Semiconductor manufacturing in Taiwan (NYSE:TSM) is on a roll. On the heels of a three-year disaster in chipmaking companies, TSMC is dealing with unprecedented manufacturing demand. The rise of synthetic intelligence (AI) that started two years in the past appears to final for years, and that is not even all: fashionable automobiles want a ton of processors, and the smartphone market can be getting back from an extended recession.

Thus, TSMC inventory doubled in 2024. Its market capitalization has been hovering across the uncommon $1 trillion degree since October.

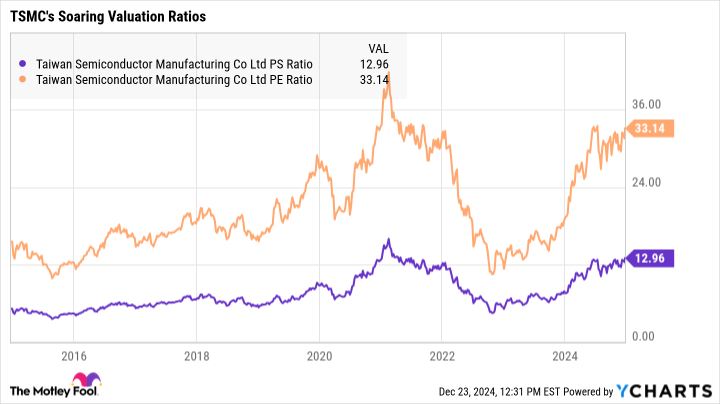

On the similar time, TSMC shares are buying and selling at excessive valuation ratios. Is the inventory overvalued at this time or is TSMC nonetheless a terrific purchase at at this time’s excessive costs?

The corporate operates in a {hardware} manufacturing business. It’s a high-tech enterprise, far faraway from constructing homes, tractors or industrial equipment, however nonetheless a comparatively low-margin enterprise that requires very vital capital funding. Chip manufacturing vegetation do not develop on bushes, you understand.

TSMC’s capital expenditures totaled $24.6 billion over the previous 4 quarters. It is greater than Apple, TeslaAnd Nvidia spent on capital investments — collectively.

Firms with costly belongings are inclined to develop fairly slowly and their shares usually commerce at very modest valuation ratios. The ten largest industrial shares, for instance, at present commerce at a median price-to-sales (P/S) ratio of two.5. TSMC inventory is price 12.8 occasions gross sales. It is the identical story with price-to-earnings or price-to-free money stream: TSMC shares are hovering to traditionally excessive ratios and look costly subsequent to corporations with comparable enterprise fashions.

The corporate backs up its costly inventory valuation with sturdy enterprise outcomes.

After a short lived decline because of the latest scarcity of semiconductor supplies and engineers, TSMC’s gross sales and earnings are hovering once more. Income grew 39% yr over yr within the not too long ago reported third quarter. Internet revenue jumped 54% throughout the identical interval and money earnings actually soared. TSMC’s free money stream almost tripled, rising 172% to NT$185 billion (roughly US$5.7 billion).

So chances are you’ll be paying a premium for TSMC inventory, however it is a world-class firm that is arguably price each penny of its excessive value. Development-oriented valuation metrics look fairly affordable, with a ahead price-to-earnings ratio of 23 occasions greater than subsequent yr’s estimates and a price-to-earnings-to-growth (PEG) ratio of 1.1. Each figures recommend that the present share value is about proper – neither terribly costly nor notably low cost.

#Taiwan #Semiconductor #Inventory #Purchase , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america