In terms of sturdy retail corporations, traders may wrestle to outperform Costco (NASDAQ: COST). The warehouse retail big’s stock apparently continues to defy gravity. Regardless of more and more sturdy arguments in favor of the inventory’s overvaluation, it’s up 50% in comparison with final 12 months.

This example naturally leaves traders questioning transfer ahead with Costco inventory. Do continued will increase imply traders should purchase as a result of its valuation not issues? Plus, even when they personal it, can a shareholder justify remaining within the inventory, or is its worth so stratospheric that each one traders ought to keep away? Given these potentialities, traders ought to take a better have a look at retail stock earlier than making such choices.

Regardless of the extreme competitors within the retail trade, Costco has distinct benefits. Certainly, it should compete with Amazonwhich doesn’t have the overhead of sustaining warehouse shops and owns different companies that would theoretically take in losses from retail operations.

Nonetheless, traders ought to remember the fact that even Amazon’s success facilities are overhead, negating a lot of this benefit. Moreover, Costco sells most objects in bulk, giving it further capability to scale back costs.

Moreover, Costco has sidestepped the cultural challenges which have hindered the worldwide progress of outlets reminiscent of Walmart And House deposit. So whereas these retailers have little room so as to add areas, Costco has barely scratched the floor of its retailer progress potential, regardless of working in 47 U.S. states and 14 international locations.

Moreover, Costco has fostered sturdy buyer loyalty. Its membership renewal fee is 90% globally, and regardless of a latest hike within the worth of memberships in the USA, 93% of Costco’s U.S. members select to resume their memberships.

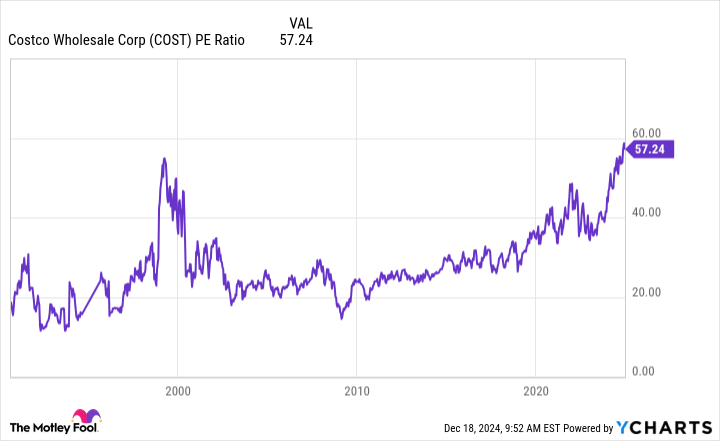

Sadly, these advantages do not come low cost for traders. Rising purchaser curiosity within the inventory has taken its toll Price/earnings ratio at practically an all-time excessive of 57, making a continued rise within the inventory worth much less seemingly. Moreover, its ahead earnings a number of of 54 signifies that rising earnings is not going to considerably scale back its P/E ratio.

Moreover, its monetary efficiency doesn’t appear to justify its earnings a number of. Within the first quarter of fiscal 2025 (ended November 24), whole income of $62 billion elevated 8% year-over-year. Extra broadly, income grew 5% in fiscal 2024 (ended September 1), indicating a good however not outsized progress fee.

Within the fiscal first quarter, web earnings was $1.8 billion, up 13%, as income from non-operating sources boosted the corporate’s income. Nonetheless, that determine is down from the 17% enhance seen in fiscal 2024.

#Costco #Inventory #Purchase #Promote #Maintain , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america