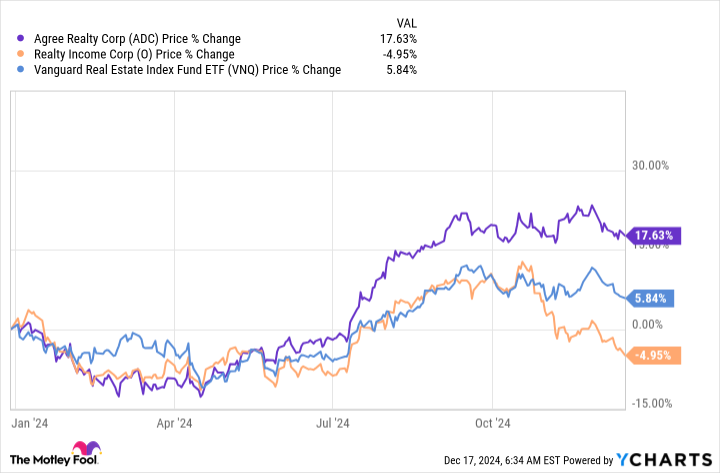

Agree with actual property (NYSE:ADC) has been a well-liked inventory in 2024, with a value achieve of over 15%. That is about 3 times the return of the typical actual property funding belief (REIT). Though Agree’s dividend yield is increased than the REIT common, at round 4% (in comparison with a mean of three.7%), it might be time to think about a value-conscious various. Right here is the largest possibility you need to think about immediately.

Agree Realty is a really nicely managed internet lease REIT (a internet lease requires the tenant to pay many of the working prices on the property stage). The final decade has been a interval of strong progress. The dividend has been elevated at a fee of roughly 6% per 12 months. The variety of properties within the portfolio elevated from 130 on the finish of 2013 to 2,271 on the finish of the third quarter of 2024.

It is a very completely different REIT than it was in 2011, when Agree was pressured to chop its dividend because of the chapter of a serious tenant. In reality, this lesson has been taken to coronary heart, with the corporate particularly working to fill its portfolio with the very best high quality tenants. For instance, he has lengthy since moved away from Walgreens, a struggling pharmacy retailer, and towards extra profitable corporations like TJX (NYSE:TJX) an overpriced one retailer.

For traders wanting so as to add a dividend progress inventory to their portfolio, it is smart to think about accepting. There’s only one small drawback: the value. As famous, Agree shares have rebounded strongly whereas different REITs are lagging. In reality, a particular REIT, Actual property earnings (NYSE:O)has really seen its shares fall about 5% in 2024. Its dividend yield can also be considerably increased than Agree’s, at 5.8%.

Realty Revenue is a little more of a gradual and regular turtle than Agree. For instance, whereas Agree’s dividend has grown about 6% yearly over the previous decade, Realty Revenue’s has grown at about half that fee. Clearly, in case you’re searching for quick dividend progress, Agree might be nonetheless a better option for you.

That stated, Realty Revenue has been rising its dividend for 3 a long time. Its steadiness sheet is rated funding grade. Its portfolio is broadly diversified, together with property within the retail and industrial sectors, in addition to some new ventures in areas resembling knowledge facilities and casinos. Its actual property portfolio of greater than 15,400 is unfold throughout each the American market and Europe. It is a slow-and-steady big within the internet lease business, roughly 4 occasions bigger than its subsequent closest competitor. That stated, an funding in Realty Revenue has confirmed to be largely worthwhile for traders over time, as proven within the complete return chart under.

#purchase #millionaire #inventory #actual #property , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america