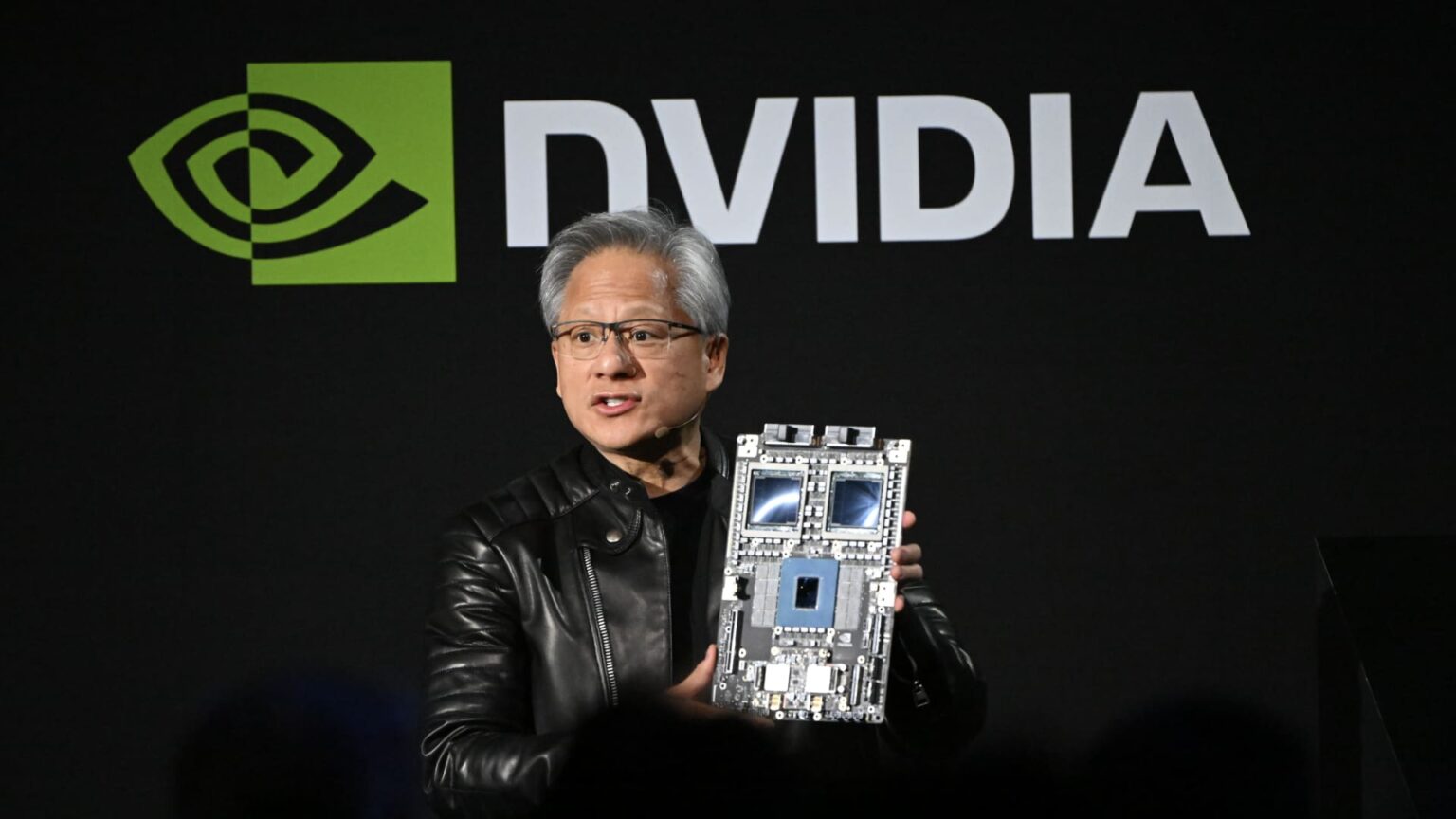

Jensen Huang, co-founder and CEO of Nvidia Corp., demonstrates the corporate’s AI accelerator chips for knowledge facilities throughout his keynote speech on the Nvidia AI Summit Japan in Tokyo on November 13, 2024.

Akio Kon | Bloomberg | Getty Pictures

Synthetic intelligence nonetheless stays an summary idea for a lot of on a regular basis customers who have no idea the way it will change their lives. However there isn’t any doubt that companies discover worth in it.

A number of the greatest winners from this 12 months’s inventory market rally, which noticed the Nasdaq leap 33% and different U.S. indexes publish double-digit beneficial properties, are instantly linked to speedy advances in AI. Chip maker Nvidia is amongst them, however he’s not the one one.

The opposite notable theme that has led to this 12 months’s outperformance is crypto. Beginning with the launch bitcoin spot change traded funds in January, cryptocurrencies had a giant 12 months in 2024, punctuated by that of Donald Trump electoral victory, which was finance closely by the crypto business. Quite a lot of crypto-related shares obtained a major increase.

With 4 buying and selling days remaining within the 12 months, listed below are the 5 best-performing U.S. tech shares of 2024 amongst corporations valued at $5 billion or extra.

AppLovin

Adam Foroughi, CEO of AppLovin.

CNBC

AppLovin entered the 12 months with a market capitalization of round $13 billion and was finest recognized for investing in a set of cell recreation studios that had produced titles like “Woody Block Puzzle,” “Clockmaker” and “Bingo Story.”

By the tip of the 12 months, AppLovin’s valuation surpassed $110 billion, making it price greater than Starbucks, Intel And Airbnb. As of Tuesday’s shut, AppLovin shares are up 758% this 12 months, thus far surpassing all different know-how corporations.

Whereas AppLovin became public In 2021, using a Covid-era wave of enthusiasm for on-line gaming, exercise is now centered on on-line ads and skyrocketing income from advances in AI.

Final 12 months, AppLovin launched the up to date model 2.0 of its promoting search engine referred to as AXON, which helps serve extra focused adverts on gaming apps the corporate owns and can also be utilized by studios that license this know-how. Software program platform income within the third quarter elevated 66% to $835 million, outpacing whole development of 39%.

Web revenue for the quarter soared 300%, bringing the corporate’s revenue margin to 36.3%, up from 12.6% year-over-year.

Adam Foroughi, CEO of AppLovin, whose net worth surpassed $10 billion, is much more enthusiastic about what’s to come back. Throughout the firm’s November earnings convention name, Foroughi praised an e-commerce take a look at venture that permits corporations to supply focused adverts in video games.

“In all my years, that is the very best product I’ve ever seen come out of our nation, with the quickest development, but it surely’s nonetheless within the pilot part,” he stated.

MicroStrategy

CostPhoto | Nuphoto | Getty Pictures

After climbing 346% in 2023, it was troublesome to think about MicroStrategy inventory discovering different gear. However it’s.

The corporate’s inventory value has jumped 467% this year because of a bitcoin shopping for technique that made founder Michael Saylor a cult crypto hero.

In mid-2020, the corporate introduced plans to start buying Bitcoin. Till then, MicroStrategy was a mid-sized enterprise intelligence software program supplier, however since then it has bought greater than 444,000 bitcoins, utilizing its steadily rising inventory value as a option to promote shares, tackle debt and purchase extra elements.

He’s now the fourth largest holder of Bitcoin on the earth, behind creator Satoshi Nakamoto, BlackRock iShares Bitcoin Trust and crypto change Binance, with stock valued at almost $44 billion. MicroStrategy’s market capitalization has grown from about $1.1 billion when it was only a software program firm to $80 billion as we speak.

Whereas the restoration had been underway lengthy earlier than November, Trump’s election victory final month added gas. The inventory is up 57% since then, whereas bitcoin has gained about 44%. Trump as soon as referred to as bitcoin a “rip-off,” but it surely was the business’s most well-liked selection on this election and was strongly supported by among the main gamers, together with Coinbase.

“With the crimson sweep, Bitcoin is rising with tailwinds, and the remainder of the digital property will begin to rise as properly,” Saylor instructed CNBC shortly after the election. He stated bitcoin stays the “secure commerce” within the crypto house, however that as a “digital asset framework” is put in place for the broader crypto market, “there shall be an increase in energy of all the digital property sector.”

Palantir

Alex Karp, CEO of Palantir Applied sciences, attends the morning session on the Allen & Co. Media and Know-how convention in Solar Valley, Idaho, July 10, 2024.

David Paul Morris | Bloomberg | Getty Pictures

Palantir has seen many vital beneficial properties in 2024 en path to a 380% acquire in its inventory value. One among its finest moments got here final month, when the software program firm raised its income forecast on the eve of the presidential election.

The corporate, which sells knowledge evaluation instruments to protection companies, bumped into its goal for 2024, with forecasts for the fourth quarter that blew analysts’ estimates. Palantir additionally dominated third-quarter outcomes, main CEO Alex Karp to say within the publication of results“We utterly gutted this quarter, pushed by relentless demand for AI that won’t decelerate.”

The inventory jumped 23% when the outcomes have been launched, then 8.6% the day after Trump’s victory. Co-founder and board member of Palantir Pierre Thiel was a giant promoter of Trump throughout the 2016 marketing campaign and helped manage a meeting with technical managers at Trump Tower shortly after this election. Karp was one of many members.

Karp, nonetheless, overtly supported the vice chairman Kamala Harristhe Democratic candidate, throughout the 2024 marketing campaign. He told the New York Times in an article revealed in August, Thiel’s prior help for Trump and subsequent backlash made it “really more durable to get issues completed.”

Nonetheless, Wall Avenue rallied behind Palantir after the election, optimistic that extra navy spending will move to the corporate.

Karp’s feedback within the earnings report earlier than the election counsel the corporate would do properly both method.

“Our enterprise development is accelerating and our monetary efficiency is exceeding expectations as we meet unwavering demand from our U.S. authorities and industrial prospects for probably the most superior synthetic intelligence applied sciences,” Karp stated in a press launch. letter to shareholders.

Analysts anticipate income development of about 24% in 2025, to $3.5 billion, in response to LSEG.

Robin Hood

Robin Hood the worth of shares has greater than tripled this 12 months, regardless of a 17% drop on October 31, following disappointing gains.

Buyers surpassed these numbers days later, sending the fill up 20% following Trump’s election victory as every thing crypto-related rallied. One among Robinhood’s fundamental development drivers is crypto, which retail buyers can simply buy on the app, alongside their shares.

Crypto buying and selling income jumped 165% within the third quarter from a 12 months earlier to $61 million, accounting for 10% of whole internet income.

Along with bitcoin, Robinhood customers can simply buy round 20 different cryptocurrencies, starting from common digital property like Ethereum to altcoins like dogecoin, Shiba Inu, and Bonk. On the firm’s investor day in November, Robinhood CEO Vlad Tenev stated crypto is extra than simply an funding, but in addition a “disruptive know-how that may change the infrastructure underlying funds , loans and all kinds of tradable property.

For the fourth quarter, analysts anticipate Robinhood to see income development of greater than 70% to $805.7 million, in response to LSEG, which might be the quickest development charge for 1 / 4 since 2021 , the 12 months the corporate was based. became public.

Robinhood’s rally this 12 months outpaced that of Coinbase, which surged 61%. However with a market cap of $70 billion, Coinbase remains to be twice as helpful.

Nvidia

from Nvidia an astonishing run continued.

Following the one from last year With a acquire of 239%, because of the keenness round generative AI, Nvidia has climbed one other 183% this 12 months, including $2.2 trillion in market capitalization.

Twice this 12 months Nvidia won the title of the world’s most beneficial publicly traded firm. Apple has pulled forward and is approaching $4 trillion, with Nvidia at $3.4 trillion and Microsoft at $3.3 trillion.

Nvidia stays the most important beneficiary of the AI growth, as the most important cloud suppliers and web corporations snap up each graphics processing unit they will discover. Annual income has elevated by not less than 94% in every of the final six quarters, with development exceeding 200% 3 times throughout that interval.

CEO Jensen Huang stated within the firm launch latest earnings report that the next-generation AI chip referred to as Blackwell is in “full manufacturing.” Chief Monetary Officer Colette Kress stated the corporate was on monitor to generate “a number of billion {dollars}” in income at Blackwell within the fourth quarter.

“Each buyer is preventing to be first to market,” Kress stated. “Blackwell is now within the palms of all of our main companions, and they’re working to modernize their knowledge facilities.”

Whereas development ought to stay strong for an organization of Nvidia’s dimension, the inevitable slowdown is approaching. Analysts forecast a year-over-year deceleration within the coming quarters, with development plunging to the mid-40s by the second half of subsequent 12 months.

Nvidia depends on sizable income from a handful of tech giants, so any financial shifts current vital danger for buyers.

This partly explains why Nvidia likes to inform Wall Avenue in regards to the huge listing of corporations creating new AI providers and “speeding to speed up the event of those functions with the potential to deploy billions of brokers inside years arising,” Kress stated. throughout the outcomes name.

#cuttingedge #know-how #shares #cryptography #AppLovin #MicroStrategy #Palantir #Nvidia, #gossip247.on-line , #Gossip247

,

—

ketchum

chatgpt

instagram down

is chatgpt down

dortmund vs barcelona

ai

dortmund – barcelona

rosebud pokemon

drones over new jersey

juventus vs man metropolis

the voice winner 2024

inexperienced skinned pear selection

paralympics

arsenal vs monaco

hannah kobayashi

intercontinental cup

bidwell mansion

brett cooper

hawks vs knicks

alexander brothers

wealthy rodriguez

christopher wray

time journal individual of the 12 months 2024

ruger rxm pistol

unc

austin butler

milan vs crvena zvezda

captagon

jalen brunson stats

gerry turner

invoice belichick girlfriend

pachuca

elon musk internet price

kraven the hunter

kyle teel

david bonderman

rocky colavito

mitch mcconnell fall

cam rising

survivor finale

liver most cancers

fortnite ballistic

feyenoord – sparta praha

luis castillo

jim carrey internet price

xavier legette

kj osborn

invoice belichick girlfriend age

copilot ai

volaris flight 3041

suki waterhouse

bomb cyclone

100 years of solitude

la dodgers

rangers vs sabres

kreskin

sabrina singh

brian hartline

emory college

russia

ai generator

mega thousands and thousands 12/10/24

jalen johnson

colby covington

adobe inventory

riley inexperienced

alperen sengun

recreation awards

meta ai

josh hart

nationwide grid

og anunoby

triston casas

the highway

dyson daniels

sutton foster

sec schedule 2025

jordon hudson

emory

mta

microsoft ai

mikal bridges

bard ai

tally the elf

invoice hennessy

elizabeth warren

utep basketball

julia alekseyeva

zaccharie risacher

lily phillips documentary

fred vanvleet

devon dampier

colgate basketball

jonathan loaisiga

anthropic

david muir

ai chatbot