We have formally put 2024 behind us, and it marked one other robust 12 months for the inventory market. The S&P 500 Index (SPX) recorded a acquire of greater than 20% for the second 12 months in a row. On this article, I’ll discover the historic efficiency of the inventory market based mostly on the earlier 12 months’s returns. Moreover, I will have a look at what historical past suggests we would count on from shares in January, given final 12 months’s spectacular efficiency. Lastly, I’ll analyze whether or not a 3rd consecutive robust 12 months for the S&P 500 is inside the realm of historic risk.

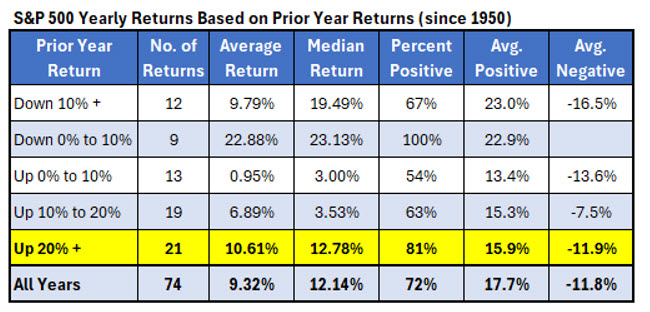

The desk beneath reveals the annual returns of the S&P 500 since 1950. It summarizes the index’s returns based mostly on their efficiency within the earlier 12 months. With 2024’s robust efficiency, we are able to count on extra good points in 2025. When the S&P 500 gained 20% or extra in a single 12 months, the next 12 months noticed a mean acquire of 10.6%, which is best than its typical return of 9.3%. . Additionally, after these robust years, the index was optimistic 81% of the time. It appears the candy spot for shares is after a 12 months by which they have been down reasonably. When the S&P 500 was down, however no more than 10%, it was optimistic 9 instances, with a mean acquire of 23% the next 12 months.

Based mostly on final 12 months’s 20% acquire, do not get too excited simply but. January considerably underperformed after robust years. Since 1950, the S&P 500 has gained simply over 1% on common in January with 59% optimistic returns. Nonetheless, after years by which the index gained 20% or extra, it’s on common close to breakeven with 52% optimistic returns.

After good points of 24% in 2023 and 23% in 2024, is it an excessive amount of to hope for one more robust inventory market 12 months? Consecutive good points of 20% for the S&P 500 are uncommon, however they’ve occurred earlier than. The desk beneath lists every time since 1950. In 1954 and 1955, the index posted consecutive good points of over 20%. Nonetheless, 1956 started with a 3.6% decline in January and ended with an annual return of simply 2.6%.

The following occasion occurred in 1995 and 1996. Shares instantly soared, with the S&P 500 leaping greater than 6% in January 1997 and ending the 12 months up greater than 30%. That made 1997 one other 20%-plus 12 months. Then got here 1998, which returned 27%, marking 4 consecutive years of good points of over 20%. Even 1999 got here shut, with a acquire of 19.5%, narrowly lacking a fifth consecutive annual motion of 20%. After all, that streak ended with the bursting of the tech bubble, with the S&P 500 falling by double digits in every of the following three years.

#report #12 months , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america