(Bloomberg) — Asian shares are anticipated to open weakly after U.S. shares fell Friday, led by losses in expertise shares.

Most learn on Bloomberg

Futures contracts in Japan and Australia each indicated a decline, as did contracts in the USA. Different potential downsides embrace feedback from US Treasury Secretary Janet Yellen that the Treasury may attain its new debt restrict in mid-January. Buying and selling is predicted to stay restricted – amplifying potential actions – as a result of end-of-year vacation season.

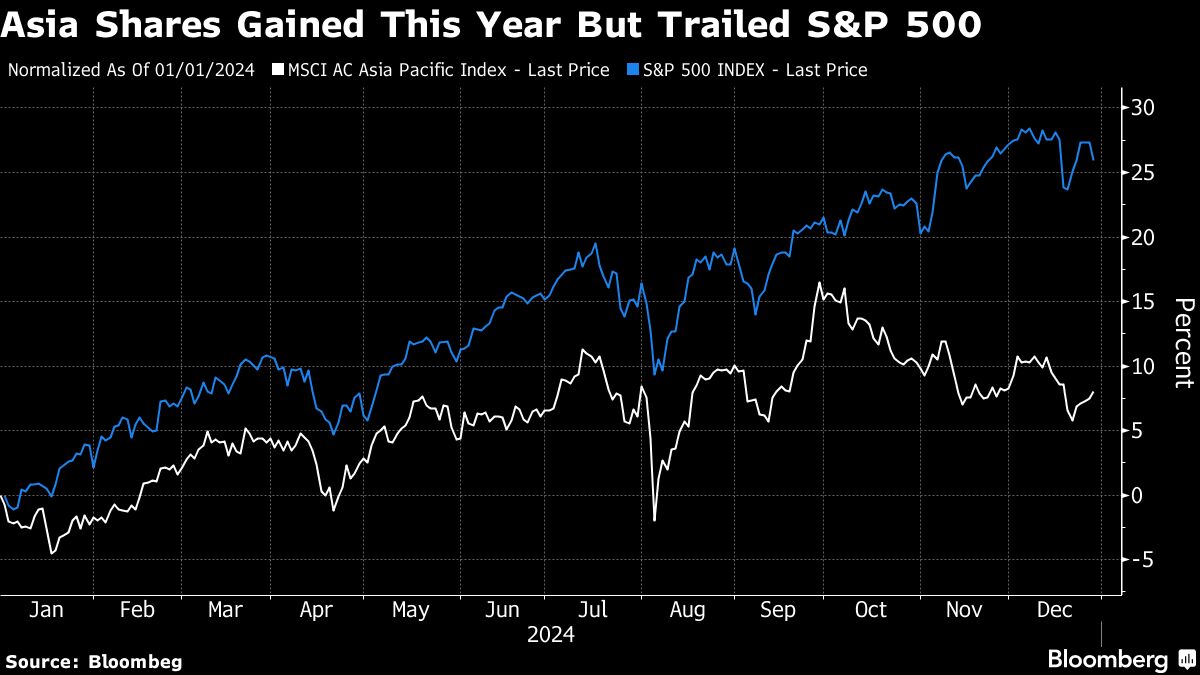

A decline within the MSCI Asia-Pacific Index on Monday would finish a five-day rally and scale back the indicator’s achieve this 12 months from the present 8%. Shares within the area have superior this 12 months as central banks have eased financial coverage and expertise shares have rallied amid optimism about synthetic intelligence.

“With U.S. shares performing poorly, we glance to begin the week on a comfortable observe for Asian fairness markets,” Chris Weston, head of analysis at Pepperstone Group, wrote in a observe. “As soon as once more, native markets are on the mercy of remaining year-end portfolio flows and the chance for extra lively managers to de-risk, feeling they’ve little purpose left to chase the ribbon from right here.”

The S&P 500 index slipped 1.1% on Friday whereas the Nasdaq 100 fell 1.4%. Whereas all main industrial teams recorded losses, tech mega-caps had been hit hardest by gross sales. This follows a pointy rise that noticed the so-called “Magnificent Seven” account for greater than half of the benchmark US inventory index’s beneficial properties in 2024.

“I believe Santa has already come – have you ever seen the present this 12 months?” stated Kenny Polcari, strategist at SlateStone Wealth LLC. The approaching week “is one other shortened trip week, volumes will likely be mild, actions will likely be exaggerated. Don’t make any main funding selections.

Treasuries fell final week, with the 10-year yield climbing 10 foundation factors to 4.63%, because the Federal Reserve signaled the probability of fewer rate of interest cuts in 2025. Bloomberg Greenback Spot index gained 0.5%, extending a profitable 12 months with beneficial properties. motivated by anticipation of President-elect Donald Trump’s “America First” insurance policies.

Treasury Secretary Yellen stated her division would doubtless start taking particular accounting measures round mid-January to keep away from exceeding the U.S. debt restrict, and urged lawmakers to take motion to defend “the total confidence and credit score” of the USA. The additional margin will doubtless be exhausted by Jan. 14-23, Yellen stated.

Excessive expectations

The rally in U.S. shares this 12 months has pushed expectations for shares so excessive that it may show to be the largest impediment to additional beneficial properties within the new 12 months. The bar is even increased for tech shares, given their beneficial properties in 2024.

#Asian #Shares #Set #Weak #Open #Losses #Markets #Fall , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america