The valuation of Indian on-line pharmacy PharmEasy now stands at round $456 million, based on disclosures from its investor Janus Henderson, a drop of 92% from its peak valuation of $5.6 billion.

The Anglo-American world belongings agency’s World Analysis Fund values its 12.9 million-share stake in PharmEasy at $766,043, based on its newest submitting for the interval ending in September. The fund initially spent $9.4 million to accumulate these shares.

THE low and persistent valuation comes regardless of PharmEasy securing greater than $200 million in new capital earlier this 12 months and getting ready to file an initial public offering next yearTechCrunch reported earlier.

This follows the launch of PharmEasy a question of rights in 2023 in a context of funding crisis and the duty to repay a debt. A rights challenge permits firms to lift capital by giving shareholders the chance to purchase shares at a reduction. Relying on the phrases, shareholders can also be faraway from their earlier possession buildings if they don’t take part in a rights challenge.

PharmEasy raised $417 million by the rights challenge that was oversubscribed, based on PharmEasy co-founder Dharmil Sheth. A regulatory submitting filed in April 2024 confirmed the startup secured round $216 million.

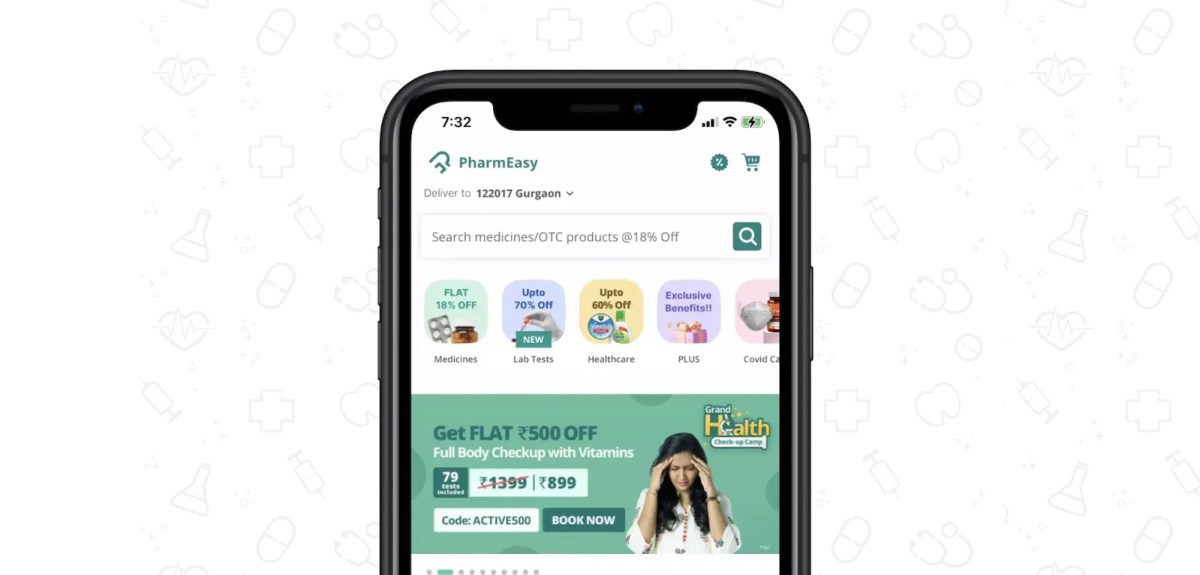

The startup, backed by Prosus, Temasek, TPG and B Capital, operates one of many largest on-line pharmacies in India. Present valuation locations PharmEasy’s worth effectively beneath some $600 million was spent to acquire the Thyrocare diagnostic laboratory chain in 2021. Pharmeasy has raised greater than $1 billion so far.

The startup’s monetary challenges emerged after an $843 million IPO deliberate for November 2021 was postponed. It then turned to debt financing, together with a $300 million mortgage from Goldman Sachs which proved problematic as the corporate struggled to repay and lift new capital in a deteriorating market.

#PharmEasys #billion #valuation #drops #million #investor #knowledge #exhibits, #gossip247.on-line , #Gossip247

Startups,TC,India,PharmEasy,Prosus Ventures,Valuation Markdown ,

chatgpt

ai

copilot ai

ai generator

meta ai

microsoft ai