(Bloomberg) — Per week after the Dec. 4 killing of UnitedHealth Group Inc. govt Brian Thompson, Individuals may wager on the destiny of his alleged killer. This might be problematic for some folks, notably monetary regulators.

Most learn on Bloomberg

Contracts supplied by Kalshi Inc., a New York-based change, enable retail merchants to wager on the result of just about something. Kalshi listed the Dec. 11 bets surrounding Thompson’s dying, together with whether or not the suspect, Luigi Mangione, could be extradited to New York from Pennsylvania, whether or not he acted alone and whether or not he could be convicted or plead responsible.

Two days later, buying and selling all of the sudden stopped, with Kalshi informing his shoppers that he had made the choice “after receiving discover from our regulators,” in line with messages reviewed by Bloomberg Information.

The Commodity Futures Buying and selling Fee and Kalshi declined to remark. The CFTC, which regulates Kalshi, prohibits futures buying and selling associated to crimes similar to assassinations, terrorism and struggle if the company decides that so-called occasion contracts are opposite to the general public curiosity.

Bets linked to episodes like a homicide illustrate the problem regulators face within the thriving occasion contracting trade – and supply a brand new view of what occurs when free markets collide with dangerous style. Scorching subjects might be very worthwhile for suppliers, and so they can go stay shortly with out prior approval from the CFTC. Critics say exchanges push futures buying and selling far past true danger hedging or different reliable financial objectives.

“It’s an actual recreation of probability,” stated Cantrell Dumas, director of derivatives coverage at Higher Markets, a monetary coverage suppose tank in Washington. “Individuals are betting on whether or not this particular person is presumed liable for the homicide of one other human being, and right here we’re being insensitive to that and betting on their capability to plead responsible.”

Contracts linked to Mangione had been nonetheless traded on unregulated exchanges like crypto-only Polymarket, which says it has excluded U.S. customers since 2022 as a part of a take care of U.S. authorities. At a Dec. 23 listening to, Mangione pleaded not responsible, together with his lawyer expressing considerations about getting a good trial due to statements made by state officers.

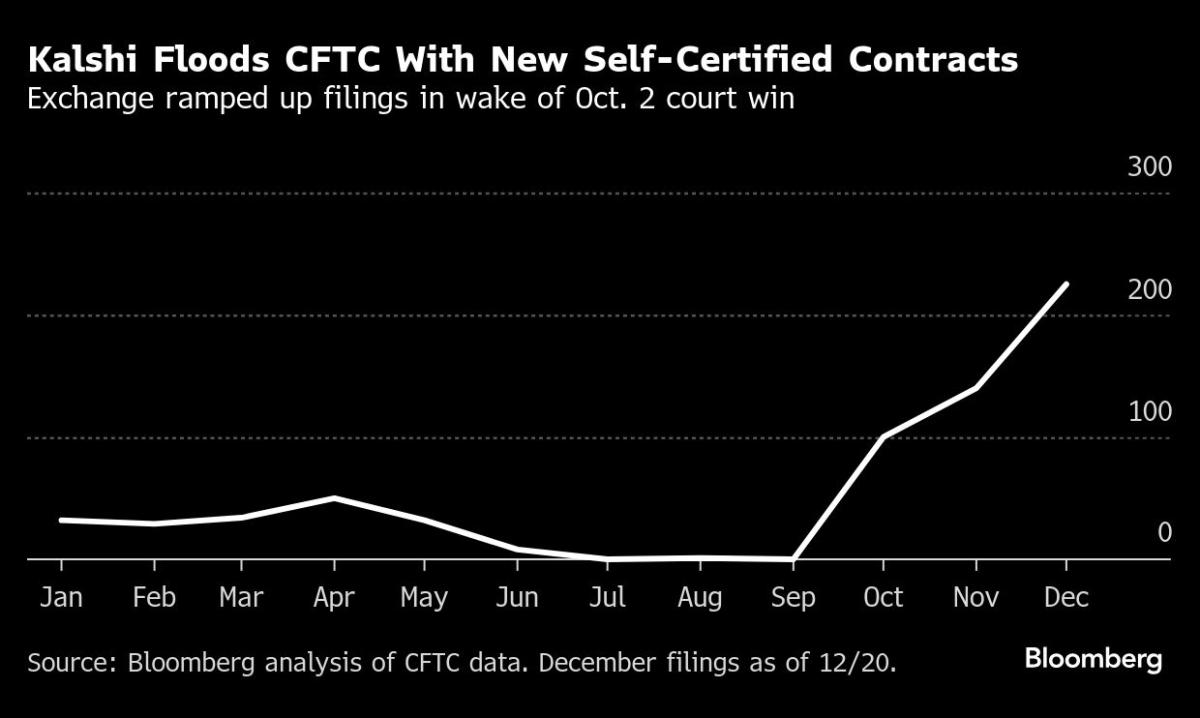

The CFTC sought earlier this 12 months to dam Kalshi from providing election bets, however confronted authorized setbacks after a U.S. appeals courtroom lifted the suspension of buying and selling and allowed these contracts to proceed. on regulated exchanges. The courtroom is anticipated to rule on the CFTC’s energy to completely terminate these contracts.

#Bets #linked #check #limits #case #CEO #homicide #occasion #contracts , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america