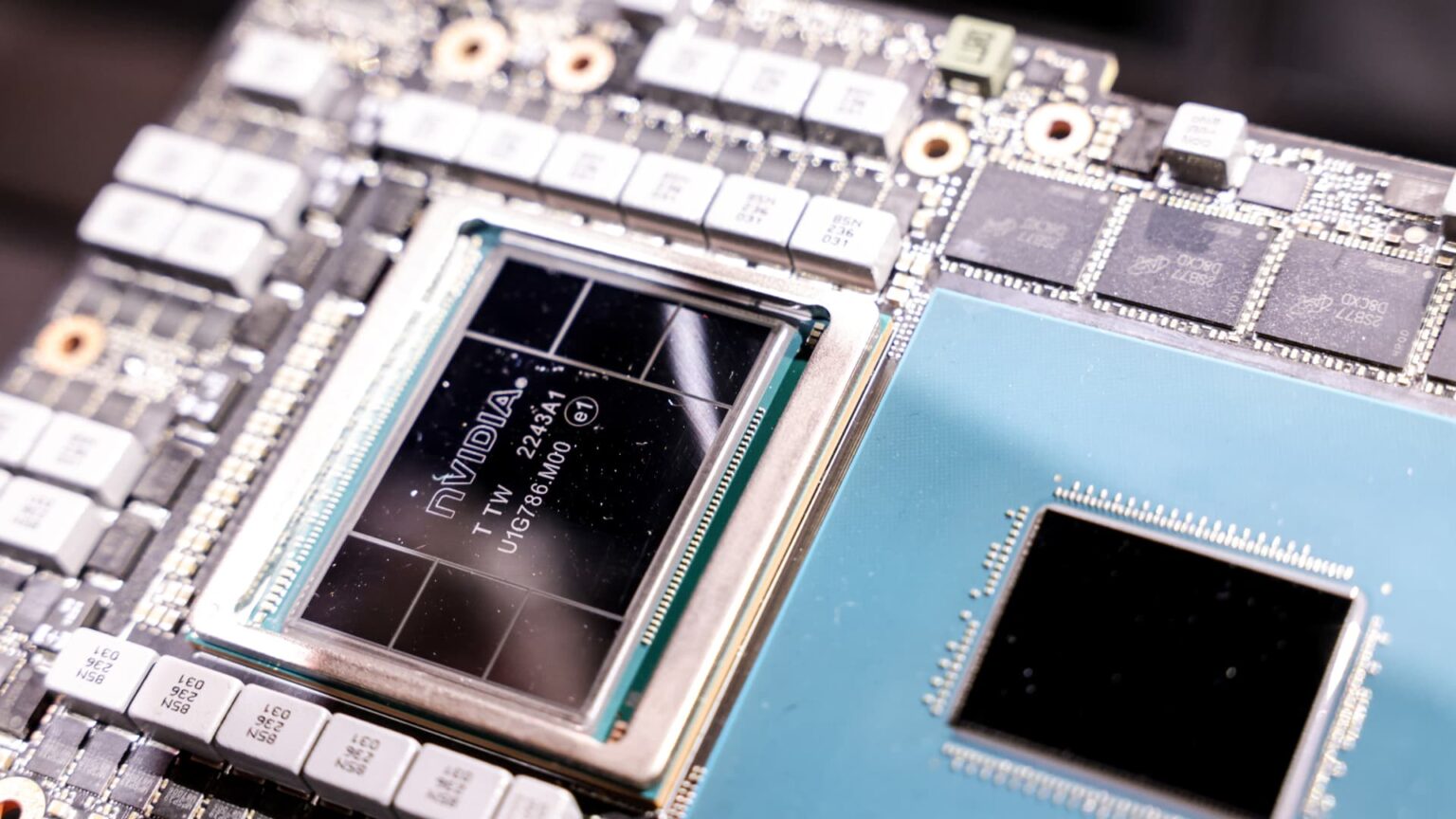

An Nvidia chip on the Taipei Computex exhibition in Taipei, Taiwan, Might 29, 2023.

Bloomberg | Bloomberg | Getty Photos

Asia-Pacific shares had a great run in 2024, with most main markets ending the 12 months in optimistic territory because the area’s central banks eased financial coverage whereas an AI increase boosted tech shares.

that of Taiwan Tax led beneficial properties within the area, up 28.85% as of December 23, whereas Hong Kong Hang Seng Index is available in second place with 16.63%.

Asia with success inflation reduced faster than the rest of the worldmentioned Mike Shiao, chief funding officer for Asia ex-Japan at funding administration agency Invesco, paving the way in which for financial easing.

“With the Federal Reserve now starting its easing cycle, Asian nations can have extra room to decrease rates of interest in 2025,” he mentioned in a be aware. Looser financial coverage tends to spice up shares.

The market’s concentrate on know-how and technology-related shares contributed to the Taiex’s rise. Heavy items automobiles Taiwan semiconductor manufacturing company soared 82.12% in 2024, and Apple’s major provider Foxconn traded as Hon Hai Precision Industry superior by 77.51%.

Whereas the demand for data centers and AI servers could moderate After this 12 months’s surge, demand for AI-enabled cellphones, computer systems and different client electronics might enhance in 2025, in keeping with a DBS Financial institution outlook be aware.

DBS famous that the worldwide semiconductor sector sometimes experiences an enlargement cycle lasting round 30 months. The present cycle, which started in September 2023, has the potential to increase till the tip of 2025.

Though tech shares helped raise Taiwan, they could not save South Korea, which was the one main Asian market to finish the 12 months in adverse territory. The nation’s “enterprise enhancement program” seems to have failed to spice up shares, with fears over tariffs and political unrest adds to uncertainty.

The reference of the nation Kospi misplaced 8.03% as of December 23, making it the worst performing Asian market.

Main economies, significantly the USA and China, can have a big influence on South Korea’s export-led financial system, Paul Kim, head of equities at Eastspring Investments, mentioned within the firm’s 2025 outlook.

“Main exporters comparable to IT {hardware} and car gamers might face challenges,” he added.

The removing of Chairman Yoon Suk Yeol will undoubtedly weigh on traders’ minds, with Lorraine Tan, director of Asia fairness analysis at Morningstar, telling CNBC earlier this 12 months that “the longer the change in path takes time, the extra probably traders are to be sidelined.

Kim additionally mentioned the federal government would play a key function within the nation’s markets, noting that potential enterprise regulatory reforms, fiscal stimulus and the potential of additional price cuts by the Financial institution of Korea might assist the enterprise setting and stimulate home demand.

Outlook 2025

Two main areas that will likely be on traders’ minds in 2025 will likely be Donald Trump’s presidency and the state of China’s financial system, in keeping with George Maris, chief funding officer and international head of equities at Principal Asset Administration.

The brand new Trump administration’s insurance policies will probably decide the 2025 progress and inflation outlook in Asia, in keeping with Nomura.. “We anticipate tariffs to extend early subsequent 12 months, which might result in a pick-up in inflation and a slowdown in funding progress.”

Nomura mentioned greater tariffs and commerce obstacles would result in fewer exports from Asia. Elevated uncertainty and tit-for-tat retaliation might delay enterprise funding within the area.

Manufacturing and trade-dependent economies, comparable to these in Asia, are prone to be extra affected, “as tariffs result in diminished commerce flows and put downward strain on progress”, Freida Tay, supervisor of institutional fastened earnings portfolio at international funding supervisor MFS Funding. Administration instructed CNBC.

Nomura predicts that Asia may also face tighter international monetary situations in 2025, on account of greater rates of interest and a stronger greenback.

At its final assembly in 2024, the US Federal Reserve signaled there would be fewer rate cuts in 2025, whereas elevating its inflation forecasts.

Nomura sees “diverging financial coverage outlooks” throughout the area, saying nations like China, Australia, South Korea and Indonesia, that are extra uncovered to forex dangers, will see coverage easing financial in 2025.

Accommodative financial coverage sometimes weakens a rustic’s forex, making exports cheaper and probably supporting progress within the face of tariffs.

Alternatively, nations which have “robust progress, greater inflation and nonetheless accommodative financial situations” will increase their charges, comparable to Japan and Malaysia.

General, 2025 comes with loads of uncertainty, specialists say.

Nomura analysts write that “turmoil lies forward” for the area, stating that whereas robust demand for AI and concentrated exports ought to present some assist for progress within the first quarter, the area “appears to be heading right into a sea extra turbulent” from the second quarter, because of the influence of the Trump presidency, China’s overcapacity and the slowdown within the semiconductor cycle.

Nevertheless, the corporate estimates that progress is greater than that of Asian economies with stronger home demand reserves, comparable to these of Malaysia and the Philippines, whereas India, Thailand and South Korea are anticipated to face opposite winds.

China: challenges and alternatives

The state of China’s financial system may also be a key space of focus for Asian traders, with merchants anticipating a “vital dedication to sustainable progress” in Asia’s second-largest financial system, Maris mentioned.

In 2024, China’s inventory markets ended a three-year dropping streak, with the CSI 300 gaining 14.64%, as Beijing focuses on strengthening its financial system.

Nomura analysts anticipate extra stimulus from China to assist its financial system, whereas stressing that Beijing must stabilize its ailing property market, restore its tax system, strengthen social assist and ease tensions geopolitical points to be able to “obtain an actual and lasting restoration”. “.

“This can be a vital problem at a time when Chinese language exports – the principle contributor to progress in 2024 – might face robust headwinds following Trump’s return. Though Beijing might persist with the GDP progress goal of “round 5%”, we anticipate progress to sluggish. to 4.0% in 2025, in comparison with 4.8% in 2024,” Nomura mentioned.

Maris sees alternative on this planet’s second-largest financial system. He’s “constructive” in the direction of firms uncovered to Chinese language shoppers.

He added that these firms are sometimes buying and selling at enticing valuations, “given the preponderance of adverse sentiment”, however that if authorities stimulus involves fruition, these firms will probably profit from improved demand.

#Taiwan #leads #Asian #shares #Trump #tariffs #outlook #Chinese language #financial system #clouded, #gossip247.on-line , #Gossip247

,

—

ketchum

chatgpt

instagram down

is chatgpt down

dortmund vs barcelona

ai

dortmund – barcelona

rosebud pokemon

drones over new jersey

juventus vs man metropolis

the voice winner 2024

inexperienced skinned pear selection

paralympics

arsenal vs monaco

hannah kobayashi

intercontinental cup

bidwell mansion

brett cooper

hawks vs knicks

alexander brothers

wealthy rodriguez

christopher wray

time journal particular person of the 12 months 2024

ruger rxm pistol

unc

austin butler

milan vs crvena zvezda

captagon

jalen brunson stats

gerry turner

invoice belichick girlfriend

pachuca

elon musk internet value

kraven the hunter

kyle teel

david bonderman

rocky colavito

mitch mcconnell fall

cam rising

survivor finale

liver most cancers

fortnite ballistic

feyenoord – sparta praha

luis castillo

jim carrey internet value

xavier legette

kj osborn

invoice belichick girlfriend age

copilot ai

volaris flight 3041

suki waterhouse

bomb cyclone

100 years of solitude

la dodgers

rangers vs sabres

kreskin

sabrina singh

brian hartline

emory college

russia

ai generator

mega hundreds of thousands 12/10/24

jalen johnson

colby covington

adobe inventory

riley inexperienced

alperen sengun

sport awards

meta ai

josh hart

nationwide grid

og anunoby

triston casas

the street

dyson daniels

sutton foster

sec schedule 2025

jordon hudson

emory

mta

microsoft ai

mikal bridges

bard ai

tally the elf

invoice hennessy

elizabeth warren

utep basketball

julia alekseyeva

zaccharie risacher

lily phillips documentary

fred vanvleet

devon dampier

colgate basketball

jonathan loaisiga

anthropic

david muir

ai chatbot