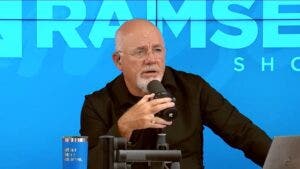

Many younger People aspire to purchase a house. Monetary knowledgeable Dave Ramsey and co-host George Kamel just lately spoke to Jared, 23, from Oklahoma Metropolis, OK, about his homeownership aspirations. Though they have been impressed by his work ethic and financial savings, Ramsey identified that he was lacking one essential step: making a strong emergency fund.

Jared is single and does “nothing however work” at his pest management job, incomes round $70,000 a 12 months. He instructed the hosts of The Ramsey Present that he can have a 20 % down fee on a $150,000 to $200,000 home saved by mid-January. And though he has no debt, he admitted that he has no emergency fund.

Don't miss:

Ramsey applauded Jared's efforts however pressured that an emergency fund is totally important when shopping for a house. “You don’t transfer right into a home with out an emergency fund,” Ramsey stated. “As a result of homes are an emergency in search of a spot to carry out.”

Ramsey illustrated the truth of homeownership: sudden repairs and upkeep prices will all the time come up. He and Kamel suggested Jared to save lots of three to 6 months of residing bills in an emergency fund. Earlier than finalize the acquisition of a home.

“Which implies you're now taking a look at March,” Ramsey stated, as an alternative of Jared's authentic objective of shopping for in January.

See additionally: Maker of $60,000 Foldable Residence Has 3 Manufacturing unit Buildings, Extra Than 600 Houses Constructed, and Huge Plans to Resolve the Housing Downside – you can become an investor for $0.80 per share today.

Jared's objective of a 20% down fee suits with Ramsey's typical recommendation when shopping for a house, significantly as a result of it permits him to keep away from non-public mortgage insurance coverage (PMI), a charge month-to-month funds required for loans with decrease down funds. With a $150,000 to $200,000 dwelling, Jared would save 1000’s of {dollars} over the lifetime of the mortgage by reaching this threshold.

Kamel and Ramsey additionally instructed Jared to stay to at least one Fixed mortgage over 15 years reasonably than a 30-year mortgage. “A paid-off dwelling mortgage is likely one of the keys to turning into a Child Steps millionaire,” Ramsey stated, referring to his extensively adopted seven-step monetary plan.

Along with monetary preparation, Ramsey suggested Jared to keep away from buying a transforming dwelling or a house with distinctive options which may make resale tougher. “Purchase one thing that’s straightforward to resell, which implies it’s a bit of boring,” he stated, noting that these properties have a tendency to understand steadily over time.

#Don39t #skip #essential #step #shopping for #dwelling, #gossip247.on-line , #Gossip247

,