Seeing firms set particular person data for income or revenue is at all times an excellent signal for traders, because it signifies the corporate is reaching new heights. Nevertheless, there are additionally some metrics the place you don’t need firms to set new data, like debt or valuation.

Apple (NASDAQ:AAPL) not too long ago set a brand new document, however it’s not for good purpose. I believe this is a crucial sign for traders to concentrate to in 2025, because it may result in a pullback within the inventory worth.

Apple has lengthy been one of many greatest shopper manufacturers. Its iPhones are within the arms of nearly all of smartphone customers in america, who additionally put on Apple Watches and AirPods and use Apple computer systems. Despite the fact that Apple has been dominant for a while, it appears to have reached its peak.

Apple hasn’t launched any vital new merchandise or applied sciences in a while, resulting in some stagnation on the firm. iPhone gross sales, the corporate’s largest section by income, have not grown at a fast tempo in a while.

|

Yr |

Fourth quarter iPhone income |

Annual progress |

|---|---|---|

|

2024 |

$46.2 billion |

5.5% |

|

2023 |

$43.8 billion |

2.8% |

|

2022 |

$42.6 billion |

9.5% |

Knowledge supply: Apple. Notice: The fourth quarter ends round September 30 however is totally different every year.

A mid-single-digit income progress share is a key indicator that an organization has reached maturity. This progress fee possible will not change except Apple releases a brand new product or raises costs. Nevertheless, the corporate is working as if its revenues are rising at a fee of 20% or extra.

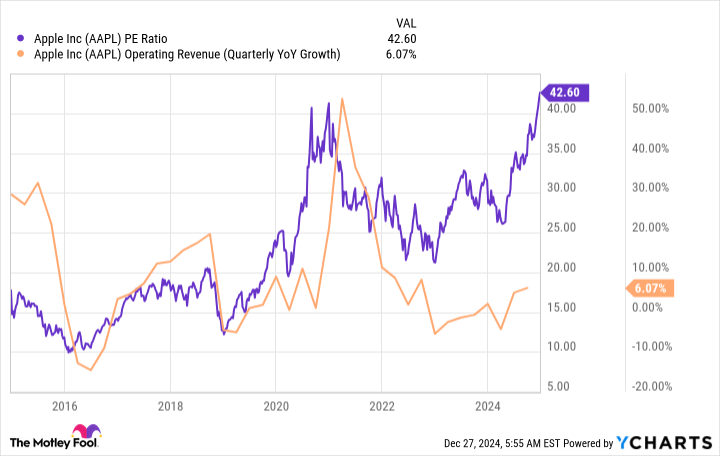

Apple inventory has now reached a brand new valuation stage not seen in a decade, even when it’s not exhibiting a lot progress. Though Apple shares have been buying and selling at a higher price-to-earnings (P/E) ratio that this throughout its life as a public firm, that is the primary time it has traded this excessive in its fashionable state (whereas iPhone gross sales characterize a good portion of its income).

I additionally overlaid Apple’s income progress fee to indicate that the earlier time Apple was valued at round 40 instances earnings, its income was rising over 50% 12 months over 12 months. With Apple’s income now rising at a a lot slower tempo, this valuation seems to be spiraling uncontrolled because it will not be capable to fetch a extra affordable worth.

Consequently, Apple will possible return to a extra traditionally regular valuation stage because of decrease costs.

With Apple rising slower than the market as an entire, there isn’t any purpose why Apple deserves a premium to the market. S&P500 (INDEXSNP: ^GSPC). With the S&P 500 buying and selling at a present P/E ratio of 25.2 and a ahead P/E of 21.9, I’d anticipate Apple inventory to commerce round these ranges. if it continues to expertise abnormal progress.

#Apple #shares #reached #alltime #highs #extent #clear #warning #signal , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america