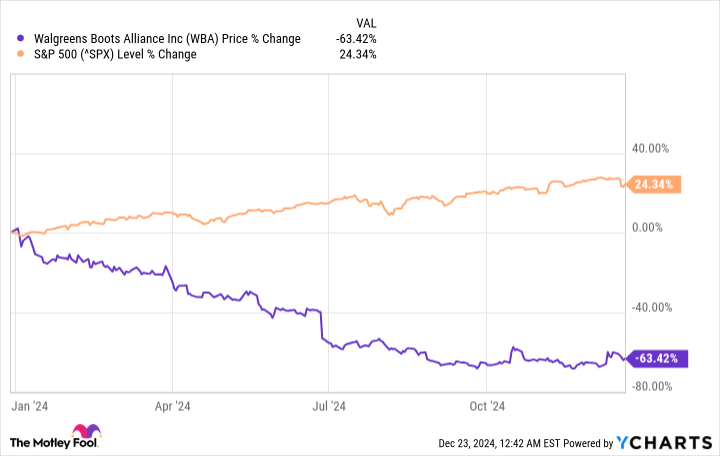

Till lately, many Walgreens Boot Alliance (NASDAQ:WBA) traders have been determined for excellent news to spice up the corporate’s sluggish inventory worth. On December 10, they obtained some, within the type of a report detailing a doable buyout settlement. This gave shares a small enhance, however general traders stay cautious.

Ought to they be monitored this fashion, or is that this a possibility to select up an undervalued inventory at a deep low cost?

This December 11 report was printed by The Wall Road Journalwho writes that Walgreens administration is in discussions with private equity company Sycamore Companions to go personal. Usually, a privatization deal is expensive for the corporate being remodeled.

The monetary newspaper instructed there was some urgency in these negotiations. Citing “unidentified individuals conversant in the matter,” he wrote that the 2 sides might attain a deal early subsequent yr.

Neither Walgreens nor Sycamore have but formally commented on the article.

Going personal would eradicate the stress Walgreens administration certainly feels from shareholders, who’ve seen the worth of their stakes decline. Regardless of the pretty minor worth hike ensuing from the obvious announcement of the buyout dialogue, shares of the pharmacy chain operator have been largely down this yr.

Walgreens is at the moment dealing with a number of challenges associated to its enterprise and isn’t dealing with them very nicely. It presents the issue shared by many different conventional firms, in that it stays a powerful operator in an setting the place the retail apocalypse continues to take its toll.

In March, Amazon spear same day delivery for treatment, and several other months later, Walmart introduced it could pilot an analogous service. Having a strong retailer making an attempt to poach your small business is a troublesome state of affairs; having to cope with a possible of two makes the issue exponentially worse.

Moreover, the facility of pharmacy profit managers (PBMs) has negatively affected Walgreens’ revenue margin. PBMs have been fairly efficient in decreasing drug costs for each medical health insurance suppliers and companies.

Walgreens has taken steps to streamline its operations, however these look like too little, too late. Over the summer season, administration introduced plans to shut numerous underperforming shops and scale back its funding in main care firm VillageMD. Nonetheless, it is not like these retailers are simply beginning to present mediocre outcomes. Entry into the care phase was by no means significantly nicely thought out, even at first.

#Walgreens #Main #Determination #Delight #Traders , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america