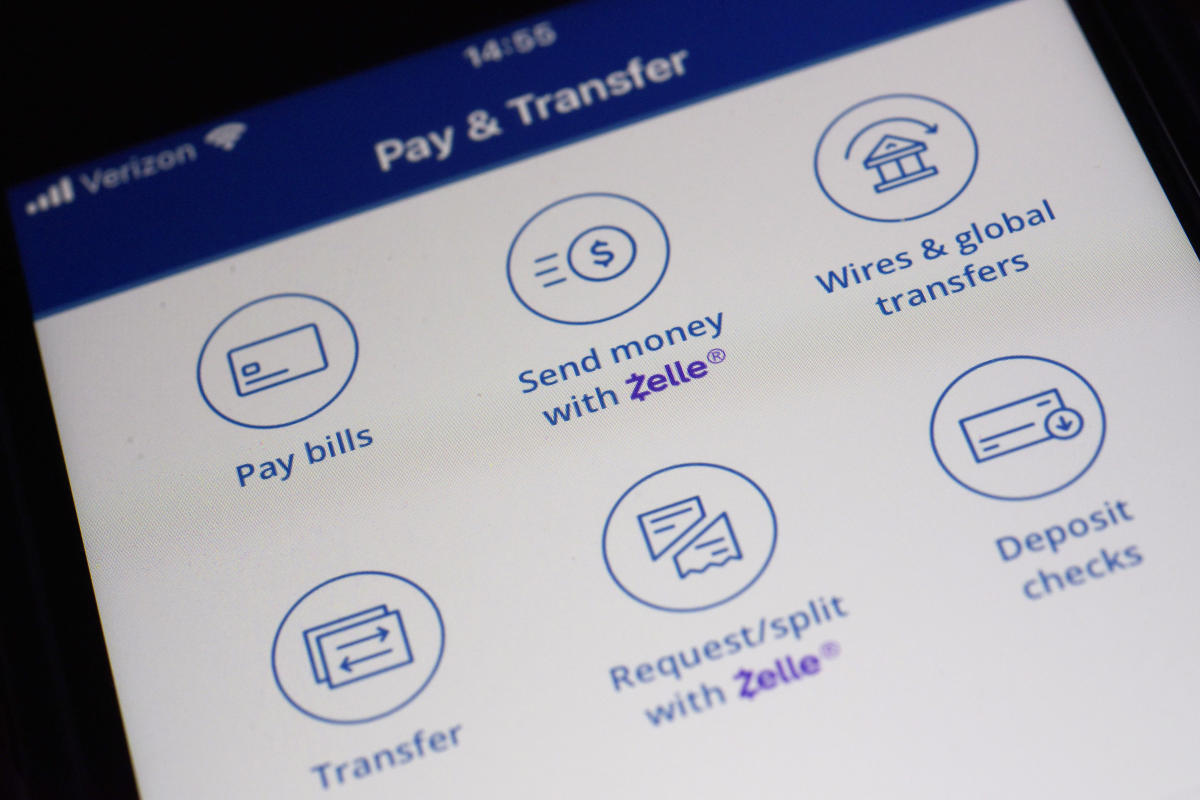

A federal regulator sued JPMorgan Chase, Wells Fargo and Financial institution of America on Friday, saying the banks failed to guard lots of of hundreds of customers from widespread fraud on the favored fee community Zelle, in violation of economic legal guidelines on consumption.

Within the federal civil area complaintThe Client Monetary Safety Bureau says banks rushed to market the peer-to-peer fee platform with out efficient safeguards in opposition to fraud, then, after customers complained of being defrauded on the service, they’ve largely refused them any reparation.

“Shortly after the launch of Zelle, vital issues, together with fraud perpetrated in opposition to customers utilizing Zelle, shortly turned obvious. However Defendants took no significant motion to treatment these apparent defects for years,” in accordance with the grievance.

The CFPB says the banks violated federal client finance legal guidelines governing electrical cash transfers, which require banks to conduct “cheap investigations” when customers report transaction errors, and the ban on company on unfair acts or practices by failing to take measures to stop and fight electrical funds switch fraud. Zelle. The company is asking for an unspecified amount of cash to cowl refunds, damages and penalties.

“Clients of the three banks named in immediately’s lawsuit misplaced greater than $870 million over the seven years of the community’s existence due to these failures,” the CFPB stated.

Additionally named as a defendant within the lawsuit is Early Warning Providers, a Scottsdale, Ariz.-based monetary expertise firm that operates Zelle. EWS is owned by seven US banks, together with JPMorgan, Wells Fargo and Financial institution of America. These three banks are the most important monetary establishments within the Zelle community, accounting for 73% of exercise on Zelle final yr.

Financial institution of America stated it strongly disagreed with the lawsuit, which it stated would end in “monumental new prices” for banks and credit score unions providing free Zelle service to their prospects. It states that greater than 99.95% of transactions on the Zelle community happen with out incident.

“When a buyer has an issue, we work immediately with them,” the Charlotte, North Carolina-based financial institution stated.

In an announcement, New York-based JPMorgan stated the CPFB was “exceeding its authority by holding banks accountable for criminals.”

San Francisco-based Wells Fargo declined to touch upon the lawsuit.

Early Warning known as the trial “legally and factually flawed.”

“Zelle leads the struggle in opposition to scams and fraud and has industry-leading refund insurance policies that transcend the legislation,” the corporate stated.

Since its launch in 2017, Zelle has change into some of the extensively used peer-to-peer fee networks in america, with greater than 143 million customers. Throughout the first half of 2024, Zelle customers transferred $481 billion throughout greater than 1.7 billion transactions, in accordance with the CFPB.

#JPMorgan #Wells #Fargo #BofA #face #federal #lawsuit #Zelle #fee #community #fraud , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america