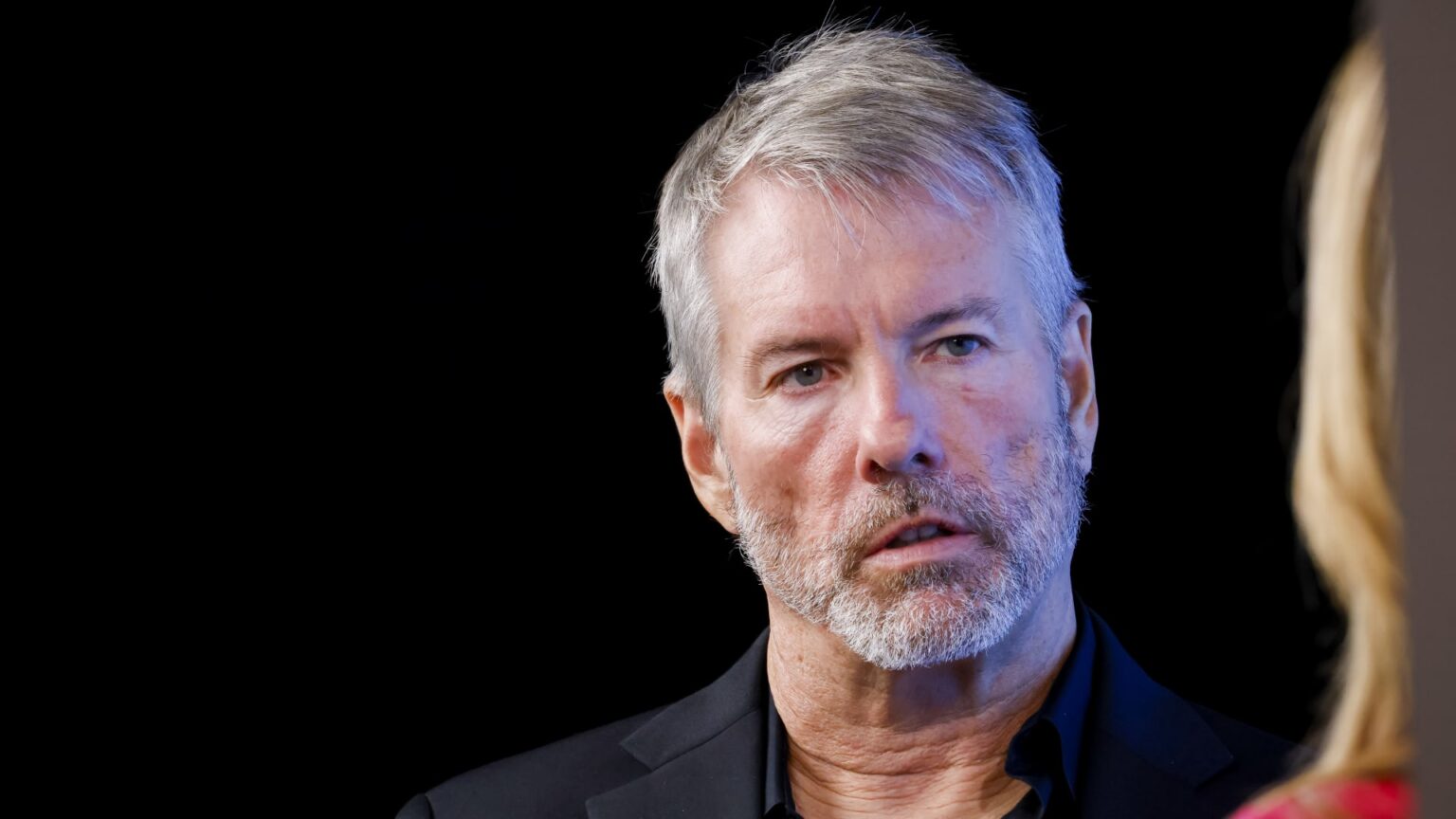

Michael Saylor, Chairman and CEO of MicroStrategy, throughout an interview on the Bitcoin 2023 convention in Miami Seaside, Florida, United States, Thursday, Might 18, 2023.

Eva Marie Uzcategui | Bloomberg | Getty Photographs

On the eve of MicroStrategythe inventory market beginning In June 1998, founder Michael Saylor stayed in a penthouse suite on the Lotte New York Palace in Midtown Manhattan. Saylor, who was 33 on the time, says it was probably the most beautiful resort room he had ever seen, paid for by lead underwriter Merrill Lynch.

The following morning, Saylor went to the Nasdaq flooring to observe his firm’s shares open. He remembers seeing a word scroll throughout the ticker, warning merchants: “Please don’t confuse MSTR with MSFT. » The latter belonged to Microsoftthe software program large that went public 13 years earlier.

MicroStrategy shares soared 76% of their debut, becoming a member of the parade of expertise firms benefiting from the dot-com increase.

“It was day,” Saylor instructed CNBC.

Greater than 26 years later, MicroStrategy and Microsoft have been linked once more, however for a completely completely different cause. In December 2024, Saylor appeared earlier than Microsoft shareholders to attempt to persuade them that the corporate, now valued at greater than $3 trillion, ought to make investments a few of its $78.4 billion in money, equivalents and short-term investments in bitcoin.

“Microsoft can’t afford to overlook the subsequent wave of expertise, and Bitcoin is that wave,” Saylor stated in a video presentation. released the final week. The put up has over 3.6 million views.

Saylor went all out on this technique. MicroStrategy has bought 439,000 bitcoins since mid-2020, a inventory now value about $42 billion and the idea for the corporate’s market cap exploding to $82 billion from about $1. $1 billion when the plan was put in place.

MicroStrategy’s software program unit, which focuses on enterprise intelligence, generates simply over $100 million in income per quarter. After hovering in 1998 and 1999, the inventory crashed through the dot-com collapse, shedding virtually all of its worth. Within the a long time since, it has slowly rebounded earlier than soar due to bitcoin.

4 years after its bitcoin shopping for spree started, MicroStrategy is the world chief fourth largest holderbehind the only real creator Satoshi Nakamoto, BlackRock iShares Bitcoin Trust and crypto change Binance.

At Microsoft, the shareholder vote supported by Saylor largely failed: lower than 1% of traders voted in favor.

However the present supplied Saylor, now 59, with a brand new alternative to evangelise the gospel of bitcoin and tout the advantages of changing as a lot cash as attainable into this distinctive digital asset. It is a story that Wall Road has wolfed up.

MicroStrategy shares are up 477% this yr as of Friday’s shut, second solely AppLovin amongst all U.S. expertise firms valued at $5 billion or extra, in line with FactSet knowledge. This follows a 346% acquire in 2023.

With the rally in full swing effectively earlier than November this yr, that of Donald Trump electoral victory, finance closely by the crypto trade, propelled the inventory even additional. Shares have soared 60% for the reason that Nov. 5 election and eventually surpassed their 2000 Web-era excessive on Nov. 11.

Saylor has lengthy spoken evangelically about bitcoin and co-wrote a e-book about it in 2022 referred to as “What’s Cash?” However his criticism has turn out to be louder than ever currently, describing Saylor as a cult chief and his technique as a “ponzi loop” it entails issuing debt and inventory to purchase bitcoin, watching MicroStrategy’s inventory value rise, after which doing the identical.

“Wash, rinse, repeat: what might go fallacious? » wrote Peter Schiff, chief economist and world strategist at Euro Pacific Asset Administration, in a Nov. 12 assertion. post on to his 1 million followers.

Saylor, who has 3.8 million followers, addressed the rising refrain of skeptics final week in an interview with CNBC’s “Cash Movers.”

“Identical to Manhattan builders, each time Manhattan actual property goes up in worth, they challenge extra debt to develop extra actual property. That is why your buildings are so tall in New York,” Saylor stated in a clip printed on X by his legion of followers. “It has been occurring for 350 years. I might name it an economic system.”

Saylor is a frequent visitor on CNBC, making appearances on varied applications all year long. He additionally agreed to 2 interviews with CNBC.com, one in September and one other shortly after the election.

The primary of those discussions befell at Lotte, a number of elevator stops from the penthouse the place he spent the evening earlier than his shares hit the Nasdaq. Saylor was giving a keynote speech on the resort and taking conferences on the facet.

He wore a designer go well with and an orange Hermès tie, matching the colour designated by Bitcoin. The election was lower than two months away and crypto firms have been pouring cash into the Trump marketing campaign after the Republican candidate and ex-president, who beforehand referred to as bitcoin a “scam against the dollar”, has began to ensure a way more crypto-friendly administration.

“Impressed the crypto group”

Two months earlier, in July, Trump gave a speech on the largest Bitcoin convention of the yr in Nashville, Tennessee, the place he promised hearth the chairman of the SEC Gary Gensleran trade critic, and stated america would turn out to be the “crypto capital of the planet” if he gained.

“I feel the election yr impressed the crypto group to search out its voice, and I feel it catalyzed a number of latent enthusiasm,” Saylor stated within the September interview. “When Trump examined tentatively optimistic, that was an enormous increase for the trade. When he examined totally optimistic, that was one other increase.”

Till this yr, MicroStrategy was one of many few methods many establishments might buy bitcoin. As a result of MicroStrategy was a inventory, funding firms didn’t want any particular preparations to personal it. The atmosphere modified in January, when the SEC Approved Bitcoin spot exchange-traded funds, permitting traders to buy ETFs that monitor the worth of Bitcoin.

Since Trump’s victory, every little thing has been transferring up and to the proper. Bitcoin is up about 41% and BlackRock’s ETF is up 39%. Gensler is making ready to go away the SEC and Trump has chosen a deregulation advocate and a former SEC commissioner. Paul Atkins to exchange it.

Enterprise capitalist David Sacks, an outspoken conservative who hosted a fundraiser for Trump in San Francisco, might be Trump’s “White Home AI and crypto czar.” announcement earlier this month in a put up on his Fact Social platform.

“With the pink sweep, bitcoin goes up with tailwinds, and the remainder of the digital property will begin going up as effectively,” Saylor instructed CNBC in a telephone interview shortly after the election. He stated bitcoin stays the “protected commerce” within the crypto area, however that as a “digital asset framework” is put in place for the broader crypto market, “there might be a increase in the complete digital property sector,” he stated.

“Taxes are taking place. All of the rhetoric in regards to the unrealized capital good points tax and the wealth tax is being dropped,” Saylor stated. “All of the hostility from regulators in the direction of banks concerning bitcoin” can be disappearing, he added.

Republican presidential candidate and former U.S. President Donald Trump gestures through the Bitcoin 2024 occasion in Nashville, Tennessee, america, July 27, 2024.

Kevin Ver | Reuters

MicroStrategy has turn out to be much more aggressive with its bitcoin purchases. Saylor stated in a job By December 16, over a six-day interval starting December 9, his firm had acquired 15,350 bitcoins for $1.5 billion.

Thus far this yr, MicroStrategy has acquired 249,850 bitcoins, virtually two-thirds of which have occurred since November 11.

“We have been going to do it anyway,” Saylor stated, referring to the election outcomes. “However what was a headwind has turn out to be a tailwind.”

Every week earlier than the elections, MicroStrategy introduced in its quarterly report publication of results a plan to lift $42 billion over three years. This included a inventory sale of as much as $21 billion by monetary companies together with TD Securities and Barclays, opening up considerably extra liquidity for bitcoin purchases.

Saylor instructed CNBC it was “most likely crucial earnings name within the firm’s historical past.”

No quantity of possession is just too excessive for Saylor, who predicted in September that bitcoin might attain $13 million by 2045, which might equate to 29% annual progress.

“We’ll proceed to purchase the very best endlessly,” he stated in the identical TV interview the place he in contrast bitcoin to New York actual property. “Day-after-day is an effective day to purchase bitcoin. We view it as a cyber-Manhattan.”

Saylor speaks enthusiastically about bitcoin as the muse of a brand new digital economic system that can solely get greater. However even since launching its Bitcoin technique in 2020, traders have struggled: the inventory misplaced 74% of its worth in 2022 earlier than hovering over the previous two years.

Nevertheless, he advises firms to mimic his technique. Microsoft hasn’t listened, however Saylor stated there are a lot of “zombie firms” whose core companies aren’t going wherever and will put their money to higher use.

“The standard recommendation could be: You make a transformational acquisition, you discover out you want a merger companion. You are useless within the water. Go discover somebody to merge with,” Saylor instructed the Lotte in September. “Bitcoin is the common merger companion, proper? The true enchantment of digital capital is that you may repair any enterprise.”

WATCH: CNBC’s full interview with MicroStrategy CEO Michael Saylor

#MicroStrategy #Rides #Pink #Sweep #Acquire #Main #Tech #Inventory, #gossip247.on-line , #Gossip247

,

—

ketchum

chatgpt

instagram down

is chatgpt down

dortmund vs barcelona

ai

dortmund – barcelona

rosebud pokemon

drones over new jersey

juventus vs man metropolis

the voice winner 2024

inexperienced skinned pear selection

paralympics

arsenal vs monaco

hannah kobayashi

intercontinental cup

bidwell mansion

brett cooper

hawks vs knicks

alexander brothers

wealthy rodriguez

christopher wray

time journal particular person of the yr 2024

ruger rxm pistol

unc

austin butler

milan vs crvena zvezda

captagon

jalen brunson stats

gerry turner

invoice belichick girlfriend

pachuca

elon musk internet value

kraven the hunter

kyle teel

david bonderman

rocky colavito

mitch mcconnell fall

cam rising

survivor finale

liver most cancers

fortnite ballistic

feyenoord – sparta praha

luis castillo

jim carrey internet value

xavier legette

kj osborn

invoice belichick girlfriend age

copilot ai

volaris flight 3041

suki waterhouse

bomb cyclone

100 years of solitude

l. a. dodgers

rangers vs sabres

kreskin

sabrina singh

brian hartline

emory college

russia

ai generator

mega thousands and thousands 12/10/24

jalen johnson

colby covington

adobe inventory

riley inexperienced

alperen sengun

sport awards

meta ai

josh hart

nationwide grid

og anunoby

triston casas

the highway

dyson daniels

sutton foster

sec schedule 2025

jordon hudson

emory

mta

microsoft ai

mikal bridges

bard ai

tally the elf

invoice hennessy

elizabeth warren

utep basketball

julia alekseyeva

zaccharie risacher

lily phillips documentary

fred vanvleet

devon dampier

colgate basketball

jonathan loaisiga

anthropic

david muir

ai chatbot