Tyme Groupa South African-born fintech working within the African nation and the Philippines, secured $250 million in a Sequence D funding spherical, bringing its valuation to $1.5 billion. The funding was led by Nu Holdings (which owns NuBank), Latin America’s most useful fintech, which invested $150 million for a ten% stake. M&G Catalyst Fund contributed $50 million whereas present shareholders supplied the remaining $50 million.

Based in 2019, Singapore-based Tyme Group operates a hybrid digital banking mannequin that mixes on-line banking with bodily service touchpoints.

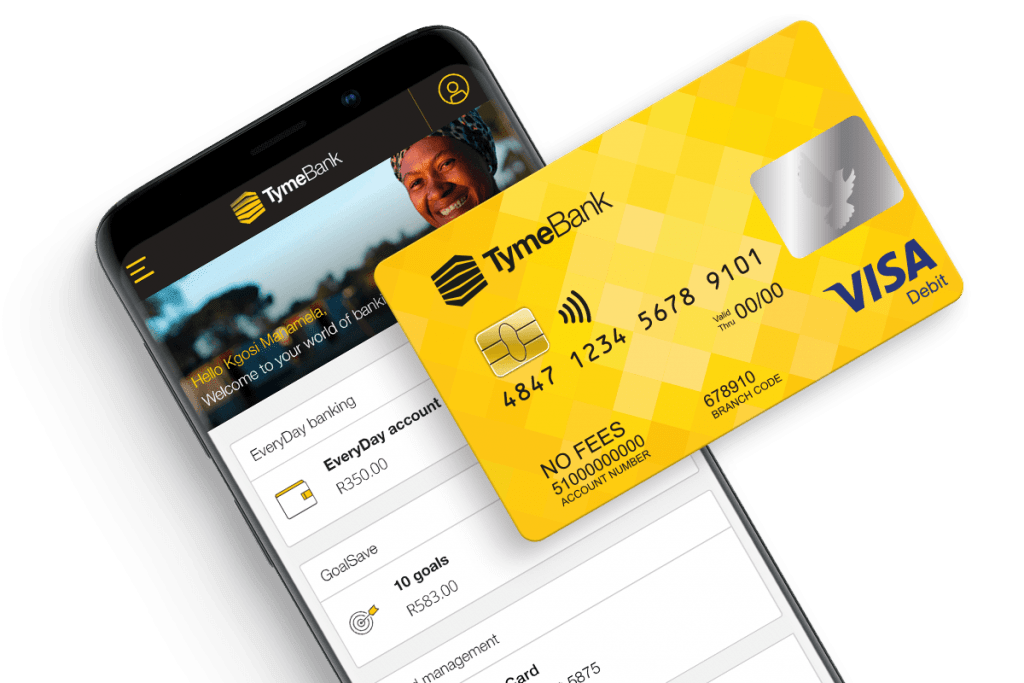

The corporate focuses on creating and creating digital banks in rising markets; its South African model, TymeBank, has been a key driver of its development, whereas GoTyme within the Philippines, launched in 2022 in partnership with native conglomerate Gokongwei Group, marked its entry into Asia. Tyme now serves 15 million prospects and plans to increase additional into Vietnam and Indonesia subsequent 12 months.

Tyme stays majority-owned by Patrice Motsepe’s African Rainbow Capital (ARC), which retains a 40% stake within the fintech. Final 12 months, fintech raised $77.8 million in a pre-Series C roundbacked by Tencent, Blue Earth Capital and Norrsken22.

The most recent funding, which brings Tyme’s whole elevate to greater than $400 million, marks a notable resurgence of investor curiosity in fintechs following a slowdown brought on by rising world rates of interest. Tyme joins Moniepoint from Nigeria as one of many African fintechs to attain unicorn standing this 12 months.

Clearly, NubanqueTyme Group’s funding aligns with its broader technique to diversify geographically and faucet the expansion potential of rising markets outdoors of Latin America, however not organically. Whereas the the largest digital banking platform Outdoors of Asia, has established itself as a dominant participant in Brazil, Mexico and Colombia, with over 100 million prospects, its core markets have gotten more and more aggressive, with firms like Neon and C6 gaining market shares.

Increasing into Asia and Africa – areas the place digital monetary companies are nonetheless under-penetrated – presents Nubank an opportunity to duplicate its mannequin in markets with comparable dynamics: giant unbanked populations, rising adoption of smartphones and a rising demand for accessible monetary merchandise.

Tyme shouldn’t be Nubank’s first transfer outdoors of its residence turf. In 2021, Brazilian fintech invested in the Indian neobank Jupiter.

“Nubank has revolutionized monetary companies and having it as a shareholder will assist construct relationships with our mannequin, execution and enlargement plans, each financially and thru enterprise recommendation,” he stated. stated Coen Jonker, president and co-founder of Tyme. “We’re centered on enhancing the monetary lives of tens of millions of individuals in our area, and we’re energized by this spherical of investments to proceed shifting ahead.” »

Tyme, which presents checking and financial savings accounts with debit and bank cards by purchase now, pay later, has raised greater than $400 million in buyer deposits and supplied greater than $600 million in financing to small firms in South Africa and the Philippines.

#Nubank #leads #million #funding #African #digital #financial institution #Tyme #valued #billion, #gossip247.on-line , #Gossip247

Fintech,nubank,tyme,TymeBank ,

chatgpt

ai

copilot ai

ai generator

meta ai

microsoft ai