Coin Tales podcast host Natalie Brunell discusses whether or not Michael Saylor’s Bitcoin technique will repay, on “Making Cash.”

The world exchange traded fund industry ends its finest 12 months ever, with file inflows of $1.4 trillion by the top of December, bringing whole belongings to $14 trillion, in line with Matthew Bartolini, head of SPDR Americas analysis at State Road GlobalAdvisors.

“Inside lively methods, lively fairness and glued earnings methods, in addition to lively “different” methods, noticed file flows of $150 billion, $100 billion and $20 billion, respectively”, » famous Bartolini.

Alongside the rise in lively funds, traders have demanded the arrival of recent ETFs.

“Another excuse has to do with the launch of crypto ETFs. You noticed Spot Bitcoin ETFs popping up in January, the inflows have simply been insane,” Sumit Roy, senior ETF analyst for ETF.com, instructed FOX Enterprise .

Since its launch on January 5, 2024, the iShares Bitcoin Belief ETF or (IBIT) has added greater than $50 billion in belongings, in line with the corporate, making it the perfect exchange-traded product in historical past.

IRS READY TO SEND REFUNDS TO MILLIONS OF AMERICANS

iShares Bitcoin Belief ETF

“Inflows into IBIT since launch spotlight traders’ desire for gaining publicity to bitcoin by the comfort and high quality of an exchange-traded product. The market has seen renewed optimism in anticipation of optimistic regulatory motion for bitcoin and crypto. targeted on educating traders and offering entry to bitcoin with comfort and transparency,” a BlackRock spokesperson told FOX Business in November.

Bitcoin has grown over 122% this yearreaching an all-time excessive of $106,734 and has since retreated from these ranges. The crypto trade acquired a lift following President-elect Donald Trump’s White Home victory and the promise of a extra crypto-friendly regulatory setting.

Asset named former SEC official Paul Atkins, closely favored by the trade, to switch present SEC Chairman Gary Gensler in January.

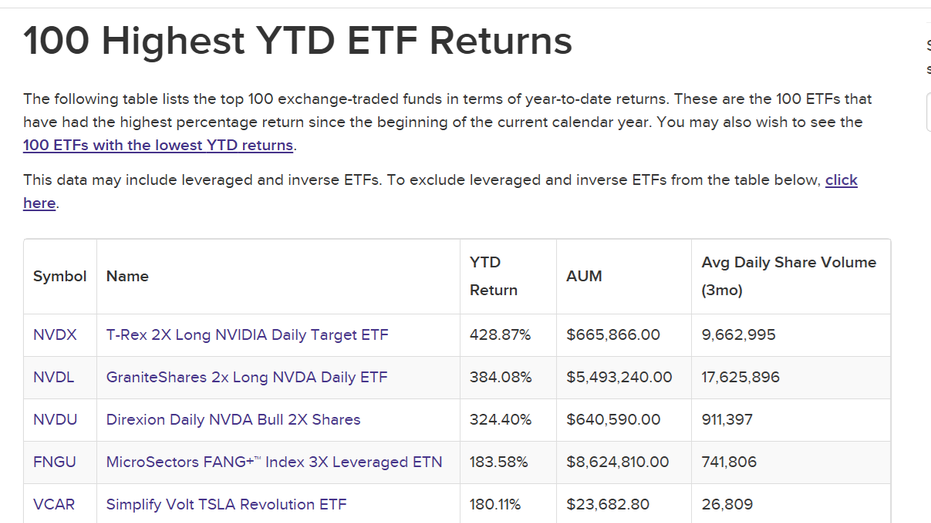

One other figuring out issue is ETFs thought-about extra “tactical” and permitting you to place your self for each side of a transaction. These ETFs are the 4 finest performers of 2024, as VettaFi exhibits, rising between 428% and greater than 178%, far outpacing the S&P 500’s 26% rise by Monday.

Finest performing ETFs of 2024: 12/29/2024 (VettaFi)

“Whether or not somebody thinks the market goes to go up or down within the quick time period, we now have these instruments for them,” Ed Egilinsky, chief govt officer of Direxion, instructed FOX Enterprise.

The corporate’s Direxion Every day NVDA Bull 2X shares are up greater than 300% this 12 months. This helps traders grasp the rise and/or fall of Nvidia’s beloved AI chip. “The one title, the leveraged inverse single title, we truly simply eclipsed six billion with the franchisee,” he added.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The corporate now has 13 single-stock ETFs, and sure plans to develop in 2025.

#ETFs #killing , #Gossip247

0e32512b-05d3-5fcc-b303-625507a103e2,fbn,Fox Enterprise,fox-business/markets/etfs,fox-business/markets/currencies/bitcoin,fox-business/investing-and-transactions/mutual-funds,fox-business/markets,article ,

ketchum

elon musk internet price

david bonderman

adobe inventory

nationwide grid

microsoft ai