Keep knowledgeable with free updates

Merely register at World financial system myFT Digest – delivered straight to your inbox.

Has speedy financial progress in high-income international locations ended? In that case, did the bursting of the financial bubble in 2007 mark a turning level? Or, are we in the beginning of a brand new period of speedy progress fueled by synthetic intelligence? The solutions to those questions will possible go a great distance in shaping the way forward for our societies, as stagnant economies partly clarify our bitter politics.

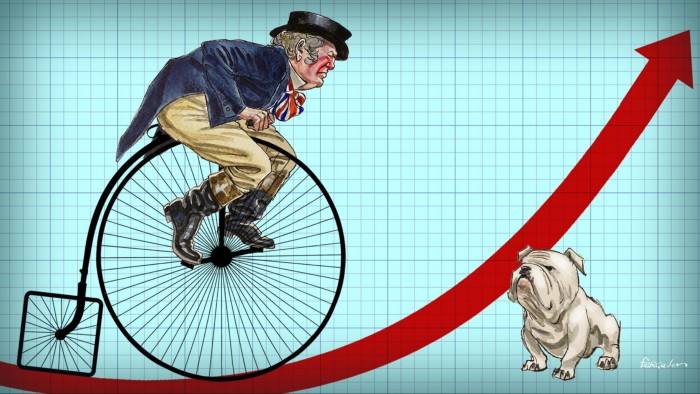

So what did the document appear to be and to what extent did it rely upon irreplaceable alternatives? Right here I’ll give attention to the UK, which is considered one of many international locations struggling to regain its dynamism. The UK has really been comparatively sluggish because the Second World Warfare. Nonetheless, based on the Convention Board, the UK’s actual GDP per capita elevated by 277 % between 1950 and 2023. Over the identical interval, the US’ actual GDP per capita elevated by 299 %, France by 375 %, Germany by 501 % and Japan by 1,220 %. hundred. Cumulatively, dwelling requirements have remodeled.

But many individuals really feel sad. That is partly defined by declining progress charges. They have been quickest between 1950 and 1973, the post-war restoration interval, weakest between 1973 and 2007 and even weaker between 2007 and 2023. It’s putting to notice that this final interval was the primary throughout of which US progress in GDP per capita and hourly output has been larger. as in France, Germany, Japan and the UK. But the extent of progress in hourly output in the US was decrease than it had been in earlier intervals.

The “miracle” of progress after 1945, significantly in continental Europe and Japan, was punctual. It was motivated by the alternatives supplied by post-war reconstruction, by the mass consumption financial system created by the US over the earlier half century, by renewed financial integration, above all by liberalization commerce, and by an financial system with a excessive fee of employment and funding supported by higher macroeconomic insurance policies and a strengthening of enterprise confidence. The Chilly Warfare was additionally important as a result of it introduced the US into the world completely, in distinction to its catastrophic disengagement from the still-ravaged Europe of the Twenties.

For a lot of of at this time’s high-income economies, the postwar growth was an unprecedented success. This was additionally true for the UK, though its financial system grew rather more slowly than its European neighbors. Development charges usually slowed from the early Seventies, however to a lesser extent in the US and the UK. The believable rationalization is that the good alternatives had then been exploited. From the Nineteen Eighties, they have been discovered extra in rising Asian international locations, whose economies took benefit of the expansion alternatives beforehand loved by Japan and South Korea. China is a exceptional instance of such success.

New applied sciences additionally continued to be created, notably these of the digital revolution. However Robert Gordon’s argument, in his masterpiece The rise and fall of American growththat there was a marked decline within the total fee of technological progress in comparison with its scale and scale earlier than World Warfare II, is compelling. One more reason for the slowdown in total productiveness progress is the rising position of labor-intensive companies, by which productiveness is tough to extend.

There have been additionally, inevitably, transitional impulses to progress within the twentieth and early twenty first centuries. Certainly one of them was the rise in girls’s participation within the labor market. One other instance was the common pattern towards extending the period of training, significantly by together with larger training. One more downside was the decline in total dependency ratios, as “child boomers” entered the workforce. The UK itself additionally benefited from its membership of the EU, which it then marginally sidelined.

One other transitional increase, notably to Britain’s public funds, got here from inflation, which helped erase the burden of public debt collected through the battle. The UK public sector additionally benefited from windfall income from North Sea oil revenues and privatization revenues, each of which have been consumed. Sadly, the influence of the monetary disaster and the pandemic then induced public debt to rise once more, with out approaching the 1945 peaks.

A closing one-off increase got here from the explosive progress of the monetary sector by which the UK performed a greater than full position. As I argued on November 5the monetary bubble “not solely exaggerated the sustainable dimension of the monetary sector, but additionally exaggerated the sustainable dimension of an entire host of ancillary actions.” Right here once more, it’s irreplaceable, at the very least we should hope so.

So what awaits us now? Is post-2007 sluggishness the norm for former high-income economies, with the potential exception of the US? Happily, new alternatives exist. The primary is to meet up with the US, as occurred within the Fifties and Sixties. Another opportunity for the UK is to raise revenues for “left behind” regions. One other risk is a return to the EU customs union and single market. However the UK might as a substitute search to change into Donald Trump’s favourite nation. For the EU, the chance is thereo fully implement the Draghi report.

But what lies forward for many of those economies, definitely together with the UK, is to handle the burden of elevated public spending, significantly on protection and the aged. Policymakers will even have to undertake financial reforms aimed toward selling competitors, innovation and funding. Within the UK they have to promote significantly higher savings. The coverage must also purpose to encourage the immigration of certified folks.

We should always not hope that AI will enhance productiveness with out destroying the data ecosystems on which we rely. Development should be sustainable, ecologically and politically.

Slowing progress is a serious attribute of our instances. This should be a political precedence.

#Counting #period #sluggish #progress , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america