The variety of energetic traders within the gaming sector will additional decline because the sector stays underinvested relative to public market capitalization.

And venture-backed content material builders will battle to siphon market share from incumbents, in line with a Pitchbook report.

The variety of energetic traders in recreation builders has fallen precipitously up to now 12 months because the begin of the COVID-19 pandemic, mentioned Pitchbook, which tracks international enterprise capital investments. In the meantime, one other report from Pitchbook famous that Discord, the gaming communications platform, has a 93% probability of going public through an preliminary public providing (IPO) in 2025.

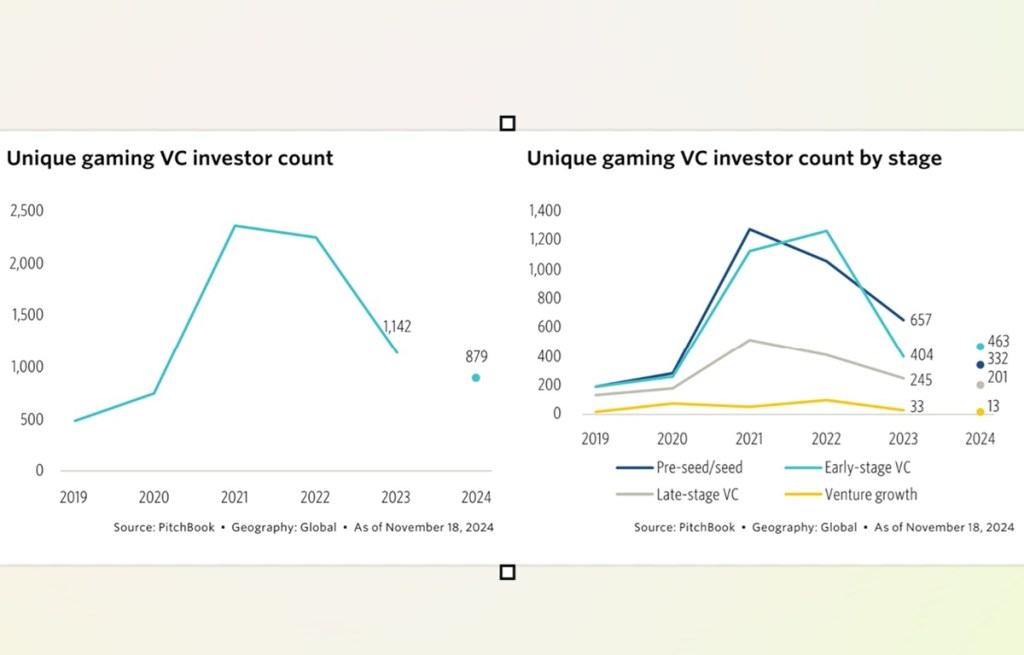

In 2021, the gaming growth was right here. Pitchbook mentioned 2,359 enterprise capitalists wrote checks to assist publishers, builders and studios (up from 734 in 2020). By 2023, that quantity had been lower in half, to 1,142 traders, and 2024 could be even decrease.

“We anticipate the identical in 2025, with an additional decline within the variety of traders supporting content material builders, however the long-term trajectory of the trade means the sector is underinvested in comparison with 187.7 billions of {dollars} spent on gaming annually,” wrote Eric Bellomo. analyst for rising applied sciences at Pitchbook.

The explanations for these sudden inflows and outflows of capital are quite a few. In the course of the frenzy of the zero rate of interest surroundings, a file variety of enterprise capital funds have been launched and file quantities of capital have been raised throughout the enterprise capital ecosystem.

Gaming itself sits on the intersection of a number of rising traits, which have attracted unprecedented capital to the trade. Fb turned to the metaverse, cryptocurrencies and blockchain-based video games exploded into the zeitgeist, and gaming consciousness elevated as stay-at-home orders have been issued , leaving shoppers with few different leisure selections.

Alas, straightforward to return, straightforward to go. On the finish of 2023, the sector was discovered to be overinvested. A glut of beforehand delayed releases have been in public palms, with a a lot smaller launch slate scheduled for 2024. Rates of interest have been climbing, forcing traders to take a better take a look at potential offers. Perpetually lengthy and costly recreation growth cycles are unrecognizable from conventional software-as-a-service enterprise fashions and have rapidly change into unpalatable.

Apple’s deprecation of IDFA (which prioritized consumer privateness over focused advertisements) elevated buyer acquisition prices, placing much more stress on cell gaming margins. Exit routes grew to become tough to see as mergers and acquisitions dried up, the IPO window closed, and regulatory intervention in offers initiated by Meta (previously Fb) and Microsoft discouraged different patrons.

Confronted with considerable content material, shoppers are more and more selecting to play established “evergreen” titles, leaving much less and fewer time for internet new releases.15 Lastly, the explosive curiosity in AI and know-how he machine studying has siphoned {dollars} from beforehand stylish classes.

Nonetheless, Pitchbook maintains that the sector is underinvested. The market capitalization of the gaming trade exceeds $1 trillion globally (excluding Microsoft, however together with Tencent)16, 17, with solely $1.5 to $4 billion invested per 12 months (excluding associated outlier years). to COVID-19), in line with the Q3 2024 Gaming Report.

This represents a tiny portion of the sector’s market capitalization that’s reinvested in high-risk firms. For comparability, public fintech firms have a market capitalization of greater than $1 trillion18 and $10 billion to $17 billion is invested within the sector annually, in line with the Pitchbook Q2 2024 Retail Fintech report.

Equally, the mixed public market capitalization of healthcare IT exceeds $100 billion, with roughly $5 billion invested yearly, in line with our Q2 2024 Tech Replace well being care info.

Thus, new funds and new vintages have appeared because the first gamers like London Enterprise Companions started focusing on the ecosystem. Andreessen Horowitz earmarked $600 million for gaming as a part of a broader $7.2 billion fundraising in April, Bitkraft introduced a $275 million spherical for its third fund and Griffin Gaming Companions has introduced its third flagship fund. One other group of specialist traders have additionally come on-line during the last 4 to 6 years to assist the sector, together with Makers Fund, Konvoy Ventures, 1Up Ventures, F4 Fund, Play Ventures and lots of others.

Regardless of depressed quarterly funding figures, a number of favorable components exist. The following era of shoppers spend quite a lot of time in gaming environments.

Greater than 90% of shoppers aged 13 to 17 play video games each week, averaging seven hours of gaming per week. Gaming’s worth has been established in know-how firms (NVIDIA), films (“The Tremendous Mario Bros. Film” and “Detective Pikachu”), tv (“The Final of Us”), and rather more.

Throughout industries, from e-commerce (Temu and SHEIN) to schooling know-how (Duolingo), media (The New York Occasions and Netflix) and social media (Twitch, LinkedIn), gaming and gamification fashions have change into extensively built-in into enterprise loyalty. methods. Rising markets in Latin America, India and components of Africa are additionally able to attracting an extra billion shoppers on this class over the last decade.

These fundamentals will solely proceed to draw extra traders to the section with further tailwinds anticipated from the discharge of Grand Theft Auto VI and new console generations from Sony and Nintendo.

#Energetic #traders #recreation #builders #fall #Presentation #ebook, #gossip247.on-line , #Gossip247

Enterprise,Sport Growth,GamesBeat,Gaming Enterprise,category-/Video games/Laptop & Video Video games,recreation investments,recreation VCs,NVCA,pitchbook , chatgpt ai copilot ai ai generator meta ai microsoft ai