Palantir (NASDAQ:PLTR) has been among the finest performing shares of 2024. On the time of writing, it’s up 340%, which means the inventory has greater than quadrupled in 2024. That's a formidable efficiency, however anybody who doesn't personal the title is questioning if there's extra upside available with Palantir. .

As 2025 approaches, will Palantir be capable of repeat its 2024 efficiency subsequent 12 months?

Lacking the morning scoop? Breakfast Information delivers it multi functional quick, silly, free each day e-newsletter. Register for free »

With returns like that, you may guess that Palantir is concerned in synthetic intelligence (AI) ultimately, and also you'd be proper. Palantir's software program offers decision-makers all the knowledge they should take advantage of knowledgeable selection potential. At first, this software program was used completely by the federal government. Palantir then expanded its attain to the business sector, the place it additionally noticed robust demand.

Nonetheless, the most important enhance in demand has occurred just lately with its synthetic intelligence platform (AIP). AIP permits AI to be built-in into workflows somewhat than being a secondary instrument. It additionally permits information to be retained inside the platform, so third-party generative AI models shouldn’t have entry to probably delicate data.

Palantir has seen demand for its software program explode in 2024 and administration is extraordinarily optimistic about its future. CEO Alex Karp summed up the third quarter in a single sentence: “We utterly gutted this quarter, pushed by relentless demand for AI that won’t decelerate. »

Within the third quarter, Palantir noticed its income enhance 30% year-over-year to $726 million. Nonetheless, america skilled outsized demand in comparison with its worldwide counterparts, as U.S. commerce revenues elevated 54% year-over-year to $179 million, and U.S. authorities revenues elevated 40% year-on-year. one 12 months to achieve $320 million. Clearly, AI has seen huge success in america, however this enthusiasm has not but unfold to the worldwide neighborhood.

One other function of Palantir's AI enterprise is that it’s really worthwhile. Within the third quarter, it recorded a second consecutive quarter with a revenue margin of 20%. This proves {that a} software program firm doesn’t have to develop in any respect prices: progress and monetary accountability can go hand in hand.

However that’s the previous; What does the longer term maintain for us?

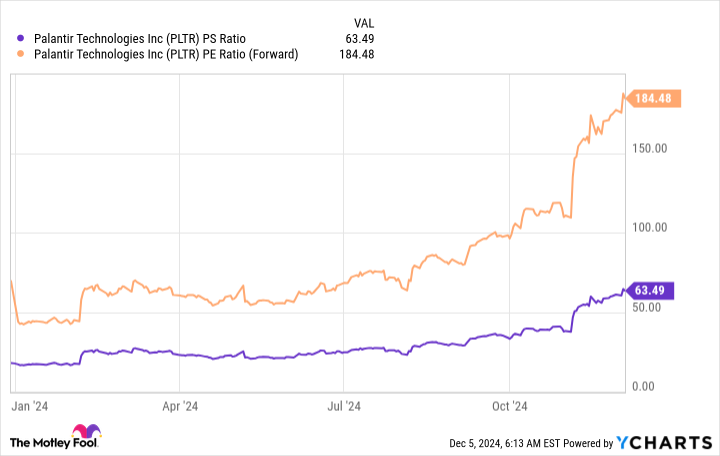

For those who're questioning, “How can Palantir inventory be up over 300% when revenues are solely up 30%,” you're not alone. Although Palantir's enterprise regarded nice, its inventory returns are unbelievable. Most of Palantir's inventory returns come from a mechanism referred to as a number of enlargement. A number of enlargement happens when traders are keen to pay extra for a corporation's financials; subsequently, its valuation will increase. That is what occurred with Palantir, because the inventory now trades at 184 occasions ahead earnings and 63 occasions gross sales.

#Palantir #shares #quadrupled #repeat, #gossip247.on-line , #Gossip247

,