With a present yield of 5.1%, shares bought from UPS (NYSE:UPS) would generate $6,550 in annual earnings for those who invested $100,000 in each shares. Though markets are questioning the corporate and its full-year steerage, the inventory nonetheless represents wonderful worth for long-term buyers. Here is why.

A blue-chip inventory like UPS yields 5.1% for a motive, and that is because of some market skepticism in regards to the firm’s dividend and/or its skill to boost its dividend. It is comprehensible. In any case, administration’s said objective is to pay about 50% of their adjusted wage earnings per share (EPS) in dividends. Sadly, whereas the market is just anticipating $7.49 in EPS this 12 months, the present dividend of $6.52 is equal to 87% of its EPS.

Analysts questioned administration in regards to the sustainability of the dividend throughout an earnings convention name earlier this 12 months, and CEO Carol Tome insisted: “We now have no intention of slicing the dividend simply to that these calculations work.” In different phrases, the dividend won’t be lowered in order that UPS can meet its objective of paying a dividend equal to 50% of income. As a substitute, administration plans to extend income to carry the ratio right down to 50%.

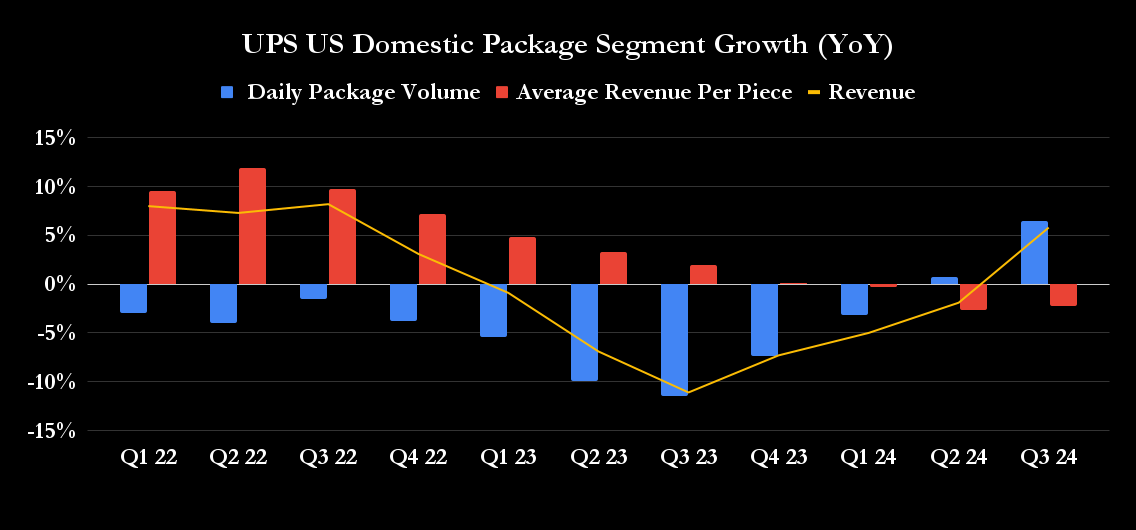

Happily, there are good causes to consider that it’s doable. After a number of years of declining parcel volumes in its primary American home market, UPS is as soon as once more bettering its volumes and its turnover is rising.

On the similar time, the corporate is now bearing elevated labor prices related to a brand new contract reached after prolonged negotiations final 12 months, making price comparisons simpler sooner or later. Moreover, UPS made good price progress in its home section within the third quarter reporting a 4.1% lower in price per half 12 months over 12 months, which greater than offset the two.2% lower in turnover per piece, resulting in a rise in margin.

Moreover, UPS will cut back its printing prices by $1 billion by slicing 12,000 jobs in 2024, lowering its skill to adapt to market demand.

As famous in the course of the Investor Day presentation in March, the US small parcel market went from a capability deficit of a median each day quantity of 6 million packages in the course of the lockdown interval to a capability deficit surplus with a median each day quantity of 12 million packages in 2023/2024.

Overcapacity is because of an sudden shortfall in supply volumes because of persistently excessive rates of interest slowing financial exercise (there’s additionally the issue of shoppers shifting to decrease price supply choices) and the fallout of the capability enhance carried out by the trade to deal with the capability deficit throughout confinements.

#HighYielding #Dividend #Inventory #Purchase #Maintain #Decade , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america