Rubrik's shares saw a notable 22% rise in U.S. pre-market trading on Friday following the data management company's announcement that it had beaten earnings expectations and raised its forecast by income for the whole year. Analysts attribute the company's strong performance to the growing demand for data security, which was one of the main factors behind these impressive results.

Truist Securities, maintaining a “buy” rating on the stock, increased Rubrik's price target to $75 from $50. The company recognizes Rubrik's unique position in the market as a single provider of cyber resilience and data security management solutions. Third quarter results were supported by the public cloud, software as a service (SaaS) and data security sectors.

KeyBanc, which takes an “overweight” stance, echoes the sentiment regarding the company's data security momentum, driven by an uptick in ransomware attacks. The company raised its price target for Rubrik from $57 to $75, a sign of confidence in the company's direction.

BMO Capital Markets, with an “outperform” rating, also raised its price target significantly to $72 from $38, calling the quarter's results impressive. BMO analysts predict that broader adoption of GenAI technology could fuel long-term growth, with current demand for the Rubrik platform remaining robust.

In the third quarter, Rubrik reported an adjusted loss per share of 21 cents, which was significantly higher than the estimated loss of 40 cents per share. Total (EPA:) revenue came in at $236.2 million, beating the estimate of $217.6 million, with subscription revenue accounting for $221.5 million, compared to a forecast of $205.2 million . Maintenance revenue was reported at $4.34 million, slightly above the estimate of $4.03 million. The company's underwriting ARR reached $1.00 billion, exceeding the forecasted $975.3 million. The number of customers with a subscription ARR of $100,000 or more was 2,085, slightly lower than the estimate of 2,092 based on two forecasts. Finally, Rubrik achieved free cash flow of $15.6 million.

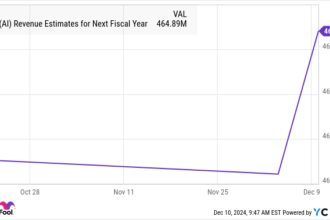

For 2025, Rubrik forecasts revenue between $860 million and $862 million, an increase from the previous range of $830 million to $838 million, with the consensus estimate being $834.9 million. The company expects an adjusted loss per share of $1.82 to $1.86, an improvement from the previous forecast of $2.06 to $2.12 loss per share, compared with an estimate of a loss per share of $2.09. Subscription annual recurring revenue (ARR) is expected to reach $1.06 billion, in line with previous forecasts. The expected adjusted contribution margin from ARR subscriptions is now -2% to -3%, better than the -6% to -7% previously expected. Additionally, Rubrik forecasts a narrower range of negative free cash flow, $39 million to $45 million, compared to the previous estimate of $57 million to $67 million, with a consensus estimate of 61.2 million negative dollars.

This article was generated with the support of AI and reviewed by an editor. For more information, consult our General Terms and Conditions.

#Rubrik #Stock #Jumps #Improved #FullYear #Earnings #Outlook #Investing.com

,