Excessive yield funds might be dangerous. In an ideal world, each ultra-generous dividend yield could be a direct results of sturdy corporations producing plenty of extra money earnings. In the actual world, they’re extra typically linked to low inventory costs and firms in severe monetary problem. In consequence, excessive yields are typically related, at finest, with disappointing worth charts and modest whole returns.

What if I instructed you that one of many largest income-oriented exchange-traded funds (ETFs) in the marketplace at the moment combines wealthy returns with spectacular fund worth features? THE JPMorgan Nasdaq Fairness Premium Revenue ETF (NASDAQ:JEPQ) ticks each of those shareholder-friendly bins – and extra.

The Premium Revenue ETF is a really younger fund, launching in Might 2022. You might also have neglected it within the huge sea of income-producing ETFs as a result of it’s an actively managed fund. Passive index funds have a tendency to come back with decrease annual charges, so it is sensible to begin your fund choice course of with this criterion.

However this JPMorgan The instrument could also be properly value its 0.35% administration charge. Here’s a transient overview of the fund’s distinctive qualities:

-

The Excessive Revenue ETF’s skilled administration group leverages knowledge science to pick out excessive earnings shares amongst growth-oriented securities. Nasdaq100 market index.

-

54% of the portfolio is at the moment invested in data and communications know-how companies, two market sectors carefully linked to the present growth in synthetic intelligence (AI).

-

Prime 10 shares embody the complete list of “Magnificent 7” actions — confirmed winners with very giant market capitalizations.

-

A few of these tech giants do not pay dividends, however fund managers earn month-to-month earnings from them in different methods.

-

Annual dividend yields at the moment stand at 9.3% after surpassing 12% over the summer time.

-

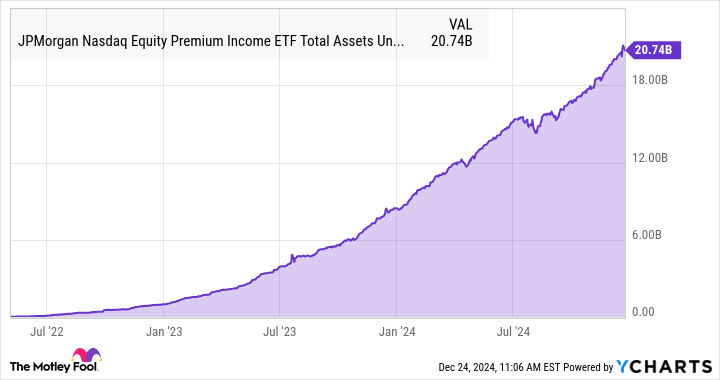

Its belongings beneath administration stand at $20.7 billion, regardless of its brief market historical past. Buyers had been fast to embrace this promising new fund:

-

Strategies for rising dividends embody some dangerous tips, akin to promoting short-term name choices to generate payouts from unstable shares. That is good when it really works, nevertheless it might additionally result in poor fund efficiency. And decrease returns amid continued market slowdown.

-

The fund was launched a number of months earlier than this bull market start. It has not but been examined in a weak financial system, which might reveal the downsides of options-based investing techniques.

-

The 0.35% administration charge might not appear excessive, nevertheless it’s properly above the 0.06% common of at the moment’s 10 largest ETFs and much more superior than low-cost funds akin to Vanguard S&P 500 ETF (NYSEMKT: VOL). These charges might truly make an enormous distinction in the long term. The Vanguard fund’s 0.03% annual charge provides as much as 0.3% over a decade, whereas the Premium Revenue ETF’s charges would whole 3.6% over the identical interval.

#Excessive #Yield #Dividend #ETF #Make investments , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america