In accordance with CNBC knowledge courting again to 1980, the Nasdaq and different benchmarks have traditionally risen within the months following a presidential election. This development has continued in 2024, with the know-how index up about 10% since Donald Trump’s victory on November 5. A brand new administration could imply much less political uncertainty, making many market contributors extra comfy holding belongings on the whole.

There is no such thing as a assure that the Nasdaq’s momentum will proceed in 2025. However as Wall Avenue continues to pour cash into AI know-how, Superior microdevices (NASDAQ:AMD) And Amazon (NASDAQ:AMZN) These are two shares that might experience the wave and enter one other yr of stellar development. Let’s dig deeper.

With shares down 13% this yr, AMD is one chipmaker that has missed a lot of the generative AI rally, regardless of being a significant participant on the {hardware} facet of the chance. The chipmaker’s diversified enterprise mannequin makes it a fantastic various to Nvidia. And an inexpensive valuation is the icing on the cake for buyers.

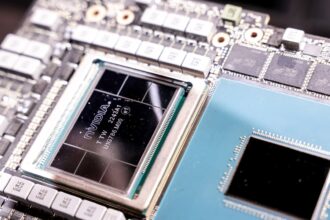

AMD’s third-quarter income elevated 17% yr after yr at $6.8 billion. Nevertheless, this consolidated determine might masks the spectacular efficiency of its knowledge heart phase, which soared 122% to $3.5 billion, pushed by gross sales of superior merchandise. graphics processing units (GPU) to run and prepare AI algorithms. Administration plans to drive continued knowledge heart development by releasing new, extra superior chips, such because the Intuition MI325X collection, designed to compete with Nvidia’s Blackwell.

With 51% of its income coming from knowledge heart gross sales, AMD is much extra diversified than Nvidia, which generated about 88% of its third-quarter income from the info heart phase. Though AMD’s much less AI-focused enterprise mannequin has led to slower development within the quick time period, it can make the corporate far more resilient to a possible business downturn.

AMD forward price/earnings ratio The (P/E) a number of of 25 can be decrease than Nvidia’s, which is round 31 occasions ahead earnings.

Whereas AMD is numerous Throughout the tech {hardware} business, Amazon is taking diversification to a different stage with footprints in e-commerce, cloud computingand AI infrastructure. Administration’s cost-cutting efforts have positioned the corporate in a superb place to execute its long-term technique and return worth to buyers.

Beneath the management of CEO Andy Jassy, who took the helm in early 2021, Amazon has moved from a growth-at-all-costs technique to at least one prioritizing sustainable profitability. A number of years of layoffs and optimization of the distribution community have labored wonders on its operational outcomes.

#Shares #Purchase #Forward , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america