Stocks of an enterprise software company Asanas (NYSE: ASAN) soared on Friday after reporting its financial results for its fiscal 2025 third quarter – results that made the investing world quite optimistic about its future. As of 9:50 a.m. ET, Asana stock was up about 40% and hitting a 52-week high.

Asana offers workplace management software. With him, his clients set goals and track progress. The company forecast third-quarter revenue of $180 million to $181 million. But it generated nearly $184 million in revenue in the third quarter.

Missing the morning scoop? Breakfast News delivers it all in one fast, stupid, free daily newsletter. Register for free »

Exceeding the upper forecast range by 1% seems inconsistent with a 40% rise in Asana's stock price. But as you might have guessed, the story is a little more complex.

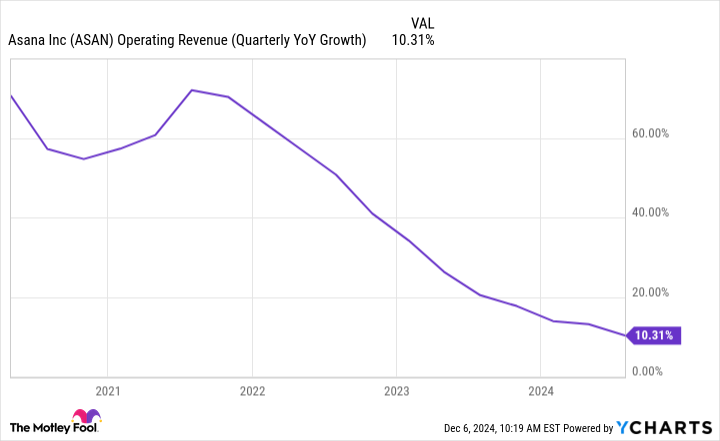

Since the company went public in 2020, Asana's growth rate has plunged at an alarming rate, as shown in the chart below.

However, with the third quarter results, Asana management highlighted the recent launch of its artificial intelligence Product (AI), AI Studio. In short, its customers love it and some bypass a pilot period and jump straight into a subscription. Investors hope this will not only jump-start Asana's growth, but also that it could even expand the company's addressable market. And it is these developments that investors are celebrating today.

During the upcoming fourth quarter, Asana management expects to generate revenue between $187.5 million and $188.5 million, which would represent 10% year-over-year growth. That's the same as its growth rate in the second quarter and third quarter, suggesting its slowdown is reaching a low point.

Asana has a negative effect free cash flow of $10 million in the first three quarters of its 2025 fiscal year. But management expects positive free cash flow in the fourth quarter.

With a successful AI launch, stabilized growth, and positive free cash flow, investors are justified in their enthusiasm for Asana stock today.

Before buying shares on Asana, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Asana wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $889,004!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

#Here39s #Asana #Stock #Soared #Today

,