(Bloomberg) — For all of Trump’s enterprise triumphalism and hysteria over AI, it has been a troublesome 12 months to generate profits within the markets. At this time, even the commerce that fueled U.S. shares is beginning to present indicators of faltering.

Most learn on Bloomberg

A fickle Federal Reserve and inflation’s refusal to behave quietly have been a recipe for asset malaise. The most important exchange-traded fund that tracks long-term Treasuries swung violently into 2024 earlier than ending deep within the purple. Commodities have adopted the hopes and goals of Chinese language stimulus measures, each up and down. Positive aspects had been pared even within the most secure credit, the place rising yields pushed BlackRock’s $30 billion Funding Grade ETF to its worst fourth quarter in eight years.

The one shiny spot was shares, and US corporations as soon as once more stole the present. That advance, nevertheless, was the furthest factor from a good march — together with Friday, when a usually sleepy year-end session noticed the S&P 500 fall as a lot as 1.7% with no apparent information. The decline capped a 12 months through which worth shares and small-cap shares struggled, and the S&P 500’s 25% return masked a achieve of half its common member.

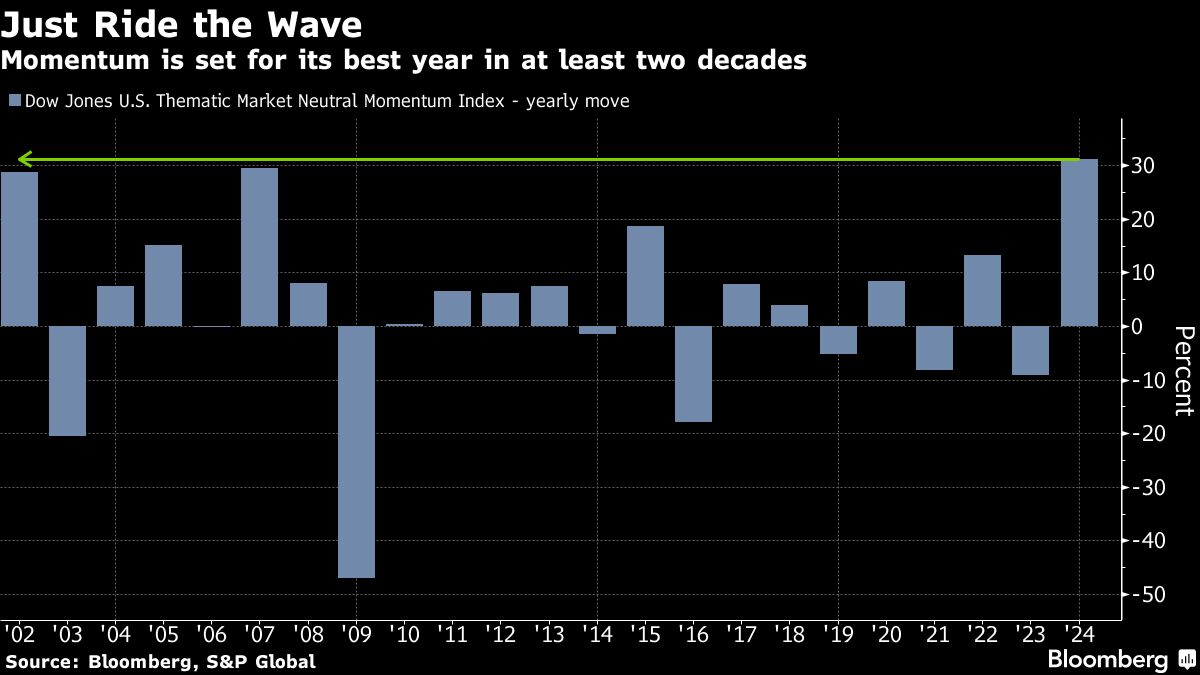

Sadly, that is additionally the second bombing in as many weeks for the one fairness technique that has labored reliably in 2024: momentum investing, or driving the market’s winners. A document 12 months for dynamism has rewarded its trustworthy handsomely – whereas growing the chance that outbursts like Friday’s will develop into extra widespread.

“Momentum is nice till it’s not, till one thing modifications,” mentioned Melissa Brown, head of utilized analysis at SimCorp, which provides issue danger fashions.

Even with this week’s hindsight, the favored quant commerce that buys final 12 months’s largest names and sells the losers has gained 31% in 2024, marking the very best 12 months on document since 2002, based on an S&P Dow index. Jones.

Briefly, the inventory rankings have confirmed remarkably constant, with favorites from massive tech corporations like Nvidia Corp. and Meta Platforms Inc. constantly occupying the highest. Whereas this represents a straightforward win for anybody with an index fund, this all-too-familiar setup fuels considerations that inventory market positive factors have develop into too concentrated and crowded.

It comes towards a backdrop of twists and turns too quite a few to depend, beginning with a U.S. central financial institution that has been at instances dovish, then hawkish once more, and encompassing every thing from international election drama and simmering geopolitical tensions to ‘to China’s completely different positions by way of financial restoration.

There have been so many headwinds {that a} technique constructed to reach all weathers, the multi-asset portfolio mannequin generally known as danger parity, ended the 12 months roughly unchanged, as measured by RPAR Threat Parity ETF.

#File #12 months #dynamic #buying and selling #ends #rising #cracks , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america