(Bloomberg) — Bitcoin’s rally is dropping steam within the last days of a document 12 months for the digital asset, as buyers assess the remaining momentum from President-elect Donald Trump’s embrace of the cryptocurrency sector.

Most learn on Bloomberg

The biggest token modified arms at $96,200 at 6 a.m. Friday in London, partly paring a virtually 3% decline from the day earlier than. Smaller rivals, together with Ether and Dogecoin, a favourite of the meme crowd, had been hovering in tight ranges.

Trump is shifting ahead along with his promise to create a crypto-friendly surroundings in the USA and has supported the concept of establishing a nationwide Bitcoin reserve. Merchants are cashing in on a number of the earnings generated by the Republican’s cryptographic encouragement and ready to see if the talked about reserve is possible.

Expiration of choices

The crypto market can be bracing for the expiration of a major quantity of Bitcoin and Ether choices contracts on Friday – one of many largest such occasions in digital asset historical past, in line with prime dealer FalconX.

The notional worth of Bitcoin contracts on the Deribit alternate – one of many largest for digital asset derivatives – exceeds $14 billion, whereas the equal determine for Ether is round $3.8 billion .

Sean McNulty, director of buying and selling at liquidity supplier Arbelos Markets, flagged the danger of a “uneven market” amid the expiration of derivatives positions.

Microstrategy plan

Bitcoin is hesitant even after MicroStrategy Inc. signaled this week the potential for increasing its token buy program. The corporate has advanced from a software program firm to a Bitcoin accumulator and now owns over $40 billion in digital belongings.

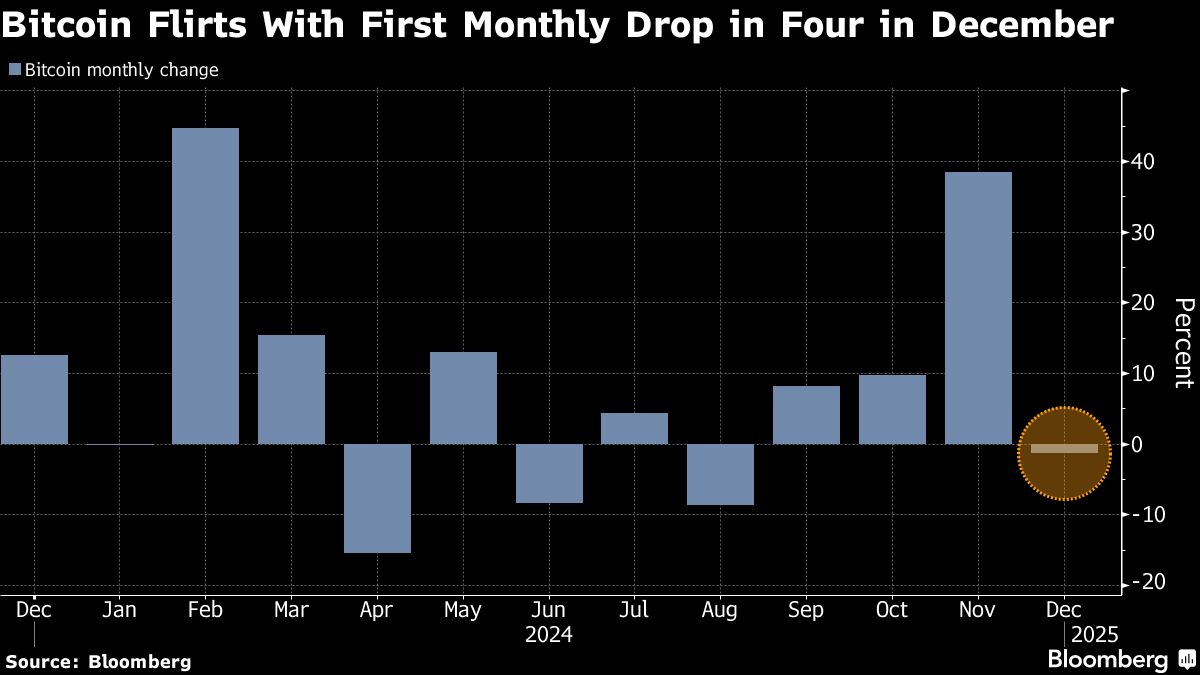

The unique cryptocurrency is flirting with a decline for December, which might be its first month-to-month decline in 4, in line with information compiled by Bloomberg. Bitcoin hit an all-time excessive of $108,316 on December 17 earlier than retreating.

Buyers withdrew a web $1.5 billion from a gaggle of a dozen U.S. money exchange-traded funds within the 4 buying and selling days via Dec. 24, the biggest outflow since Trump’s victory within the American elections on November 5.

Most learn from Bloomberg Businessweek

©2024 Bloomberg LP

#Bitcoin #Rally #Fizzles #Tokens #Document #Yr , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america