Securities in Celsius securities (NASDAQ:CELH) is down 50% this 12 months and practically 70% from all-time highs set in Might. The power drink model has been a development darling because the 2020 pandemic. Even with this decline, shares of Celsius are up greater than 2,000% since March 2020, which means they’re up 20x in lower than 5 years outdated. A 20-fold improve in 5 years makes Celsius top-of-the-line performing shares in recent times. At first of 2024, optimism was at its peak for the inventory.

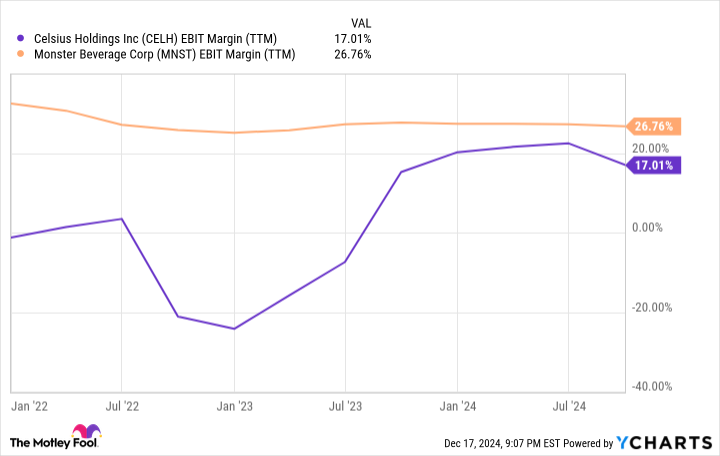

As we speak, that optimism has turned to pessimism, with Celsius’ income seeing a major slowdown and a year-over-year decline final quarter. This pessimism seemingly goes too far and presents a shopping for alternative for buyers. This is why development inventory Celsius Holdings is predicted to rebound in 2025.

By providing a sugar-free power drink, Celsius has catalyzed a shift in client preferences within the business. Traditionally, power drinks like Crimson Bull and Monster Power had been supposed for excessive sports activities, development staff and partying. A number of different folks had been ingesting power drinks, however that was the narrative that was going round.

Celsius has countered this narrative by providing its model of sugar-free power drinks to health influencers, athletes and ladies. This technique labored splendidly and helped increase your complete class and get folks transferring towards sugar-free drinks. As we speak, greater than 50% of power drinks in the USA are sugar-free, whereas Celsius generates greater than $1 billion in annual income.

As a way to get hold of nationwide distribution, Celsius has signed an settlement with PepsiCo in 2022. Pepsi is now Celsius’ nationwide distributor, giving the model higher shelf area to compete with Crimson Bull and extra established names. Early within the deal, Celsius was rising income by greater than 50% 12 months over 12 months, prompting Pepsi to order as a lot stock as potential to make sure cabinets had been all the time stocked with Celsius. In 2024, Pepsi realized that it had ordered an excessive amount of Celsius stock and started slowing down its orders to steadiness provide and demand.

Finish market demand from Celsius’ prospects continues to develop, however this slowdown in orders from Pepsi is inflicting a brief slowdown in Celsius’ income. Income fell 33% 12 months over 12 months in North America final quarter. That is the primary cause for the collapse of Celsius shares, however it is just a brief phenomenon. Its market share in North America continues to be 12%, in line with third-party estimates.

The final decade of development for Celsius was pushed by North America. Market share has grown from nearly 0% to over 10%, which is why annual income now exceeds $1 billion. Power drink gross sales are anticipated to proceed to develop steadily in its residence market, though no investor ought to count on explosive development from this market anymore, given the corporate’s present dimension.

#Development #Inventory #Anticipated #Rebound #12 months , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america