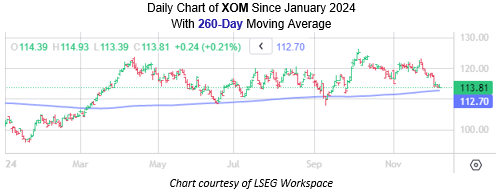

Exxon Mobil Corp (NYSE:XOM) The inventory has been falling since its late November excessive, which didn’t lengthen its Oct. 7 document of $126.36. The oil big may quickly return to those highs, nonetheless, because the latest slowdown places it in a help place on the charts. Shares started to consolidate at $113 – final at $113.60 – which supplied a flooring for pullbacks by July and August.

The 260-day shifting common is now additionally slightly below it. In keeping with Rocky White, senior quantitative analyst at Schaeffer, this pattern has been encountered six instances within the final three years. For the needs of this examine, White defines this as shares buying and selling above the shifting common 80% of the time over the previous two months and shutting north of the pattern line in eight of the final ten periods earlier than being near it. XOM completed greater a month later following 83% of those alerts, a median achieve of 9%. From its present stage, an identical transfer would put Exxon Mobil inventory simply above $123, which is only a few steps away from its all-time excessive.

It's additionally value noting that the inventory's 14-day relative energy index (RSI) of 29.5 is in “oversold” territory, which usually precedes a short-term rally.

#Purchase #dip #bluechip #oil #inventory , #Gossip247

,