to Wells Fargo & Co. and Citigroup Inc. to concentrate on expensive overhauls. However it has additionally fallen behind its solely main rival, JPMorgan Chase & Co., on a number of fronts, together with Wall Avenue market share and inventory efficiency. Warren Buffett, Financial institution of America’s largest shareholder, decreased his stake this 12 months with out remark, sparking debate over his prospects.

“‘Accountable Progress’ Will Be Financial institution of America’s Key Technique – Why Change It?” stated Morgan Stanley analyst Betsy Graseck. “It’s just about the identical factor, however it works.”

The following query is whether or not the brand new administration of President-elect Donald Trump can shake up the monetary panorama to Financial institution of America’s benefit. In an interview with Bloomberg Tv on Tuesday, Moynihan predicted an “financial environment of deregulation” that would profit the business. This might imply, for instance, stress-free capital guidelines to encourage lending.

However for Financial institution of America, the approaching years may additionally embrace different U.S. coverage modifications that throw extra risk-inclined opponents off steadiness.

“The mantra of ‘accountable progress’ makes the distinction,” stated Mike Mayo, an analyst at Wells Fargo. “Any financial institution is in the future, one mistake away from ruining its steadiness sheet. Typically gradual and regular wins.

Again when he was a scholar at Brown College, Moynihan landed a summer time job with a utility, changing filthy water pipes in his dwelling state of Ohio.

It is a story he tells sparingly to these near him, explaining how he arrived at his administration philosophy. Success, he says, is usually about making a system and making it work.

When Moynihan took over Financial institution of America, he inherited such a large number that few within the business gave him a lot probability of success.

His predecessor, Kenneth Lewis, made two notorious offers because the monetary disaster unfolded: the acquisition of subprime mortgage machine Countrywide Monetary and agreeing to pay about $50 billion for Merrill Lynch on the verge of chapter. Buffett was exasperated, telling a authorities fee that if Lewis had waited only one extra day, he may have gotten the cash again for nothing. (The buyout closed for $18.5 billion.)

In late 2009, Financial institution of America’s board was looking for a brand new CEO. He wanted somebody who may lead the corporate within the face of a tidal wave of presidency investigations and lawsuits. By Wall Avenue requirements, the pay could be meager, on condition that the financial institution was supported by taxpayers.

Amid opposition from exterior opponents, the board settled on Moynihan – a educated lawyer who, within the chaos of the monetary disaster, had simply held a collection of senior positions throughout the agency with little time to make his mark.

“A variety of success”

Throughout his first two years on the helm of the corporate, the inventory collapsed, falling beneath $5, as shareholders anxious whether or not anybody may sustain along with his monumental money owed.

Moynihan succeeded. He struck a $5 billion take care of Buffett to safe new capital and the investor’s full help. The CEO paced by way of authorized and regulatory offers, giving the financial institution time to dig itself out of the opening. He additionally decreased prices and headcount, restoring profitability.

Opponents by no means satisfied him, stated Gary Lynch, the financial institution’s former normal counsel.

“Brian was a rugby participant,” Lynch stated. “He took loads of hits, which might have put lots of people out. However he continued. »

Buffett’s stake within the financial institution has grown to greater than 13% this 12 months.

Mood the dangers

A lot of Financial institution of America’s workers on Wall Avenue wrongly assumed that as quickly because it was again on its ft, risk-taking would ramp up once more.

This isn’t the case.

The accountable progress mantra that Moynihan started invoking round 2015 in nearly all of his public appearances has confirmed to be critical. When the corporate and its friends misplaced a whole lot of tens of millions of {dollars} on loans backed by shares of a struggling South African furnishings retailer in 2018, Moynihan’s staff put the brakes on that line of enterprise. Some formidable executives have left.

Over the previous decade, Financial institution of America’s Wall Avenue operations have fallen additional behind JPMorgan.

Noninterest revenue — an amalgam of revenue from buying and selling, company buyouts, consumer wealth and different actions — was roughly corresponding to what JPMorgan had a decade in the past. However that income stream has since declined at Financial institution of America, whereas it has elevated 54% at its rival.

Final 12 months, JPMorgan’s Jamie Dimon expanded his agency’s wealth administration enterprise by shopping for First Republic, geared toward expertise entrepreneurs. He has additionally persuaded shareholders to wager huge on new applied sciences, looking for to realize a bonus over opponents who cannot match the spending. That features a wave of platform acquisitions a couple of years in the past and a rising expertise price range anticipated to achieve $17 billion.

Dimon, 68, stated he was slowly nearing the top of his tenure as CEO — a perch that has made him the business’s statesman. In January, he reshuffled a small group of senior executives seen as his greatest succession candidates to offer them extra expertise.

The Financial institution of America succession image is bleaker.

In Moynihan’s early years as CEO, his most blatant substitute was Tom Montag, the previous Goldman Sachs government who went on to run Financial institution of America’s funding financial institution and finally turn into the corporate’s chief working officer. Firm. However when Montag and Anne Finucane, the financial institution’s vice chairman and oldest lady, left in 2021, it triggered a cascade of openings beneath.

The corporate has not but clarified which of its rising executives are important CEOs.

In an emergency, the most definitely substitute could be Dean Athanasia, 58, who oversees half of the corporate’s eight major segments, together with retail banking, small enterprise and business banking. He and Moynihan use Boston as their major workplace, commuting from the upscale city of Wellesley.

Future candidates embrace Jim DeMare, who runs the corporate’s Wall Avenue gross sales and buying and selling operations, and CFO Alastair Borthwick. Each are of their fifties.

DeMare persuaded the financial institution to place extra capital into his unit and spend money on its programs. Final 12 months, his workplace generated 37% extra income than earlier than he took workplace in the course of the pandemic. Moynihan touted his rising market share and this month expanded DeMare’s position to incorporate search operations.

Borthwick repositioned the corporate’s steadiness sheet, which contained too many low-yielding belongings when rates of interest rose in 2022. Now well-known in markets because the number-cruncher on convention calls, he beforehand ran providers business banking.

Different long-term candidates embrace Holly O’Neill, director of retail banking, and Wendy Stewart, director of business banking, who report back to Athanasia.

O’Neill oversees customer support for the lender’s 35 million retail banking clients. The corporate’s checking account checklist has grown for 23 consecutive quarters.

Stewart made a giant impression throughout final 12 months’s regional banking disaster, when clients flocked to the protection of huge banks. Its unit, which serves one in 5 U.S. companies producing between $50 billion and $2 billion in income, grew its buyer base by 55% amid chaos.

Buffett’s gross sales

After years of publicly praising Moynihan’s management, Buffett started lowering his stake in mid-July, with out remark. For months, the paperwork confirmed him promoting nearly day by day, till his stake fell beneath 10% in October, releasing him from the requirement to promptly disclose transactions. Markets might not know if its frenzy continues till a regulatory submitting is predicted early subsequent 12 months.

On stage at a management city corridor in October, Moynihan appeared irritated with some attendees over Buffett’s selloff. It’s doable that the financier merely needed to safe his income or acted primarily based on a imaginative and prescient of the sector. Regulators discourage main financial institution shareholders from talking with administration and influencing technique.

“It would not be honest to speak to him about inventory possession when he owns such a big share of the corporate,” Moynihan stated in a tv interview that month. “He doesn’t speak about it, we wouldn’t speak about it. However he has been a giant supporter of our enterprise and we now have benefited from it.

A month later, after Trump’s election victory, Mayo met Moynihan at a celebration and was struck: “I’ve by no means seen Brian Moynihan extra engaged and optimistic than at that dinner.” »

However the Wells Fargo analyst would not anticipate the CEO’s type to alter.

Moynihan “will get the place he needs to go, a couple of steps at a time,” Mayo stated. “He doesn’t do huge jumps, no huge gestures, no jumps over holes. He’ll get there, at his vacation spot, with out breaking a leg.”

–With assist from Hannah Levitt and Max Abelson.

Most learn from Bloomberg Businessweek

©2024 Bloomberg LP