Michael Nagle/Bloomberg by way of Getty Photos

-

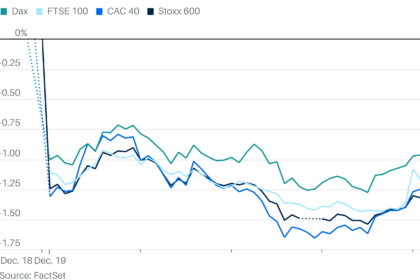

Shares fell on Thursday, dampening traders’ hopes of a Santa Claus gathering in early 2025.

-

The typical return of the S&P 500 in years with no Santa Claus rally is lower than half of its return in years with no Santa rally (5% versus 10.4%).

-

Analysts are usually optimistic about shares’ prospects this yr, though there’s uncertainty about a few of the insurance policies new President Donald Trump will implement, amplifying the chance of volatility.

In any case, Santa is probably not coming to Wall Avenue this yr.

The S&P 500 fell 0.2% on Thursday and misplaced floor in five consecutive sessionsleaving little hope to traders of acquiring a Santa Claus Gatheringwhich is the upward pattern of shares during the last 5 classes of a yr and the primary two of the brand new yr. The index would wish to rise 1.8% on Friday to return to constructive territory for the seven-day interval this yr.

Actually, 2024 was an exceptional year for stockseven with out an end-of-year increase. THE S&P500 elevated by greater than 20% for a second consecutive yr, the primary of its sort through the millennium.

However a Santa gathering is extra than simply the icing on a yr’s cake; it’s generally additionally thought of an omen. THE Santa Claus Gathering is traditionally correlated with inventory efficiency in January and all year long.

Since 1950, the S&P 500 has returned a median of 1.4% in January and 10.4% within the calendar yr after a Santa gathering, in line with a current evaluation from LPL Monetary. (THE S&P500 was launched in 1957; Inventory market efficiency previous to this yr is predicated on its predecessor, the S&P 90.) In years with no Santa Rally, the index’s common return in January was barely unfavorable and its efficiency for your complete yr averaged solely 5%.

Though the possibilities of a Santa Claus gathering appeared slim on Thursday, inventory market specialists stay optimistic in regards to the 2025 outlook.

Shares are usually should be supported by new President Donald Trump, who has pledged to increase the mandate of companies tax cuts of his first mandate and slash rules. Continued power within the U.S. financial system can also be anticipated to help company income, which specialists say will widen after two years of slender management. The actions of the Magnificent Seven are at all times should increase profits quicker than the common of S&P 500 corporations, however by the bottom margin in seven years, in line with analysts at Goldman Sachs.

The recognition of synthetic intelligence (AI) can also be evolving this yr as its use turns into extra widespread. A small variety of corporations, principally semiconductor and networking {hardware} corporations like Nvidia (NVDA) And Broadcom (AVGO) – have to date benefited from the AI revolution. Specialists estimate that extra corporations will start to reap these advantages in 2025, as new infrastructure comes on-line and companies discover new functions for this know-how.

#hopes #Santas #gathering #fade #whats #shares , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america