Keep knowledgeable with free updates

Merely register at UK Curiosity Charges myFT Digest – delivered straight to your inbox.

The Financial institution of England warned that cussed inflation would forestall it from slicing rates of interest rapidly, because it saved financial coverage unchanged regardless of a weaker development outlook.

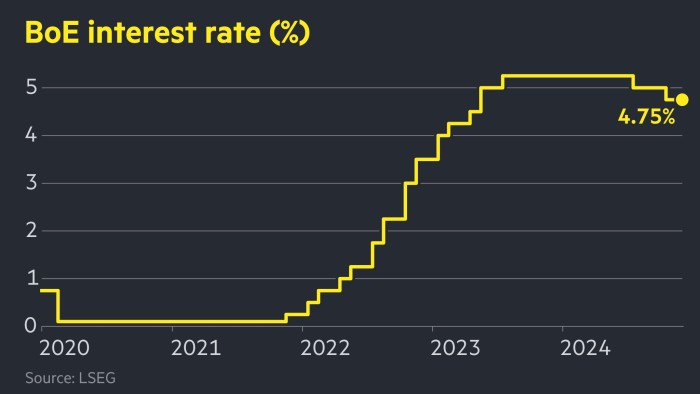

In a six-to-three choice on Thursday, the BoE’s financial coverage committee saved its key charge at 4.75 p.c, with a majority expressing concern that current wage and value will increase have ” elevated the danger of persistent inflation.

The transfer comes even because the BoE forecast zero development for the ultimate quarter of the 12 months – a downward revision from its earlier forecast of 0.3 per cent – compounding the financial issues going through the chancellor Rachel Reeves.

Referring to fiscal measures that elevated employer taxes and the nationwide dwelling wage, the central financial institution famous “important uncertainty over how the economic system would possibly reply to total rising employment prices.”

“Most indicators of UK short-term exercise have declined,” the BoE stated.

“We imagine {that a} gradual strategy to future rate of interest cuts stays the best resolution,” stated Andrew Bailey, Bank of England governor. “However with elevated uncertainty within the economic system, we can’t decide to the timing and extent of charge cuts over the approaching 12 months.”

Merchants anticipate the BoE to make two quarter-point charge cuts subsequent 12 months – because it did simply earlier than Thursday’s choice. This compares to the 4 anticipated by the market final October.

Rob Wooden, a British economist at Pantheon Macroenomics, stated the minutes of the MPC assembly have been “cautious and subsequently extra hawkish than that six-to-three headline suggests.”

He stated inflation was anticipated to exceed 3 p.c within the spring, “with extremely seen value will increase that would destabilize already above-average and rising inflation expectations.”

A majority of the MPC stated “current developments strengthen the argument” for gradual moderately than speedy charge cuts, warning of “the potential trade-off between extra persistent inflationary pressures and larger weak point in output and of employment”.

The BoE’s pessimistic speech got here a day after the US Federal Reserve introduced it will slow down the pace of its rate cuts subsequent 12 months because it manages a extra buoyant economic system alongside indicators of persistent inflation.

It additionally follows knowledge this week which confirmed UK inflation hit 2.6 percent final month, in comparison with 2.3 p.c in October.

However the three MPC members favoring a quarter-point discount – Deputy Governor Dave Ramsden, Alan Taylor and Swati Dhingra – cited “sluggish demand” and a weaker labor market.

The BoE stated dangers to world development and inflation from geopolitical tensions and commerce coverage uncertainty had “elevated considerably” – an obvious reference to US President-elect Donald Trump’s plans to boost customs duties on imports to the USA.

Reeves’ allies stated Britain confronted a “very troublesome time” however maintained the chancellor was pushing for long-term reforms in areas reminiscent of pensions and planning to spice up development .

However with inflation rising, development slowing and employers shedding confidence, the chancellor heads into 2025 with rising uncertainty about her price range plans. It solely has £10bn put aside to guard itself from its personal borrowing guidelines.

If development underperforms and curiosity prices stay increased than anticipated, Reeves could possibly be compelled to resort to additional politically painful spending cuts within the spring – or tax hikes within the fall – to maintain his Funds plans add up.

“We need to put more cash in staff’ pockets, however that is solely doable if inflation is steady,” Reeves stated. “I totally assist the Financial institution of England in reaching this.”

Yields on the pound and gilts fell after the BoE’s charge choice, as traders centered on the larger-than-expected flock of doves calling for speedy charge cuts.

By late afternoon, markets have been assigning a 14 p.c likelihood of a decline within the third quarter of subsequent 12 months.

The British pound fell to $1.252, down 0.4 p.c on the day. The yield on two-year rate-sensitive authorities bonds fell 0.04 share factors to 4.43 p.c.

The BoE reduce charges by 1 / 4 level at its earlier assembly in November, however then signaled {that a} additional reduce was unlikely earlier than 2025. It has reduce charges twice in 2024 and is predicted to announce its subsequent choice in February.

#Financial institution #England #charges #unchanged #development #outlook #darkens , #Gossip247

,

ketchum

elon musk web value

david bonderman

adobe inventory

nationwide grid

microsoft ai