Rosenblatt surveyed its analysts, together with Steve Frankel, assembling their prime picks for the primary half of 2025. The shares mirror key themes in its analysis universe, together with the period of synthetic intelligence and constructing out next-generation broadband.

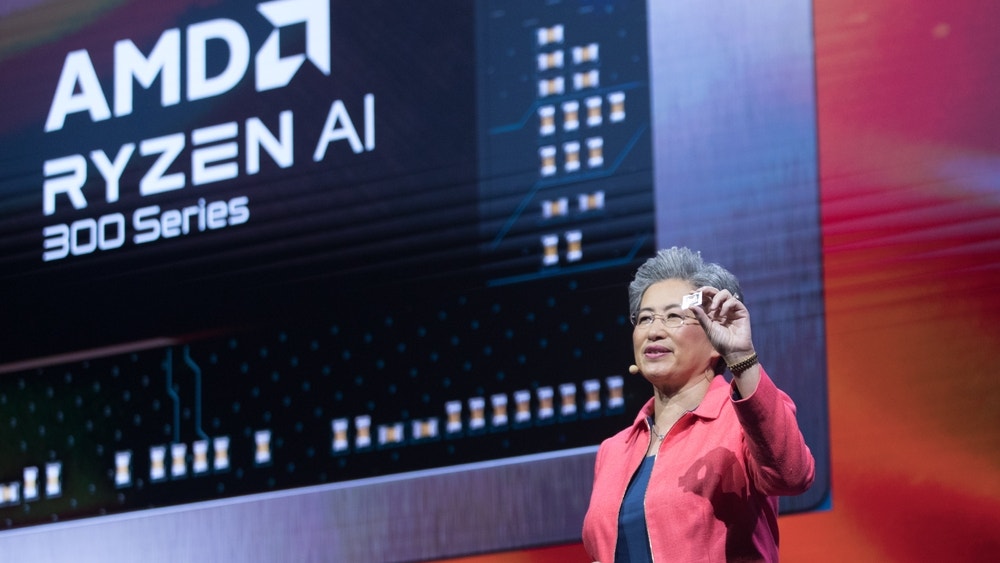

Steve Frankel maintained a Purchase ranking on Superior Micro Units, Inc. (NASDAQ:AMD) with a value goal of $250.

Learn additionally: Nvidia wins EU approval for Run:ai deal, US investigates Chinese export violation

AMD is one in every of Rosenblatt’s prime picks for the primary half of 2025 as a consequence of momentum in CPU and GPU share good points by way of 2025 and a broader non-AI restoration in late 2025.

The distinction as we method 2025 is that the Road acknowledges this dynamic, which has double-digit market shares in GPU computing and AI inference on the edge, as a long-term alternative on the place of Xilinx and the prowess of the chipsets.

AMD’s EPYC processors will doubtless proceed to extend the corporate’s income share in server and information middle processors as a result of the enterprise proposition is important, the analyst stated.

AMD’s MI350 GPUs in 2025 and MI400 GPUs in 2026 will drive incremental income and elevated market share by way of large-scale adoption, chipset scale and the transfer of AI to the sting, a- he added.

The worth goal displays a P/E a number of of 25 instances to Frankel’s adjusted EPS of $10.00 for fiscal 2026. This a number of is in step with the common of the analyst’s AI calculation group, which is 25 instances.

Frankel reiterated a purchase ranking on Micron Expertise, Inc. (NASDAQ:IN) with a value goal of $250.

Micron is one in every of Rosenblatt’s prime picks for the primary half of 2025 because it appreciates the big alternative for deploying DRAM content material on AI platforms sooner or later.

The analyst significantly preferred Micron’s HBM alternative, the place swap ratios are 3 to 1 in comparison with DDR5 and improve to 4 to 1 with the transfer to HBM4, a structural change that Frankel solely noticed in no different reminiscence cycle.

HBM provide within the trade continues to be a difficulty to observe as provide doesn’t meet up with demand till 2025.

For Micron, Frankel’s view on HBM has extra to do with the general DRAM bit provide implications, with HBM3E getting a 3-to-1 swap ratio and HBM4 getting a 4-to-1 swap ratio, creating favorable dynamics of provide and demand.

Frankel famous Micron as an HBM market share winner within the HBM3E and HBM4 varieties and because the phase strikes from 8-Hello to 12-Hello and 16-Hello configurations, the place energy effectivity (a structural benefit of Micron) is turning into increasingly vital.

Frankel discovered utilizing P/E to worth Micron to be affordable, given its constant, confirmed profitability by way of cross-memory cycles, aggressive inventory repurchases, and a cycle pushed by stock-load dynamics. AI work in correlation with DRAM content material. The worth goal displays a P/E a number of of roughly 15% on FY2026 analyst adjusted EPS of $18.

#AMD #Micron #analysts #prime #picks #progress #nextgeneration #applied sciences , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america