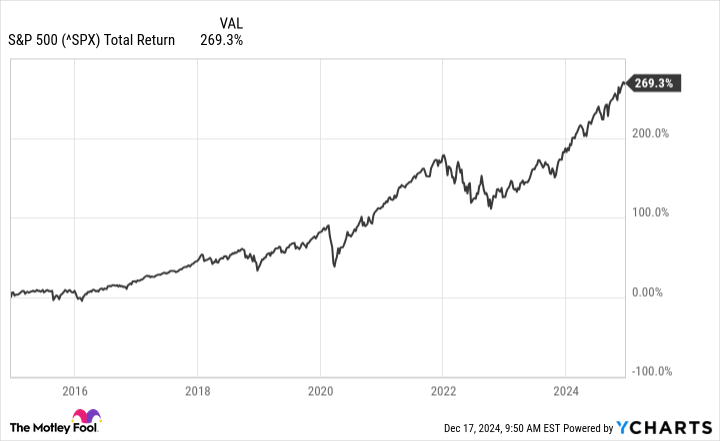

Spend money on S&P500 (INDEXSNP: ^GSPC) has at all times been a good way for somebody to extend their wealth. As a benchmark for your complete market, the index tracks 500 of the biggest and most profitable U.S. firms.

Though you can not make investments straight within the S&P 500, quite a few exchange-traded funds (ETFs) observe the low value index. And since these ETFs unfold your cash throughout a whole lot of shares, a guess on the S&P 500 generally is a much less dangerous approach to put money into the inventory market than selecting particular person shares.

It’s not at all times doable to speculate a big sum within the inventory market. Nevertheless, should you inherit or revenue from the sale of a house, you could possibly make a big funding, even when you have not collected important financial savings.

Under, I am going to take a look at whether or not investing $50,000 in an S&P 500 index fund can put you on the trail to having $1 million in retirement, a objective many individuals must comfortably reside out their golden years.

Practically a century in the past, the compound annual return of the S&P 500, together with dividends, was 10.1%. However over the previous 10 years, the index’s return has been much more spectacular, at 13.7%. Whereas that is nice information for buyers who invested throughout this era, the outlook for the subsequent decade is probably not as rosy.

Goldman Sachs analysts, for instance, predict that the S&P 500 will generate a median annual return of solely 3% over the subsequent 10 years as a consequence of excessive valuations and the ensuing focus of worth within the largest holdings of the trace. JPMorgan analysts estimate that the index will generate an annual return of simply 6% over the subsequent decade.

Merely put, investing within the index right now may imply considerably decrease returns than buyers have turn out to be accustomed to in current historical past.

However for somebody simply beginning out or within the technique of beginning their profession, investing your retirement financial savings means pondering past the subsequent decade. So even when the index’s returns over the subsequent 5 or ten years are comparatively low, the S&P 500 may nonetheless make up for these down years with higher returns sooner or later. There are just too many components that might weigh on the markets, making it virtually unimaginable to foretell precisely what the market will do a number of years into the longer term.

As a substitute of making an attempt to guess precisely what the S&P 500’s annual returns can be over the subsequent decade and past, the chart under illustrates what a $50,000 funding may very well be value below completely different situations.

#investing #right now #surefire #hit #million #retirement , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america