As 2025 dawns, traders seeking to refresh their portfolios with corporations at engaging valuations might look to shares which have lagged the market in 2024. Beverage giants Coca-Cola (NYSE:KO) And PepsiCo (NASDAQ:PEP) have been beneath strain over the previous 12 months, and each are down about 14% from their 52-week highs.

Given the overlapping companies, it in all probability does not make sense for many traders to carry each shares of their portfolio. So which one is healthier to purchase now?

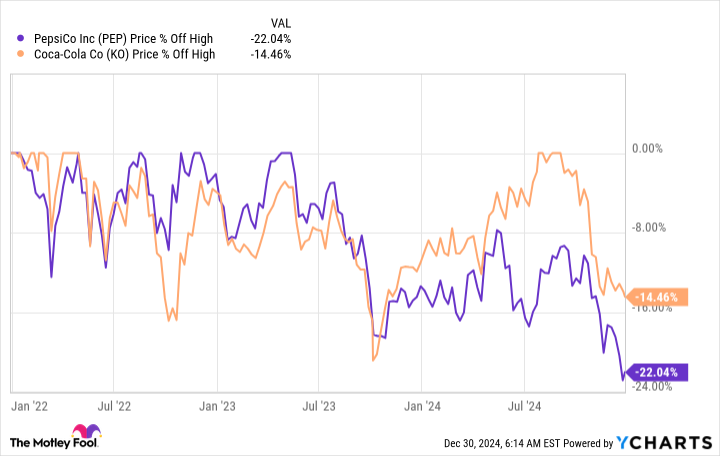

PepsiCo’s 2024 was a bit worse than Coca-Cola’s. Not solely has its decline from its peak been barely steeper, however it’s really down greater than 10% 12 months up to now, whereas Coca-Cola is up about 5%.

Nonetheless, wanting again additional, PepsiCo’s decline from its three-year excessive is about 22%, whereas Coca-Cola’s is about 14%. However Coca-Cola noticed a rally beginning in late 2023 that lasted till 2024, not like PepsiCo. Total, traders seem to have been a bit extra destructive about PepsiCo total.

This negativity hole extends to their relative valuations. PepsiCo price/sales ratio is sort of 18% decrease than its five-year common. Coca-Cola’s P/S ratio is simply about 7% beneath its five-year common. Likewise, PepsiCo price/earnings ratio is about 14% beneath its five-year common, whereas Coca-Cola’s P/E is about 2% beneath its common.

After which there are their dividend yields. At its present share worth, PepsiCo is down 3.5% whereas Coca-Cola is down 3.1%. At an absolute stage, PepsiCo’s efficiency is extra engaging, however there’s extra to the story. Whereas Coca-Cola’s present efficiency is about midway for the inventory in recent times, PepsiCo’s is close to its all-time excessive. Total, PepsiCo looks like the most effective worth you probably have a price bias when investing.

To be honest, these corporations aren’t precisely interchangeable, though their beverage companies overlap significantly. That mentioned, they’re related in some ways. For instance, each have elevated their dividends yearly for over 50 years, incomes them each a spot among the many Dividend Kings. Members of this elite group have confirmed that they will climate the inevitable ups and downs of the enterprise world and proceed to reward their shareholders alongside the way in which.

However contemplate the distinction between them. Coca-Cola has grown its revenues at a barely sooner charge in recent times, and its earnings have grown at a significantly sooner charge. PepsiCo’s full-year revenue development charges remained caught within the low single-digit vary, whereas Coca-Cola grew its earnings at a low-double-digit tempo. With this in thoughts, it is sensible that traders at present appear to want Coca-Cola over PepsiCo.

#PepsiCos #inventory #decline #purchase #CocaCola , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america