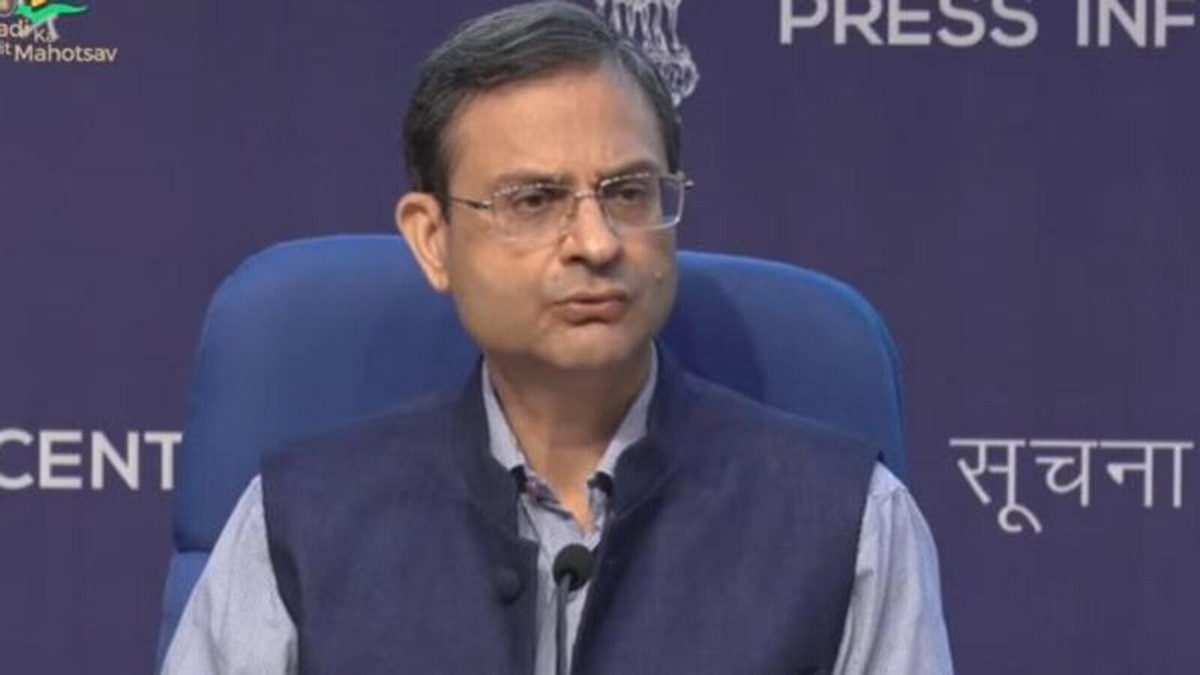

Amid authorities criticism over the Reserve Financial institution of India’s (RBI) concentrate on controlling inflation reasonably than financial development, new RBI Governor Sanjay Malhotra mentioned on December 30 that the Indian economic system is anticipated to enhance in 2025, pushed by sturdy development. client and enterprise confidence.

Within the foreword to the monetary stability report, Malhotra highlighted the RBI’s dedication to sustaining monetary stability, which he considers essential to help sustainable development of the Indian economic system. “As we work to make sure the steadiness of economic establishments and broader systemic stability, our focus stays on fostering the next development trajectory,” he mentioned.

Malhotra additionally famous that regardless of international uncertainties, the Indian economic system is anticipated to realize momentum within the second half of the present monetary 12 months. “Regardless of persistent international macro-financial challenges, the Indian economic system is anticipated to regain momentum after the slowdown within the first half of 2024-25,” it mentioned. “Shopper and enterprise confidence stays excessive, and the funding local weather seems to be promising, as corporations enter 2025 with sturdy stability sheets and wholesome income. »

The Finance Ministry, in its month-to-month financial evaluation in November, had highlighted potential structural elements contributing to the slowdown within the first half of 2024-25. India’s GDP development fell to a seven-quarter low of 5.4% for the second quarter ending September 2024, bringing first-half GDP development to six%.

The slowdown, coupled with subdued inflation, is elevating expectations that the RBI might minimize its coverage price on the subsequent Financial Coverage Committee assembly.

Malhotra additional highlighted that monetary sector regulators in India are pursuing reforms and strengthening supervision. He highlighted the energy of the monetary system, supported by sturdy income, low impaired property and robust capital reserves. The stress check outcomes point out that the banking sector and non-banking monetary corporations (NBFCs) will preserve capital ranges nicely above regulatory minimums, even in careworn eventualities.

“We proceed to strengthen and guarantee public belief, supporting India’s formidable objectives. We’re dedicated to creating a contemporary monetary system that’s customer-centric, technologically superior and financially inclusive,” he mentioned .

Relating to the worldwide economic system, Malhotra acknowledged resilience within the face of great challenges, reminiscent of political and financial uncertainty, ongoing conflicts and fragmentation of worldwide commerce. He famous, nevertheless, that the worldwide outlook is enhancing, with inflation anticipated to proceed to fall, supporting the restoration in buying energy. As financial coverage positive aspects extra room to help financial exercise, favorable monetary situations are anticipated to spice up international GDP development after a protracted interval of weak development.

Though the outlook seems promising, Malhotra warned that medium-term dangers persist, together with a possible escalation of geopolitical conflicts, monetary market instability, excessive climate occasions and rising debt ranges. Further uncertainties come up from excessive asset valuations, vulnerabilities of much less regulated non-bank monetary intermediaries, and challenges posed by rising applied sciences.

#RBI #Governor #Sanjay #Malhotra #shares #key #insights #economic system #enterprise #optimism #Heres , #Gossip247

,

ketchum

elon musk web price

david bonderman

adobe inventory

nationwide grid

microsoft ai