Kraft-Heinz (NASDAQ:KHC) is among the world’s main meals firms, however its enterprise has not been doing nicely lately. The corporate struggled to develop and buyers bought off its shares, with Kraft’s inventory worth falling 18% over the previous 12 months. As of this writing, it’s buying and selling round its 52-week low.

This is a take a look at a number of the largest points going through Kraft at the moment and what the corporate must do to show issues round.

There are numerous manufacturers in Kraft’s portfolio, however one which seems to have the potential to generate appreciable development within the coming years is Lunchables, its line of prepackaged lunch meals. The corporate noticed an enormous alternative in providing them in class cafeterias, which it stated may very well be a market price $25 billion. That is big contemplating Kraft’s annual gross sales are usually between $26 billion and $27 billion. Progress hasn’t been simple for the corporate these days, and promoting Lunchables in class cafeterias might have been an enormous alternative.

I say “might” as a result of the corporate not too long ago introduced it was pulling out of faculty canteens as a result of low demand. A spokesperson stated that “whereas many faculty directors had been excited to have these choices, demand has not met our targets.” Considerations have been raised concerning the dietary worth of the meals, as well being consultants concern Lunchables are extremely processed and include excessive ranges of sodium.

That is sadly a part of a a lot greater downside for Kraft, as demand for its merchandise as a complete hasn’t been very sturdy lately.

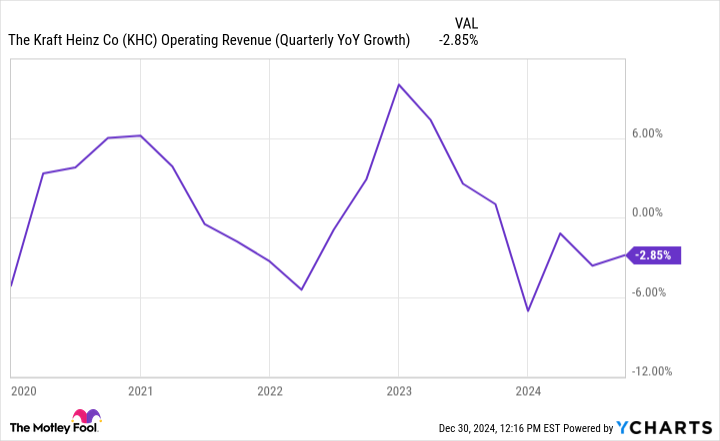

An enormous concern for buyers is that the corporate just isn’t producing any development. Over the previous 5 years, the corporate has struggled to persistently develop its income. Though Kraft has a variety of manufacturers, this diversification has not confirmed to be of a lot assist in rising the corporate’s income; in current quarters, revenues have declined.

As shopper attitudes shift towards more healthy meals choices, the corporate might want to adapt with a purpose to improve gross sales. Manufacturers like Oscar Mayer, Kool-Help and Kraft Dinner aren’t precisely synonymous with wholesome consuming. And even when gross sales are slowly declining at the moment, the decline might turn out to be extra pronounced sooner or later. Making its merchandise more healthy will probably be key for Kraft to curb this pattern.

Kraft Heinz is a number one shopper model and stays one of many prime holdings in Kraft Heinz’s portfolio. Warren Buffett, successful investor. This stays worthwhile and generates enough free cash flow to cowl its dividend funds, however buyers must be cautious of the dangers.

#Kraft #Heinz #Inventory #Hassle , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america