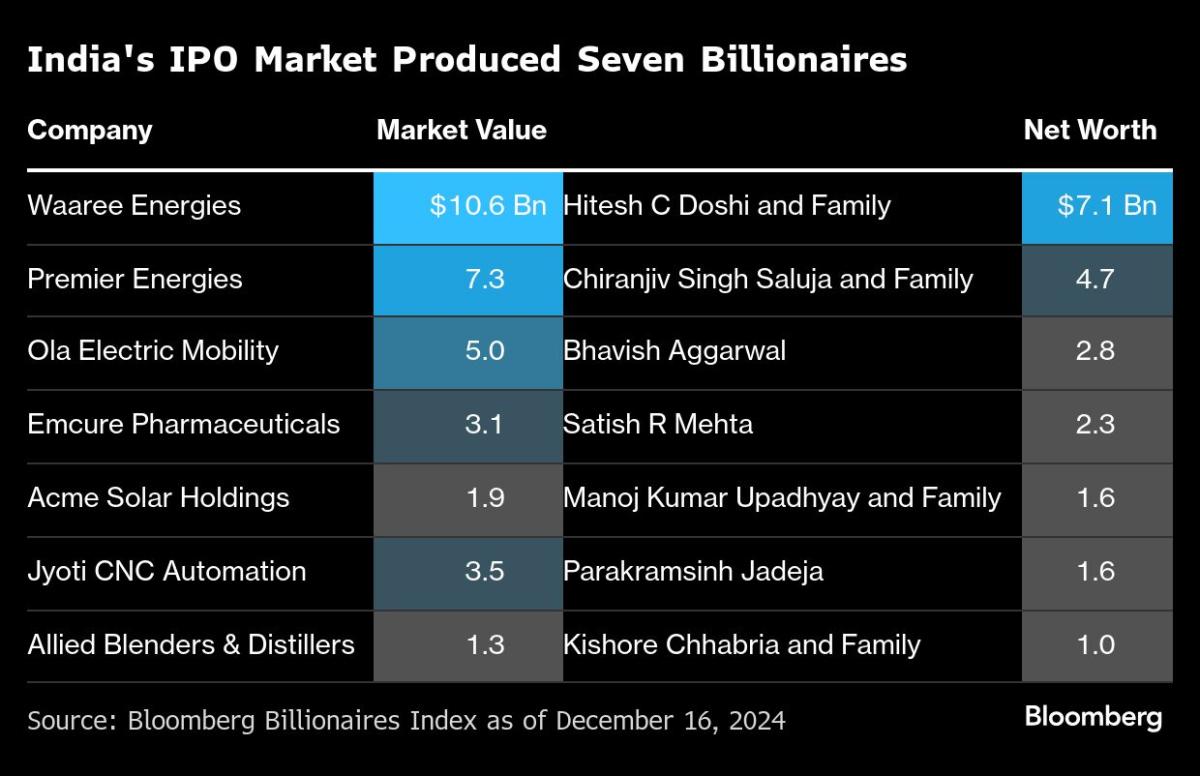

(Bloomberg) — A blockbuster 12 months for India’s IPOs has catapulted seven entrepreneurs into the league of greenback billionaires, a lot of whom had been pioneers within the nation’s booming renewable vitality sector.

Most learn on Bloomberg

Chiranjeev Singh Saluja of Premier Energies is amongst those that have managed to experience the wave.

“My father equipped hand pumps to rural villages,” the 51-year-old mentioned in an interview. “He noticed that entry to electrical energy was scarce in these areas, so he began Premier Photo voltaic in 1995,” Saluja mentioned.

Three many years later, the renamed Premier Energies is the second largest built-in producer of photo voltaic modules and photo voltaic cells within the nation behind the Adani Group. Traders optimistic concerning the authorities’s funding in photo voltaic vitality have seen Premier’s shares almost triple since their September debut, valuing them at round $7 billion.

Saluja is one in all 4 renewable vitality entrepreneurs whose private fortunes soared after their corporations listed on the inventory trade final 12 months.

The others are Hitech C Doshi of Waaree Group, which additionally makes photo voltaic modules, Bhavish Aggarwal of electrical automobile maker Ola Electrical Mobility Ltd and Manoj Ok Upadhyaya of solar energy generator Acme Photo voltaic Holdings Ltd.

The outlook for photo voltaic gamers seems promising as India goals so as to add one other 100 GW of capability over the subsequent 4 years, in keeping with a Frost & Sullivan report. However that could possibly be a double-edged sword, Saluja mentioned.

It expects a rise in new photo voltaic cell and module manufacturing capability over the subsequent 18 to 24 months. “There will certainly be consolidation within the sector, so solely those that broaden will survive,” Saluja mentioned.

The same pattern may happen within the Indian inventory market, which was booming in 2024, with a document 1.66 trillion rupees ($19.82 billion) raised via IPOs, up from 650 billion rupees final 12 months. This was fueled by a 27% improve within the variety of distinctive traders on the principle trade, to 109 million.

Round 85 corporations intention to checklist in 2025, collectively focusing on 1.53 trillion rupees ($18 billion), in keeping with information from Prime Database.

On the identical time, issuers might want to put together for headwinds from a slowing economic system, weak company income, rupee volatility, weak shopper spending and the brand new president’s tariff insurance policies. American Donald Trump.

#billionaires #created #Indias #IPO #increase , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america