MicroStrategy (NASDAQ:MSTR) nonetheless sells enterprise software program, targeted on knowledge evaluation and enterprise intelligence. Nevertheless, most buyers see it as a direct guess on Bitcoin (CRYPTO:BTC) as of late, and for good motive.

Below co-founder and chairman Michael Saylor, who was additionally MicroStrategy’s CEO on the time, the corporate transformed most of its money reserves to Bitcoin in 2020. Since then, Microstrategy has bought shares and contracted new money owed to finance extra. Bitcoin purchases, whereas injecting free money stream from the software program sector into much more Bitcoin purchases.

In keeping with regulatory filings, MicroStrategy now holds roughly 423,650 bitcoins on its stability sheet. They had been bought at a mean value of $60,324 per piece. This can be a $25.6 billion funding, with a present worth of roughly $42.4 billion. The present worth of this Bitcoin pockets represents nearly half of MicroStrategy’s $90.4 billion. market capitalization.

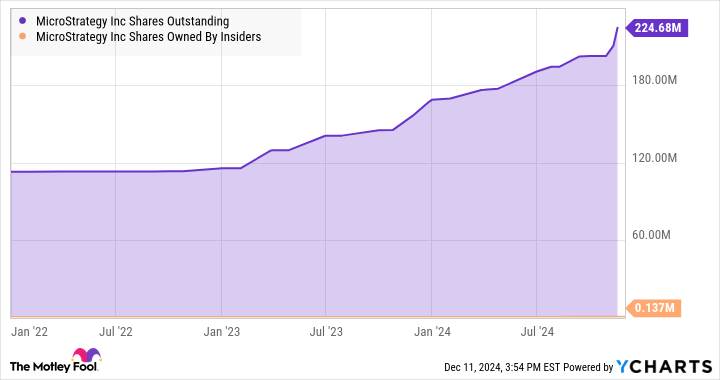

And that brings me to the metric that each MicroStrategy investor ought to comply with like a Wall Road hawk. These Bitcoin shopping for sprees are dearer than they appear, and shareholders are footing the invoice for a big portion of them. Because of this, MicroStrategy’s inventory depend has almost doubled in lower than two years:

That is extremely dilutive This technique has actual results on MicroStrategy’s inventory value. The market capitalization elevated by 1,410% in the course of the interval proven on the chart, whereas the value per share elevated by 657%. Nobody is complaining a couple of seven-fold return in two years, however MicroStrategy plans to borrow about $21 billion from its shareholders over the subsequent three years, whereas signing the same quantity of debt.

So it is best to hold a detailed eye on MicroStrategy’s inventory depend earlier than hitting the “purchase” button. The Bitcoin buy plan could or could not create wealth in the long run, however the underlying funding strikes will definitely compromise shareholder returns alongside the best way.

Earlier than shopping for shares in MicroStrategy, think about this:

THE Motley Idiot Inventory Advisor The analyst group has simply recognized what they assume is the 10 best stocks for buyers to purchase now…and MicroStrategy was not certainly one of them. The ten chosen shares might produce monster returns within the years to come back.

Think about when Nvidia made this checklist on April 15, 2005…for those who had invested $1,000 on the time of our advice, you’ll have $853,765!*

Fairness Advisor gives buyers with an easy-to-follow plan for achievement, together with portfolio constructing recommendation, common analyst updates, and two new inventory picks every month. THE Fairness Advisor the service has greater than quadrupled the return of the S&P 500 since 2002*.

#MicroStrategy #investor #eye #quantity , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america