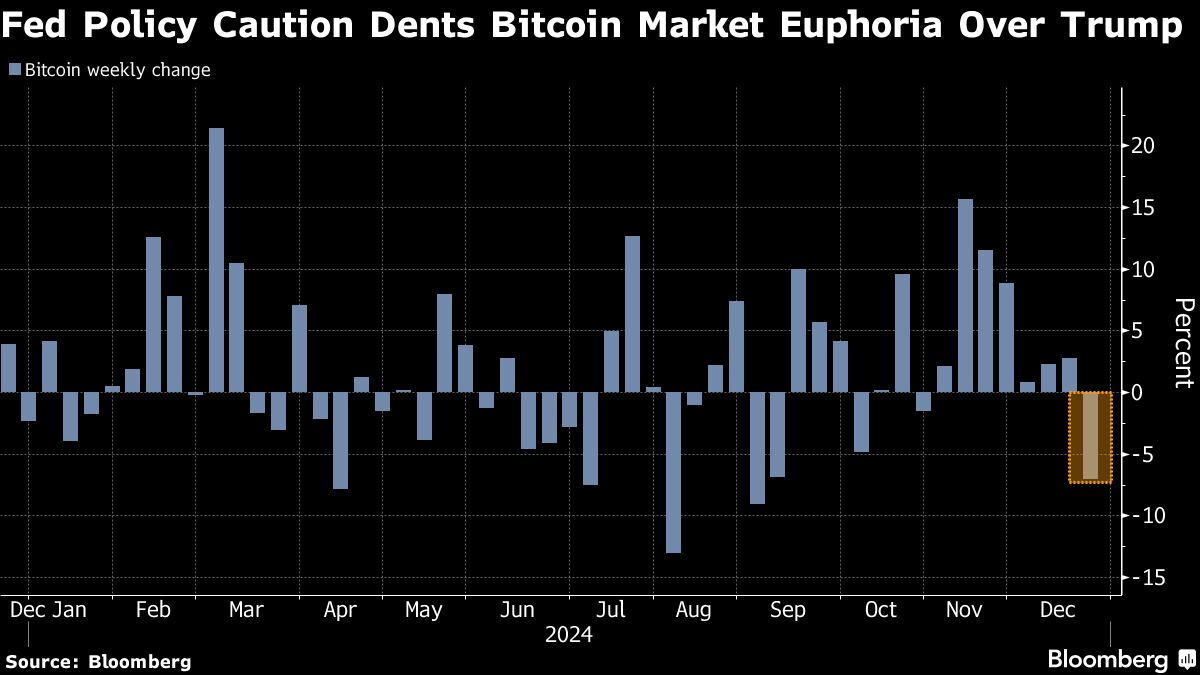

(Bloomberg)-Bitcoin (BTC-USD) marked its first weekly decline since Donald Trump’s election victory, because the Federal Reserve’s cautious coverage outlook tempered optimism concerning the president-elect’s embrace of the crypto sector.

Most learn on Bloomberg

The biggest digital asset was down 9.5% over a seven-day interval via 10 a.m. Monday in London. A broader crypto market gauge, encompassing smaller tokens reminiscent of Ether and meme-favorite Dogecoin (DOGE-USD), suffered a extra marked decline, of round 12%.

The Fed made a 3rd straight rate of interest minimize on Wednesday whereas signaling a slower tempo of financial easing subsequent yr to include inflation, sending international shares tumbling. The hawkish pivot additionally dampened the speculative spirits unleashed within the crypto market by Trump’s dedication to favorable regulation and his help for a nationwide Bitcoin stockpile. A document outflow of U.S. exchange-traded funds investing immediately in Bitcoin final week will weigh on costs within the close to time period, mentioned Sean McNulty, director of buying and selling at liquidity supplier Arbelos Markets.

“We should always keep the $90,000 degree for Bitcoin via the top of the yr, but when we fall beneath it might set off additional liquidations,” McNulty mentioned, including that “vital protection on the decline” was noticed within the choices market final week with heavy consumers for January. February and March predict strikes of $75,000 to $80,000.

The unique cryptocurrency modified palms at round $96,000, nearly $12,000 beneath the document set on December 17. The token remains to be up round 40% for the reason that November 5 presidential election.

Unstable near-term worth motion earlier than an “upward trajectory” via the primary quarter of 2025 stays the “most certainly state of affairs,” David Lawant, head of analysis at crypto prime dealer FalconX, wrote in a word.

Lawant mentioned a “low liquidity atmosphere might result in extra volatility as we enter the ultimate days of the yr, particularly as a result of on December 27, crypto will possible expertise the biggest expiration occasion of “choices of its historical past”.

All eyes are on the Bitcoin proxy operated by MicroStrategy Inc. (MSTR), the previous dot-com period software program maker, continues its weekly purchases of the biggest cryptocurrency in america on Monday and hits the subsequent worth set off, merchants mentioned.

(Updating costs.)

Most learn from Bloomberg Businessweek

#Bitcoin #posts #weekly #decline #Trumps #election #victory , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america