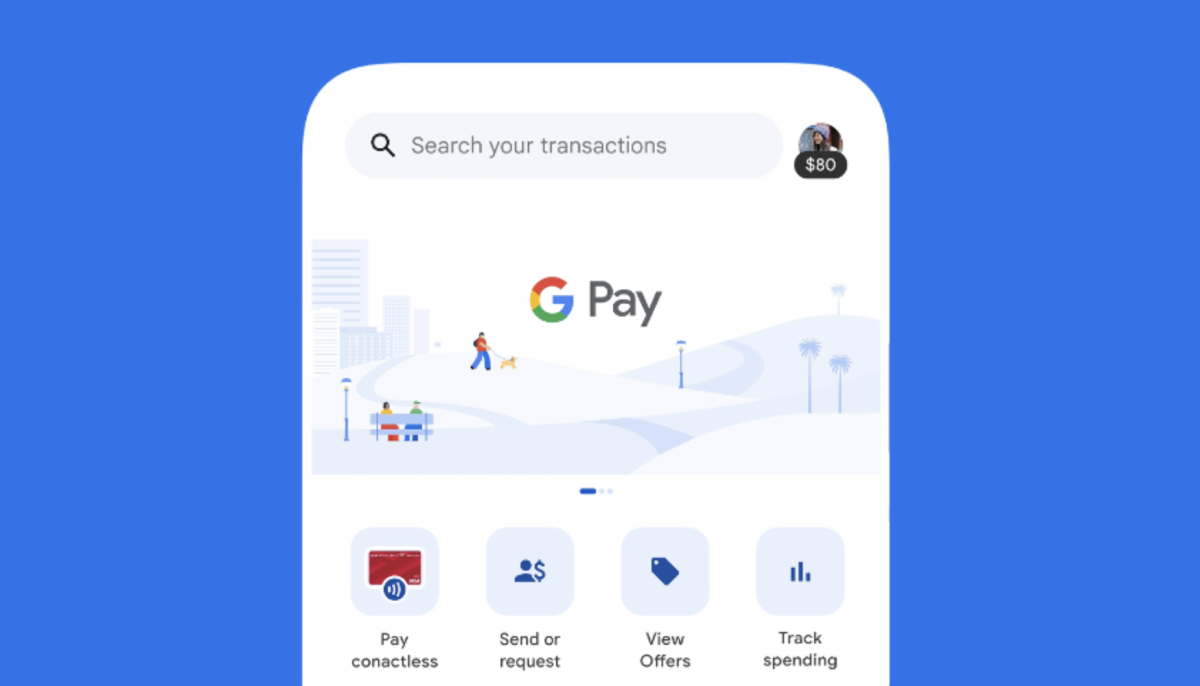

THE (CFPB) introduced Friday that it had ordered federal oversight of Google Fee Corp. after figuring out that it meets the authorized necessities for such monitoring. The CFPB oversees banks, credit score unions and different monetary establishments and not too long ago finalized a rule to supervise digital cost purposes. Within the which focuses on the Google Pay app and its peer-to-peer (P2P) cost service (discontinued in the United States earlier this year), the CFPB stated it had “cheap grounds to find out that Google engaged in conduct that posed dangers to shoppers.” Google filed a lawsuit shortly after the announcement difficult the choice, reviews.

The dangers recognized by the CFPB relate to Google's dealing with of faulty transactions and fraud prevention. Primarily based on buyer complaints, the order says it seems Google didn’t adequately examine the faulty transfers, nor adequately clarify the findings of its investigations into these points. The complaints additionally point out that Google didn’t do sufficient to forestall fraud, the order states. However the CFPB's announcement notes that the order “doesn’t represent a discovering that the entity engaged in wrongdoing” nor does it require the CFPB to conduct a supervisory overview.

In a press release to A Google spokesperson stated: “It is a clear case of presidency overreach involving Google Pay's peer-to-peer funds, which have by no means posed any dangers and are in the USA, and we’re difficult it in court docket. The CFPB's order acknowledges that Google Pay has been discontinued, however says this “shouldn’t be a motive to chorus from designating Google for oversight,” though it might impression its determination to conduct a overview .

#Google #sues #Client #Monetary #Safety #Bureau #orders #oversight #funds #arm, #gossip247.on-line , #Gossip247

Firm Authorized & Regulation Issues,web site|engadget,provider_name|Engadget,area|US,language|en-US,author_name|Cheyenne MacDonald ,